Bitcoin Mining Stocks Slip as Production Costs Surge in 2025

Bitcoin mining stocks slip as BTC production costs surge, raising pressure on miners while investors brace for volatility across the crypto market.

The cryptocurrency market is once again experiencing volatility, and one of the biggest shifts is happening in the world of Bitcoin mining stocks. Investors have been monitoring rising mining difficulty, higher electricity prices, and post-halving pressure—but the latest data shows a sharper downside. Over the past week, Bitcoin mining stocks slipped 1.8%, a decline closely linked to the surge in BTC production costs, which have climbed to some of the highest levels miners have ever faced.

As global energy prices fluctuate and mining difficulty continues climbing, miners find themselves squeezed between soaring operational expenses and slower revenue growth. This pressure is reshaping investor sentiment, influencing stock performance, and forcing mining companies to rethink long-term strategies. The keyword Bitcoin mining stocks has quickly become a focal point in financial analysis, signaling broader implications for the cryptocurrency sector.

Why Bitcoin Mining Stocks Are Slipping

The recent decline in Bitcoin mining stocks can be attributed to multiple intersecting forces. While volatility is nothing new for the crypto industry, the combination of rising operational costs and slowing revenue growth is leading to a more sustained impact on stock performance.

The Impact of Rising BTC Production Costs on Mining Shares

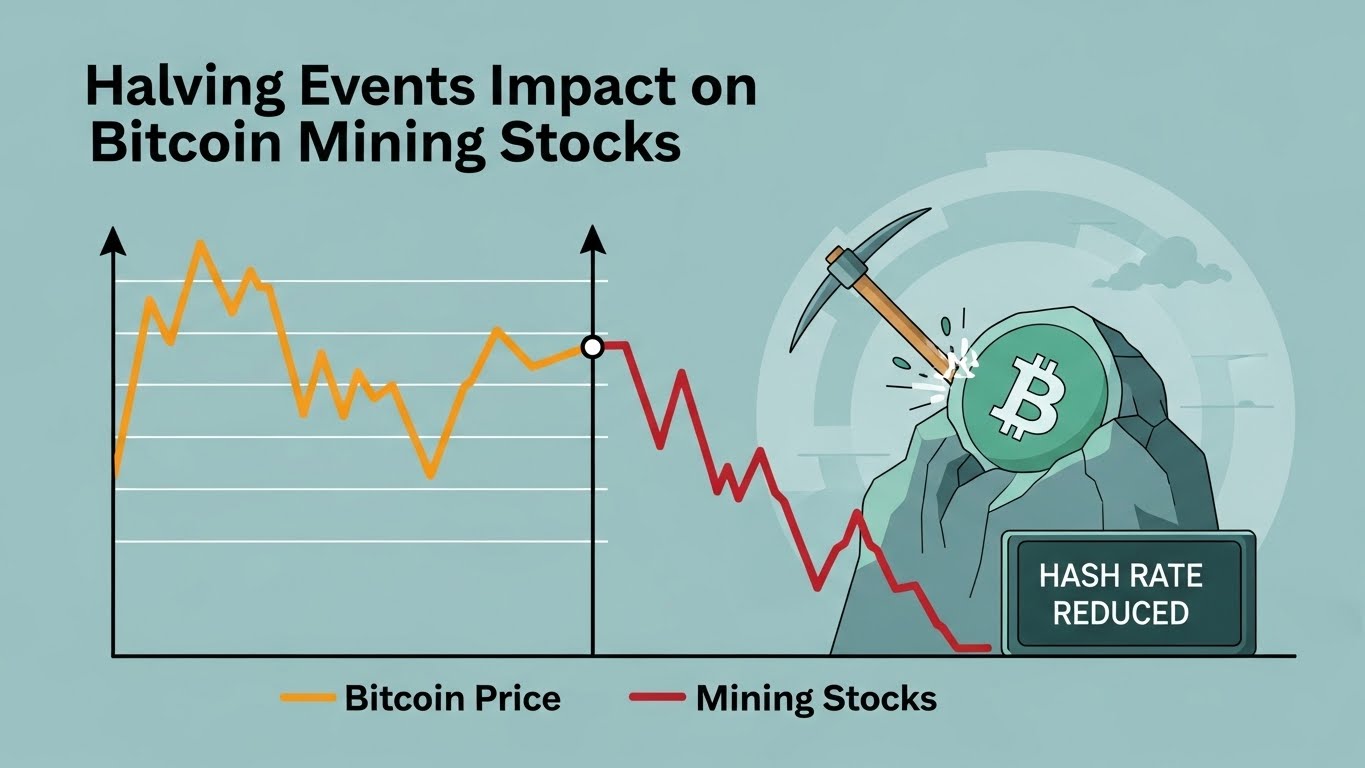

One of the biggest reasons Bitcoin mining stocks have dropped 1.8% is the dramatic increase in BTC production costs. These costs measure how much money a mining company spends to produce a single Bitcoin.With Bitcoin’s halving cutting block rewards, miners now receive fewer BTC for the same amount of work. At the same time, rising difficulty means machines must perform more computations—requiring more energy—to mine each block.

This double-pressure triggers a rise in the break-even price, making profitability harder to maintain. Many mining companies are now spending more on electricity, cooling systems, labor, and equipment maintenance, which directly affects the valuation of Bitcoin mining stocks.

Bitcoin Mining Stocks and the Surging BTC Production Costs

The exact keyword appears in this heading as requested.

