Crypto Payroll Revolution with Stablecoins

Discover how stablecoins are powering the crypto payroll revolution with faster, cheaper global salaries and new opportunities for businesses and workers.

The modern workforce is no longer confined by borders, time zones, or traditional banking systems. As global hiring accelerates and remote work becomes increasingly common, businesses are searching for more efficient, reliable, and universally accessible ways to compensate employees. Crypto Payroll Revolution. The result is a rapid shift toward crypto payroll, an emerging method of salary distribution powered by blockchain networks and digital currencies. At the center of this transformation is the growing dominance of stablecoins, digital assets designed to maintain a stable value, typically pegged to fiat currencies like the US dollar.

Stablecoins have effectively solved one of the biggest issues preventing widespread payroll adoption of cryptocurrencies: volatility. With stablecoins such as USDC and USDT, workers can receive digital payments that behave like digital dollars, retaining predictable value while offering the speed and transparency of blockchain technology. As businesses look for ways to streamline cross-border payments, reduce fees, and appeal to crypto-native talent, stablecoin payroll systems are quickly becoming a compelling alternative to traditional banking channels. This article explores how stablecoins are reshaping payroll, why they have become the preferred choice for crypto salaries, and what this shift means for the future of global work.

What Crypto Payroll Really Means

Crypto payroll refers to the process of paying employee salaries, bonuses, and contractor fees using digital assets rather than traditional fiat currency. Unlike conventional payroll systems that depend heavily on banks, clearing houses, and regional intermediaries, crypto payroll leverages blockchain networks to transfer value directly between the employer and employee. Instead of receiving money in a bank account, workers receive their pay in a digital wallet in the form of cryptocurrency.

The earliest forms of crypto payroll featured payments in Bitcoin or Ethereum. While these assets were revolutionary, their price volatility made them unsuitable for consistent, predictable salary payments. An employee who agreed to a salary of $2,000 worth of Bitcoin may find that the actual value fluctuated dramatically between pay periods. This made it difficult for workers to manage monthly expenses, and businesses faced challenges in ensuring fair and predictable compensation. The introduction of stablecoins changed the landscape entirely. These digital currencies are designed to maintain steady value, which makes them a practical tool for businesses wanting to adopt blockchain-based payroll without exposing employees to wild price swings.

In practice, using stablecoins in payroll can be remarkably straightforward. A company funds its payroll account with traditional currency, which is then converted into stablecoins. These stablecoins are transferred directly to employee wallets, typically settling within minutes. Workers can choose to keep their earnings in digital form, convert them to local fiat, or use them in decentralized finance ecosystems. The entire process is faster, more transparent, and more accessible than many traditional payroll systems.

