Gold market analysis Jan 23 intraday entry levels

Gold market analysis for Jan 23 with key intraday price entry levels, support/resistance, momentum cues, and risk tactics for active traders.

If you trade gold actively, you already know the difference between a good day and a frustrating day is often a matter of timing. The broader trend might be obvious, yet the trade still fails because the entry is late, the stop is poorly placed, or the market chops inside a range before breaking out. This Gold market analysis for January 23 is built for that reality: it’s about identifying clean intraday zones where price is most likely to react, and combining those zones with momentum cues so you’re not guessing.

On most sessions, gold doesn’t move randomly. It rotates around liquidity: prior highs and lows, widely watched moving averages, and psychologically important round numbers. Active traders can exploit those rotations by mapping key levels before the busiest hours, then waiting for price action confirmation during the highest-liquidity windows. That’s the spirit of this Gold market analysis: a practical framework for intra-day price entry levels that helps you stay patient and decisive.

Also, January 23 trading often sits in a “decision pocket” of the week where market positioning can shift quickly. Even without dramatic headlines, gold can accelerate because the market is constantly repricing real yields, the U.S. dollar, and risk sentiment. The goal isn’t to predict every tick; it’s to define where you want to do business, where you refuse to do business, and what will prove you right or wrong.

In the sections that follow, you’ll get a structured Gold market analysis focused on intraday execution: how to think about trend vs. range conditions, how to treat support and resistance zones, and how to plan entries around pullbacks, breakouts, and reversals. You’ll see related concepts—like liquidity sweep, momentum, volatility, and risk management—woven in naturally, so the strategy stays readable and tradable.

