Crypto’s Meme Magic and Market Moves Understanding Today’s Viral Trends

Explore how meme magic, social hype, and digital culture shape crypto market moves, price trends, and investor psychology in today’s fast-changing landscape.

The world of crypto thrives on innovation, unpredictability, and cultural momentum. What makes it even more fascinating is the way internet humor and viral storytelling shape real financial movements. Crypto’s Meme Magic and Market. Traders often speak about meme magic, a playful yet surprisingly accurate term that describes how jokes, trends, and online communities influence market moves across digital assets. The modern crypto market is no longer driven solely by technical analysis or fundamental metrics. Instead, it is intertwined with social sentiment, community hype, and viral narratives that spread faster than traditional financial news.

In recent years, the rise of meme coins, the influence of decentralized communities, and the impact of celebrity endorsements have transformed the crypto environment into a culturally charged ecosystem where humor and speculation blend into real price action. This article explores the surprising relationship between memes and markets, explaining how meme magic and market moves interact, why they matter, and how investors can navigate a space where culture often moves faster than economics.

Meme Magic in Crypto

Meme magic refers to the collective power of online communities to influence real-world outcomes. In crypto, this influence is amplified due to the speed of information distribution, the global nature of digital culture, and the emotional energy found within investor communities. Memes serve as a universal language, distilling complex ideas into simple, entertaining visuals or phrases that resonate instantly with millions of users.

The concept gained significant attention when assets like Dogecoin and Shiba Inu skyrocketed in value primarily because of community enthusiasm and social media virality. These coins did not gain traction due to technical superiority but because their narratives captured the public imagination. That cultural resonance creates a psychological effect that turns a meme into a catalyst for financial speculation. Once a meme becomes widely recognized, it encourages participation, discussion, and the kind of collective optimism that fuels upward price momentum.

Meme magic exists because people identify with stories more than statistics. A meme simplifies market sentiment into something humorous yet relatable, making the asset feel approachable even to newcomers. This psychological accessibility leads to increased buying pressure when positive memes surge and equally fast sell-offs when the tone shifts. In a marketplace where perception often dictates reality, meme magic becomes a powerful driver of market moves.