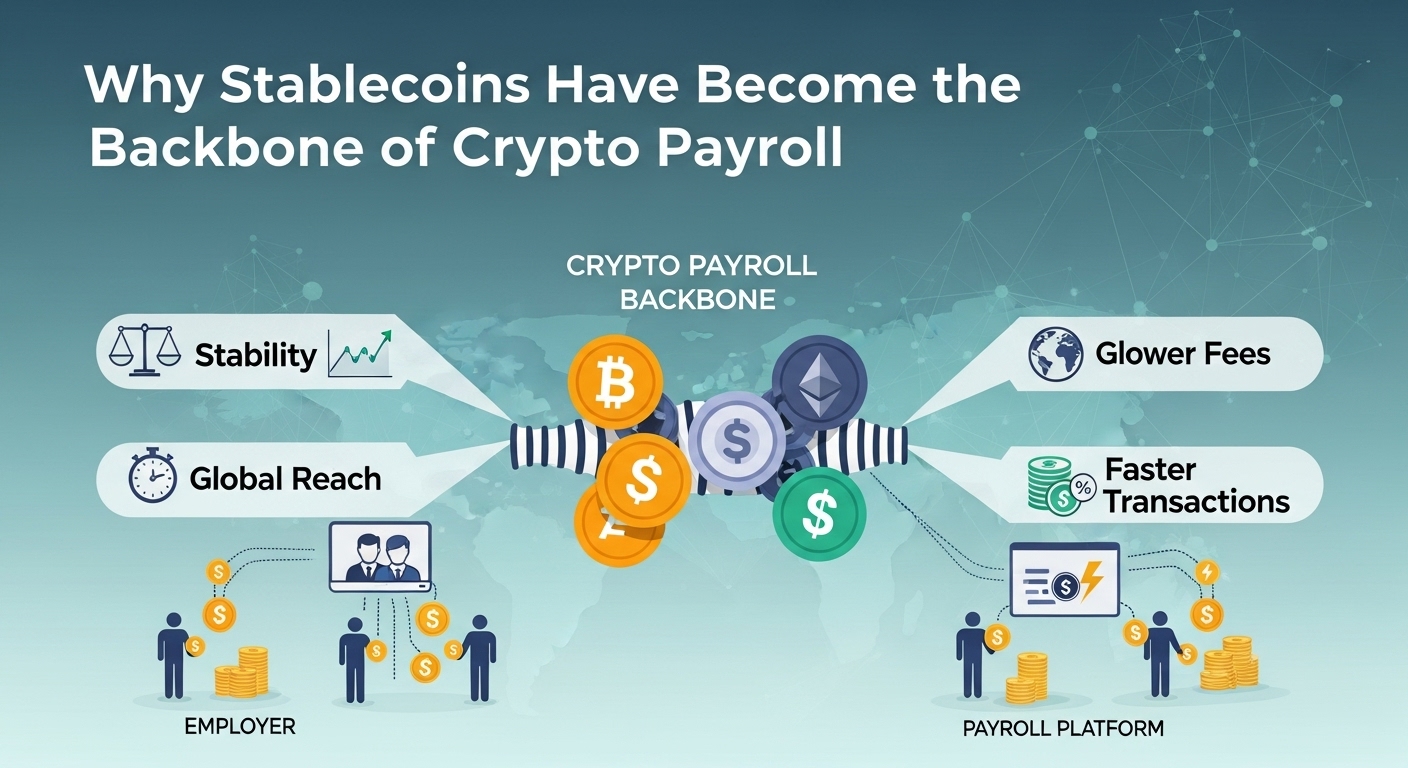

Why Stablecoins Have Become the Backbone of Crypto Payroll

The dominance of stablecoins within crypto payroll arises from their unique ability to provide value stability while still benefiting from all the efficiencies of blockchain technology. Employees want predictable salaries, and businesses want predictable costs. Stablecoins offer both. Where traditional cryptocurrencies like Bitcoin are subject to rapid market fluctuations, stablecoins closely mirror fiat currencies, which allows them to serve as a reliable medium of exchange.

The stability alone makes stablecoins attractive, but the real appeal lies in how this stability is paired with the efficiency of blockchain networks. Since stablecoins operate on-chain, they settle transactions within minutes and remain available twenty-four hours a day, even during weekends and global holidays. This creates a payroll environment free from delays caused by banking cut-off times or international wire transfer procedures. Companies no longer need to navigate slow clearing processes or rely on multiple financial intermediaries. Instead, they can execute payroll operations instantly and at significantly lower cost.

Additionally, the cost-effectiveness of stablecoin transactions is a major reason behind their rise in payroll. Traditional cross-border salary transfers often involve paying high banking fees, foreign exchange costs, and intermediary charges. Stablecoins eliminate many of these overhead costs. The transparency of blockchain means that both employers and employees can see exactly how much was sent and received, without worrying about hidden fees. For organizations with global teams, these savings can compound significantly.

Perhaps one of the most strategic reasons behind the adoption of stablecoins is their ability to support global hiring. Businesses can hire talent from any country without worrying about local bank access, slow payment systems, or currency instability. Stablecoins serve as neutral, borderless digital money that all parties can rely on. This not only simplifies payroll but also allows companies to expand their global workforce with confidence.

Why Employers Are Embracing Stablecoin Payroll

Employers are adopting stablecoin payroll systems because they solve many long-standing problems in global compensation. For companies with remote or international teams, paying employees in traditional banking systems often requires juggling multiple banks, currencies, and compliance rules. Stablecoins eliminate these complexities by offering a universal digital currency that can be transferred quickly and economically.

The ability to pay workers rapidly is a major advantage. Salaries that would normally take three to five business days to reach an international employee can now arrive within minutes. This efficiency strengthens relationships with global contractors and freelance workers, who often rely on timely payments to manage their personal finances. For companies operating on tight project timelines, being able to issue immediate payments can also improve operational agility.

Employers also benefit from enhanced transparency. Blockchain-based payroll systems provide clear records of every transaction, simplifying accounting and internal audits. Companies can more easily track payment histories, analyze payroll costs in real time, and provide transparent documentation for regulatory reporting. This ease of recordkeeping improves internal governance and reduces the risk of payroll-related errors.

Beyond operational advantages, offering crypto payroll options helps companies improve their employer brand. Many modern professionals, especially those working in Web3 or technology sectors, prefer to be compensated in digital assets. By offering stablecoin payroll options, businesses can position themselves as forward-thinking and aligned with the evolving digital economy. This can give companies a competitive edge when recruiting global talent.