The relationship between Bitcoin mining stocks and rising production costs is straightforward but severe. When expenses rise faster than Bitcoin’s market price, mining companies experience shrinking margins. This in turn affects their stock prices, which investors often use as a proxy for the broader health of the mining sector.Mining Difficulty Reaches New HighsMining difficulty—an algorithmic measure that adjusts every two weeks—ensures that block times remain stable. But higher difficulty means miners must consume more energy to compete. Recent difficulty increases have pushed operational expenses to record levels, making even top-tier miners feel the strain.

Electricity Prices Are Driving Up Costs

Energy is the largest operating cost for any mining facility. Regions that once offered cheap electricity—such as parts of North America and Europe—are experiencing higher utility rates due to inflation, geopolitical tension, and seasonal demand.This directly affects Bitcoin mining stocks, as publicly traded miners must disclose rising expenses in earnings reports, often triggering sell-offs.

How Halving Events Affect Bitcoin Mining Stocks

Every Bitcoin halving reduces miner rewards by 50%, making profitability harder. The most recent halving drastically reshaped the cost structure of mining, forcing miners to operate with narrower margins unless Bitcoin’s price rises significantly.Revenue Compression and Falling MarginsWhen block rewards fall but production costs rise, miners experience a profitability squeeze. This is reflected in the performance of Bitcoin mining stocks, which tend to fall following halvings until the market stabilizes.

Increased Competition Among Miners

Mining is better funded and more competitive than ever before. Major companies have access to advanced ASIC machines, large mining farms, and institutional capital. Smaller miners struggle to compete, increasing consolidation across the industry—another factor influencing stock performance.Investor Sentiment and the Future of Bitcoin Mining StocksMarket sentiment plays a major role in how Bitcoin mining stocks behave. When investors see operational costs rising, stock prices falling, and uncertainty across the crypto landscape, they often hesitate to enter the market.

Short-Term Bearish, Long-Term Bullish

While the short-term outlook for Bitcoin mining stocks appears bearish, many analysts remain optimistic about the long-term future of Bitcoin mining. As Bitcoin’s price historically grows after each halving, miners often experience delayed but substantial revenue increases.Institutional Interest Remains StrongDespite the current downturn, institutional investors continue accumulating shares of major mining companies. Their long-term view suggests confidence in both the Bitcoin market and improving mining efficiency through hardware innovation.

How Mining Companies Are Responding to Surging Production Costs

Mining companies are not sitting idle while production costs surge. Several strategies are being employed to improve profitability and stabilize Bitcoin mining stocks.Investing in Newer, More Efficient ASIC MachinesMiners are adopting the latest-generation ASIC machines, which offer significantly better hash rate performance while consuming less electricity. Efficiency improvements can reduce the cost of producing Bitcoin.Expanding Into Renewable Energy Sources

Solar, wind, hydro, and geothermal power are becoming essential to reducing long-term mining costs. Miners that leverage renewable energy can lower expenses and appeal to environmentally conscious investors.Geographic Diversification Some miners are relocating operations to regions with cheaper electricity or more favorable regulations. Areas such as Kazakhstan, Paraguay, and certain U.S. states have become hotspots for mining expansion.

Broader Crypto Market Trends Affecting Bitcoin Mining Stocks

The performance of Bitcoin mining stocks does not exist in isolation. Several broader market conditions affect their price movements.Bitcoin’s Price VolatilityThe more volatile Bitcoin becomes, the harder it is for mining companies to forecast revenue. Sudden drops in BTC can send Bitcoin mining stocks tumbling. Regulatory Uncertainty

New regulations on crypto mining—particularly those concerning energy usage and environmental impact—can negatively affect mining companies.Global Economic ConditionsRising interest rates, inflation, and geopolitical tension all influence investor behavior. Companies with high energy costs or large debts typically suffer the most.Expert Predictions for Bitcoin Mining Stocks Over the Next YearFinancial analysts offer mixed predictions about the future of Bitcoin mining stocks.

Optimism Driven by Post-Halving Cycles

Historically, mining stocks rebound several months after halving events as Bitcoin gradually appreciates. Analysts believe the same trend may repeat this cycle.

Rising Corporate Adoption Could Boost the Sector

If major corporations integrate Bitcoin or continue adding it to their balance sheets, demand may push Bitcoin’s price higher—boosting mining profits and stock prices.Strategies for Investors Watching Bitcoin Mining StocksInvestors interested in Bitcoin mining stocks need to understand how factors like energy costs, mining difficulty, and Bitcoin’s price correlate with stock performance.Track Energy Market Forecasts

Electricity cost trends provide direct insight into mining profitability.Monitor Public Miner Earnings ReportsQuarterly reports from companies like Marathon Digital, Riot Platforms, Hive, and CleanSpark reveal critical data on cost-per-coin, hash rate expansion, and future plans.Evaluate Hash Rate Growth vs. Operating ExpensesA miner increasing hash rate faster than operating costs is better positioned for long-term profitability.

Conclusion:

The 1.8% decline in Bitcoin mining stocks highlights the significant impact of rising BTC production costs on the mining sector. While miners face short-term challenges—ranging from increasing energy prices to halving-driven revenue cuts—the long-term outlook remains cautiously optimistic.As Bitcoin continues maturing and institutional interest grows, mining companies that innovate, reduce energy costs, and expand efficiently may see their stock valuations strengthen again. Investors watching Bitcoin mining stocks

should keep an eye on production costs, difficulty levels, and broader market conditions to make informed decisions.For those who believe in the long-term potential of the mining industry, now may be a strategic moment to study market trends, analyze miner fundamentals, and prepare for future opportunities. Stay informed, stay observant, and continue exploring the evolving world of Bitcoin mining stocks.