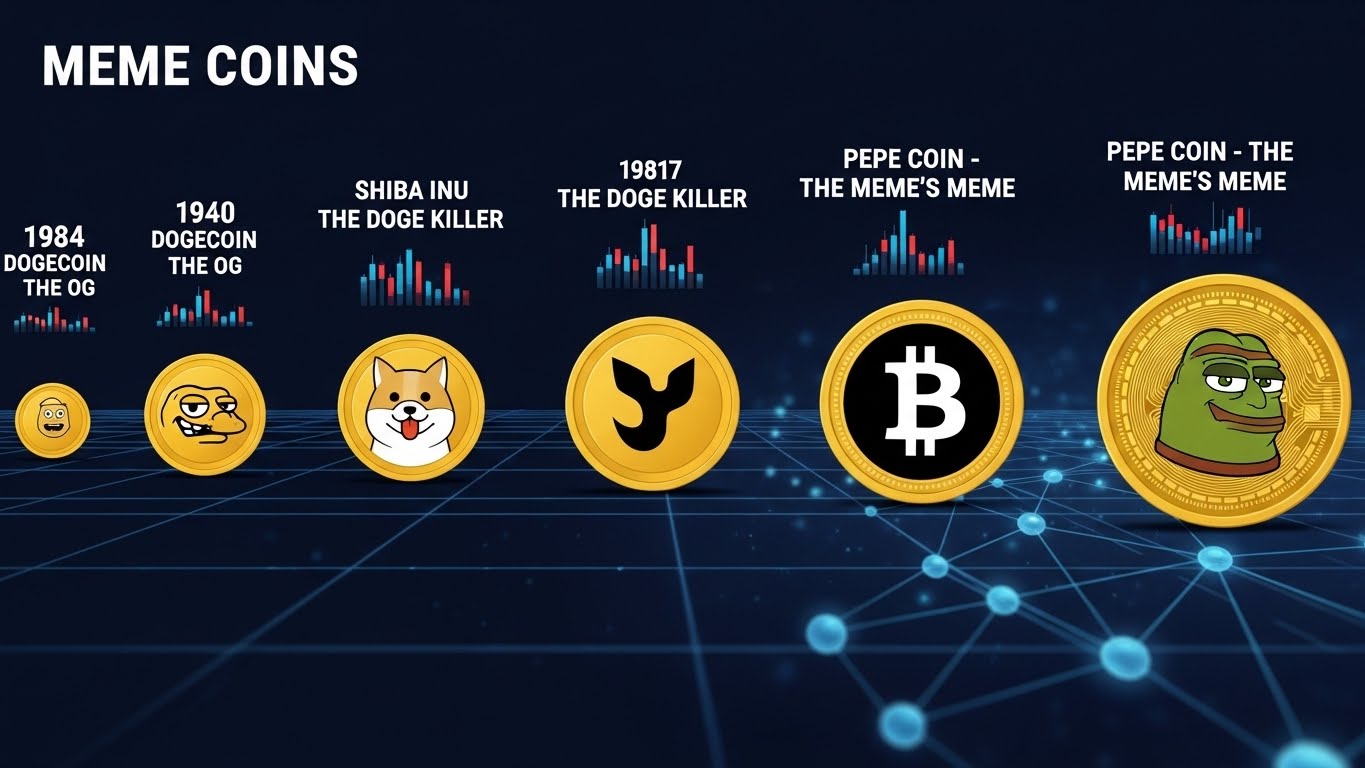

The Evolution of Meme Coins

Meme coins began as internet jokes but evolved into a defining feature of crypto culture. Dogecoin, created as a parody of the industry’s speculative nature, unexpectedly became one of the most widely recognized digital currencies in the world. Its ascent was largely driven by community support and periodic endorsements from influential figures, most notably tweets that propelled it into mainstream awareness.

Following Dogecoin, countless other tokens emerged, relying heavily on branding, humor, and viral appeal. Coins like Shiba Inu and Pepe attracted large followings not because of groundbreaking technology but due to the cultural impact of their associated memes. These coins represent a fusion of entertainment and investment, drawing users who enjoy participating in a shared social experience as much as they enjoy potential financial gains.

While meme coins often lack the sophisticated blockchain functionality found in projects like Ethereum or Avalanche, their success highlights a central truth about crypto markets: value is defined by what people collectively believe in. When a community rallies behind a token with conviction and creativity, the meme becomes a self-sustaining engine of attention and liquidity.