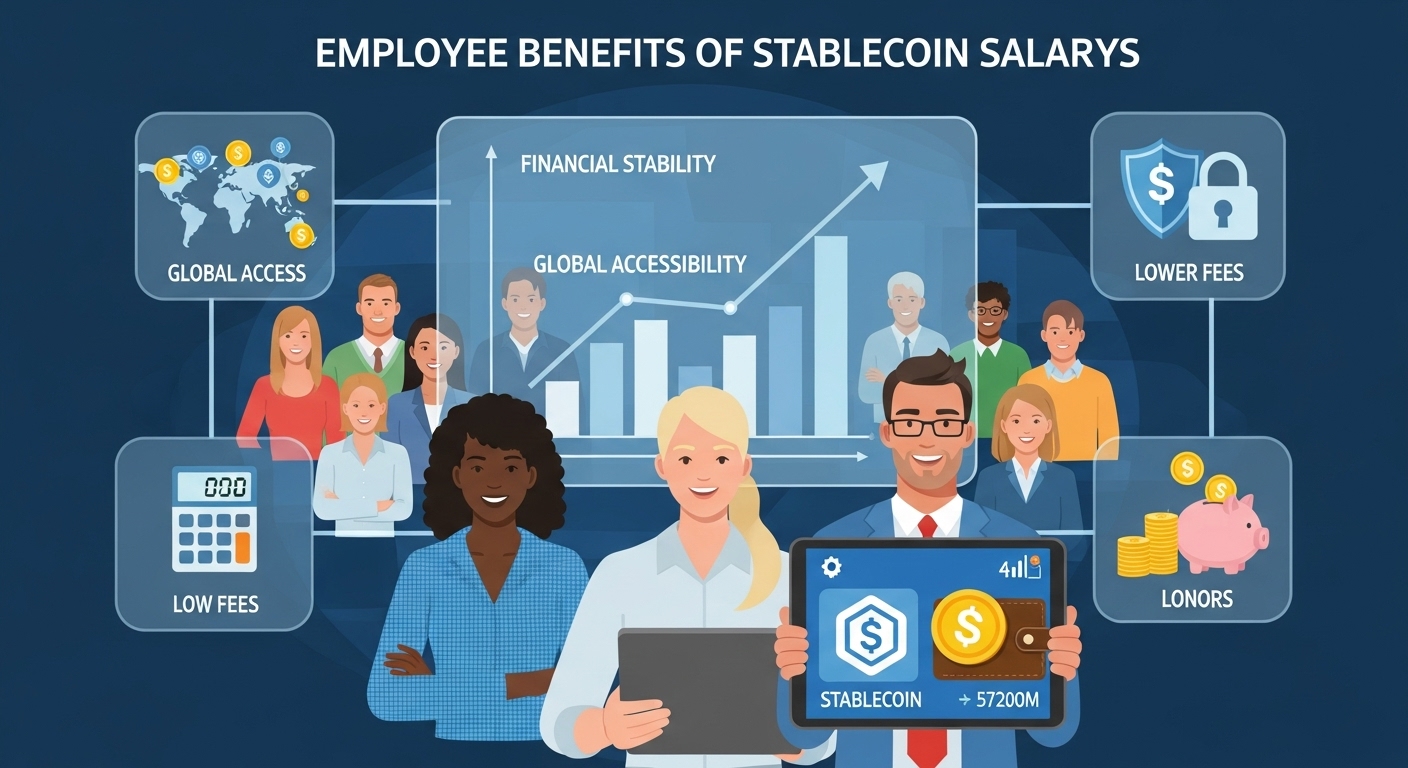

The Employee Benefits of Stablecoin Salaries

Employees working for global companies are often the ones who feel the drawbacks of traditional payroll systems the most. Delayed transfers, high foreign exchange fees, and unstable local currencies can make it difficult for workers to access the full value of their earnings. Receiving salaries in stablecoins offers a path around these burdens.

One of the biggest benefits for employees is instant access to their earnings. Rather than waiting days for an international transfer to clear, workers can receive stablecoin salaries and access their money within minutes. This can dramatically improve financial stability, especially for contractors and freelancers who depend on timely payments.

Stablecoins also open the door to financial inclusion for workers living in emerging markets. In many countries, local currencies suffer from inflation, capital controls, or limited banking infrastructure. Receiving stablecoins gives employees access to a stable, dollar-pegged asset that protects their future earnings. It also empowers them to make global purchases, participate in the digital economy, and use on-chain financial tools.