How Meme Magic Influences Market Sentiment

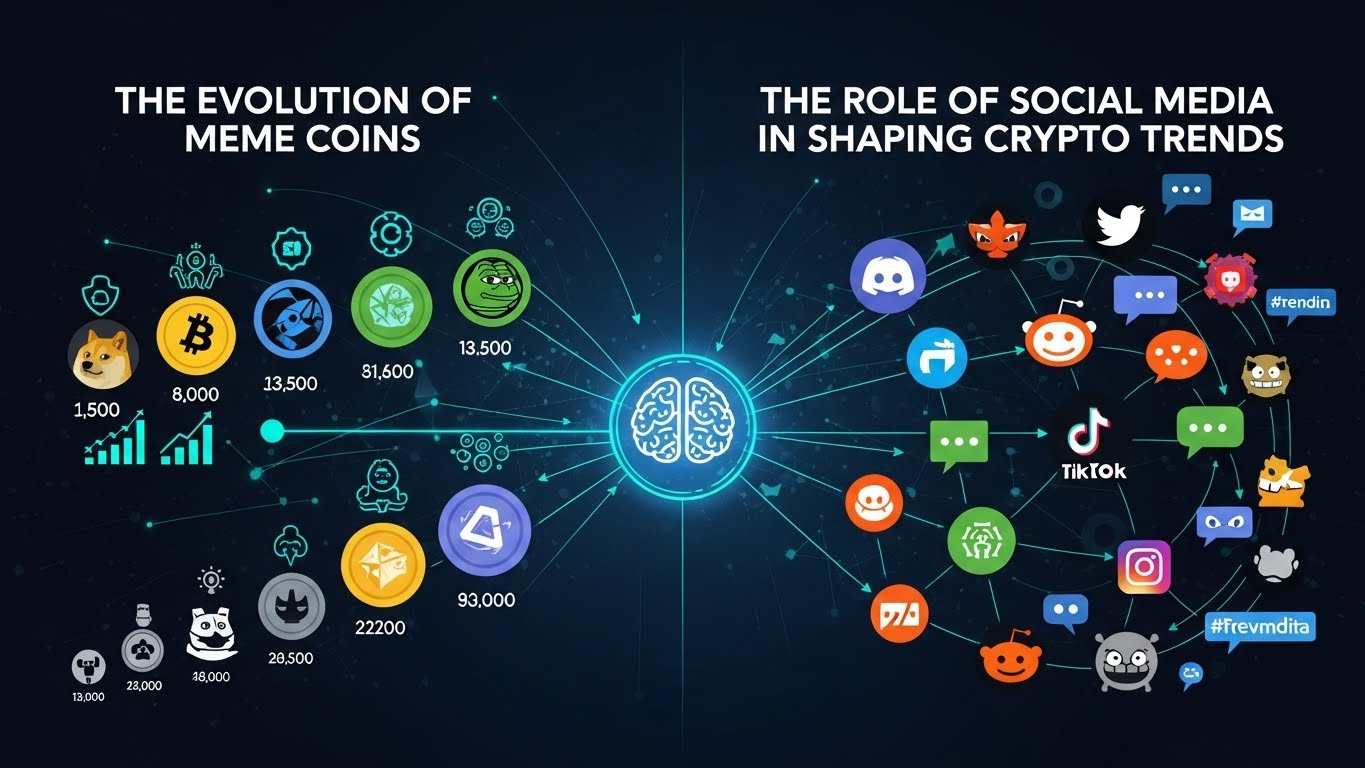

Market sentiment in crypto is more volatile and reactive than in traditional financial markets. With constant discussions happening across platforms like X (Twitter), Reddit, Discord, and Telegram, narratives shift rapidly. When a meme begins trending, it can quickly ignite a chain reaction among investors who fear missing out on early gains. This fear of missing out, often abbreviated as FOMO, magnifies the emotional nature of trading and contributes to sudden, dramatic price movements.

What makes meme magic particularly influential is the way it spreads. Viral memes attract individuals who may never have traded crypto, expanding the pool of participants beyond conventional traders. As new buyers flood into an asset due to excitement rather than analysis, demand increases and prices rise. This creates a feedback loop in which price action generates more memes, attracting more investors and further elevating the market.

However, the same mechanism can work in reverse. Negative memes or shifts in sentiment can trigger equally powerful sell-offs. When the cultural narrative surrounding a coin shifts from optimism to skepticism, confidence erodes quickly. Understanding this balance is essential for anyone trying to interpret market moves influenced by social dynamics.

The Role of Social Media in Shaping Crypto Trends

Social media platforms act as the pulse of the crypto market. Price movements often follow waves of conversation long before they appear on technical charts. Influencers with large followings can ignite buying frenzies with a single post, while grassroots communities can propel unknown tokens into global visibility through collective effort.

This dynamic creates an environment where information spreads instantly, and interpretations multiply rapidly. Crypto discussions online are not confined to investment analysis; they blend humor, education, speculation, and storytelling. Memes become part of how traders understand and interpret ongoing trends, allowing the community to shape the narrative collectively.

Platforms like X amplify the speed of dissemination. Trending hashtags, viral screenshots of gains, and humorous content create a sense of urgency, convincing many that they must act before the opportunity disappears. This urgency powers short-term volatility and contributes to sudden market surges associated with meme magic and market moves.

Meme Culture vs. Fundamental Analysis

A unique tension exists in crypto between meme-driven sentiment and fundamental analysis. Serious blockchain projects rely on technology, development teams, utility, and adoption metrics to justify long-term value. Meanwhile, meme coins often thrive purely on cultural momentum, challenging traditional notions of how assets should be valued.

Traders who rely heavily on fundamentals sometimes underestimate the power of cultural relevance. A project with exceptional technology but poor community engagement may struggle to gain traction, while a simple coin backed by humor and viral energy may see explosive growth. This doesn’t make fundamentals irrelevant but highlights the multifaceted nature of modern crypto markets.

Long-term sustainability typically requires more than memes, but memes themselves can act as gateways. They draw newcomers into the ecosystem, increasing overall participation. Many traders who first enter through meme coins eventually expand into decentralized finance, layer-1 infrastructure projects, and Web3 applications, deepening the market overall.