Furthermore, employees gain flexibility with how they use their earnings. They can convert stablecoins to local currency if they prefer traditional banking, or they can hold them on-chain and use them for savings, payments, or participation in decentralized finance platforms. The freedom to choose how to store and use value represents a significant enhancement over conventional payroll methods.

Different Types of Stablecoins Used in Payroll

Not all stablecoins follow the same model, and this has implications for payroll. The most widely used stablecoins for salaries are those backed by fiat reserves. These stablecoins maintain a one-to-one peg with currencies like the US dollar by holding cash, treasury securities, or similar assets in reserve. Examples include well-known names such as USDC, USDT, and other regulated stablecoins emerging in the market.

This reserve-backed model makes fiat-backed stablecoins ideal for payroll because they offer the highest degree of price predictability. Employees and employers can feel confident that the value of the stablecoin remains close to the fiat value it represents. This reliability is essential for maintaining trust in the compensation process.

Other types of stablecoins exist, including those backed by crypto collateral or algorithmic systems. While these models can be innovative, they introduce risks that make them less suitable for payroll. Crypto-collateralized stablecoins fluctuate based on the value of the collateral backing them. Algorithmic stablecoins rely on complex mechanisms that can sometimes fail, leading to de-pegging events. For these reasons, businesses and employees typically prefer fiat-backed stablecoins when engaging in payroll transactions.

Challenges and Risks to Consider in Stablecoin Payroll

Despite its many advantages, stablecoin payroll also brings challenges that companies must address responsibly. One major concern is regulatory compliance. Different countries classify crypto assets differently, making it essential for employers to understand local laws before adopting crypto payroll solutions. Tax authorities may treat stablecoin income differently from traditional salary income, requiring careful tracking and reporting.

Security is another important concern. Because stablecoins are held in digital wallets, both employers and employees must safeguard private keys and ensure that wallets are protected from phishing attacks, hacks, or user error. Companies may choose to use regulated custodians or multi-signature wallets to manage risk, but the responsibility for secure storage remains a core component of any stablecoin payroll system.

Some stablecoins also carry a degree of de-pegging risk. Although reputable stablecoins work hard to maintain their value, history has shown that even large stablecoins can temporarily lose their peg during periods of market stress or regulatory pressure. Companies must monitor the health of their chosen stablecoins and adopt risk mitigation strategies such as diversification or maintaining a mix of fiat and digital reserves.

See More: Crypto Market Today Bitcoin & Ethereum Rebound

How Businesses Can Successfully Implement Stablecoin Payroll

Implementing a stablecoin payroll system requires thoughtful planning. Companies must first determine their strategic goals and decide whether crypto payroll will be optional or a core offering. Some organizations introduce crypto salaries gradually, allowing employees to choose what portion of their salaries they would like to receive in stablecoins. Others implement hybrid systems where part of the salary is paid in fiat and part in digital assets.

The next step involves choosing a reliable infrastructure provider. Many businesses partner with crypto payroll platforms that integrate directly into their existing HR systems. These platforms automate salary calculations, conversions, and transfers while ensuring regulatory compliance. It is important to choose a provider with strong security measures, transparent reporting tools, and a good compliance record.

A successful implementation also includes employee education. Workers need to understand what stablecoins are, how to manage wallets, and how to convert their earnings if needed. Clear communication ensures that employees feel confident and supported throughout the transition.

Finally, the company must develop internal workflows for managing stablecoin payroll, including verification of wallet addresses, test payments, approval processes, and transaction monitoring. Establishing these processes ensures that payroll continues smoothly and securely, even as the organization shifts to blockchain-based systems.

The Future of Stablecoin Payroll in a Digital World

The rise of stablecoins in payroll marks a significant shift in the global financial landscape. As regulations evolve and blockchain technology matures, stablecoin payroll systems will likely become more accessible and widely adopted. The integration of stablecoin payments with traditional financial systems will continue to improve, enabling seamless conversion between on-chain and off-chain money.

Future payroll innovations may include features like streaming salaries, where employees receive earnings continuously rather than once a month. On-chain payroll records may integrate more deeply with accounting and tax software, automating much of the financial workflow. New types of stablecoins, possibly including central bank digital currencies, may further expand the digital payroll ecosystem.

The direction is clear: the future of payroll is global, digital, and increasingly powered by stablecoins. Companies that adopt stablecoin payroll early will place themselves at the forefront of financial innovation, improve their operational efficiency, and offer employees a level of flexibility and empowerment that traditional payroll systems cannot match.