The Risks Behind Meme Magic

Although meme magic can produce impressive short-term gains, it carries inherent risks. Price volatility is significantly higher in meme-driven assets, meaning values can rise or collapse within hours. Liquidity can be inconsistent, especially in newer projects, leading to dramatic slippage during trades.

Another risk is the presence of speculative mania. When investors buy solely based on hype rather than analysis, the market becomes vulnerable to sudden corrections. These corrections often occur when early participants take profits, leaving late entrants to absorb losses. In extreme cases, developers may abandon projects or exploit community trust, resulting in infamous rug pulls where liquidity is drained and the token collapses.

Understanding these risks helps investors approach meme-fueled markets with a balanced perspective. While participating in viral trends can be entertaining and potentially profitable, relying exclusively on sentiment makes one vulnerable to rapid and unexpected downturns.

Interpreting Market Signals Beyond Memes

To navigate markets influenced by meme culture, traders often combine sentiment analysis with market indicators. Monitoring social media trends offers insights into when interest in a coin is rising or fading. However, sentiment alone is not enough; it must be evaluated alongside measurable factors such as trading volume, liquidity depth, exchange listings, and price volatility.

Signals such as increasing trading volume may suggest that a meme-driven rally has more room to grow, while rapidly declining volume can indicate exhaustion. Liquidity plays a crucial role because a heavy concentration of tokens in a few wallets can lead to dramatic movement when those holders decide to sell. Understanding how these factors interact provides a clearer picture of what may happen next.

Even meme-driven markets follow cycles. After periods of intense hype, consolidation phases often emerge before another trend begins. Recognizing these cycles helps traders better interpret market moves, making them more capable of identifying genuine opportunities while avoiding overheated situations.

Preparing Strategies for Meme-Driven Markets

Successful participation in the world of meme magic requires strategy rather than spontaneous reaction. Research is always the starting point, even for meme coins. Although these tokens may not offer deep technical fundamentals, evaluating their community strength, developer history, token distribution, and project transparency can reveal valuable insights.

Position sizing is equally important. Allocating only a portion of a portfolio to high-risk meme assets reduces exposure to sudden drawdowns while still allowing participation in potentially high-reward movements. Setting clear entry and exit points helps traders avoid emotional decision-making, especially during fast-moving rallies.

Timing matters significantly in meme-driven markets. Early participants benefit the most, while those who enter after widespread hype may face elevated risk. Understanding this reality helps traders adopt a disciplined approach, maintaining enthusiasm while respecting market structure.

The Cultural Future of Meme Magic in Crypto

As crypto becomes more integrated with digital culture, the influence of memes is likely to grow. New generations of traders entering through social platforms will bring fresh forms of humor, identity, and collaboration. The boundary between investment communities and entertainment communities may continue to blur, creating hybrid ecosystems where participation feels more like joining a movement than engaging in financial speculation.

Web3 environments, such as virtual worlds, gaming ecosystems, and decentralized social platforms, will likely intensify this trend. In these spaces, memes act as symbols of belonging, transforming from viral jokes into digital assets themselves. The blending of culture and technology ensures that meme magic remains a defining force in how market moves unfold.

Regulation may introduce guardrails, especially concerning transparency and advertising, but cultural momentum is unlikely to disappear. If anything, it will evolve alongside the broader digital economy, influencing how new tokens emerge, how communities grow, and how narratives shape perceived value.

Conclusion

Understanding meme magic and market moves is essential for interpreting what is happening in crypto today. While memes may appear humorous and lighthearted, their influence on investor psychology and price action is substantial. They shape narratives that spread quickly, alter sentiment, attract new participants, and steer the direction of entire market segments.

Crypto is unique because it merges technology with culture, emotion, and global community energy. This convergence means that prices do not move solely based on logic but also on the power of shared ideas. Recognizing the interplay between memes and market moves allows investors to navigate the dynamic landscape with greater clarity, balancing enthusiasm with strategy and curiosity with caution.

As long as digital culture continues to thrive, meme magic will remain a force shaping crypto’s evolution. Investors who understand both the cultural and analytical sides of the market will be best equipped to interpret trends, adapt to changes, and recognize opportunities within one of the most unconventional financial ecosystems in the world.