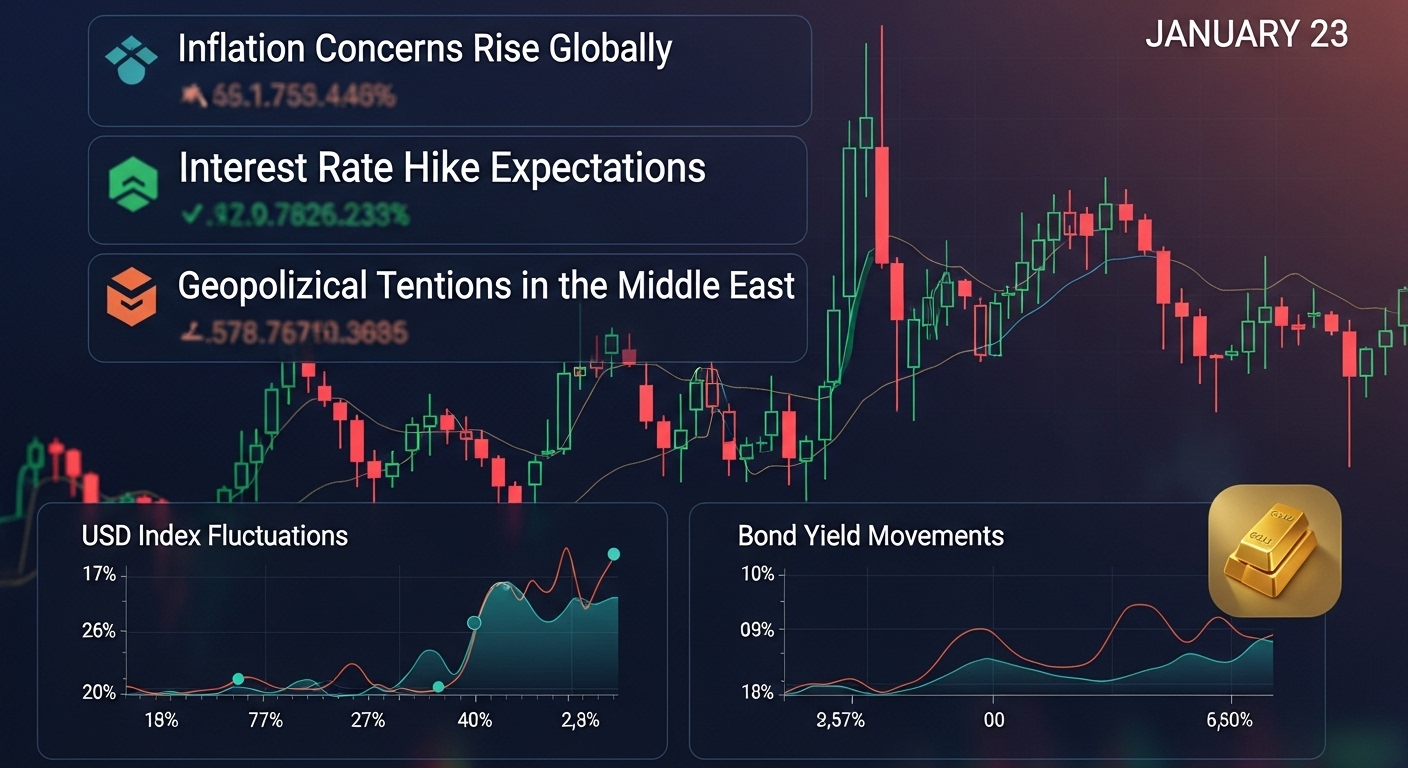

Market context for January 23: what typically drives intraday gold

The best Gold market analysis starts with a simple truth: gold is a hybrid asset. It trades like a currency when the U.S. dollar dominates, like a bond proxy when real yields drive flows, and like a risk hedge when macro uncertainty spikes. On an intraday basis, that creates a pattern: gold often makes its cleanest moves during the overlap of major sessions, when futures liquidity is deep and price can travel from one liquidity pool to another.

For active traders, the most important intraday drivers usually show up as correlations rather than news. If the U.S. dollar strengthens aggressively, gold may struggle to rally unless safe-haven demand overwhelms currency pressure. If real yields sink, gold can rise even if the dollar isn’t collapsing. Your Gold market analysis should assume these forces are present, then focus on execution: enter where the market proves direction, not where you merely hope.

This is why key intraday levels matter. When gold is indecisive, it tends to ping between well-defined zones. When it’s trending, it often respects dynamic support (like a rising short-term average) and accelerates after reclaiming a prior swing. Either way, the trader’s job is the same: define levels, wait for confirmation, manage risk.

Reading the intraday structure: trend day vs. range day

A practical Gold market analysis for January 23 must account for two common day types: trend days and range days. The same level can behave differently depending on which day type is unfolding.

Trend-day clues active traders should respect

On trend days, gold tends to establish directional intent early and then defend pullbacks. You’ll often see the market push beyond a prior intraday swing, consolidate briefly, then continue. The defining feature is that pullbacks are shallow and buyers or sellers step in quickly. For entries, the highest-quality setups usually come from pullbacks into a reclaimed level or into a dynamic trend reference like a short-term moving average. In this Gold market analysis, that means you prioritize “buy the pullback” in uptrends or “sell the rally” in downtrends, rather than fading every move.

Range-day clues that save you from chop

Range days are trickier because gold can look like it’s breaking out—then reverse sharply. On these days, price often respects the range extremes and punishes traders who chase the middle. A range-day mindset in Gold market analysis means you focus on mean reversion: entries near range support or resistance with tight invalidation, and profit-taking toward the opposite side of the range. Active traders can still do well, but only if they stop forcing trend logic onto a ranging market.

Key intra-day price entry levels: how to map them before price arrives

Instead of relying on a single number, a stronger Gold market analysis uses zones. Gold often reacts within a band because institutions scale orders and liquidity is distributed. The highest-importance intraday references typically include the prior day’s high and low, the Asian session range, the first major swing formed during the early European hours, and any clearly defended mid-range pivot.

What matters for January 23 is not the exact label of a level but the behavior of price as it interacts with that level. Active traders should treat levels as decision points: if price accepts above, you look for long entries; if it rejects, you look for shorts; if it whipsaws, you step back and wait. This is the heart of Gold market analysis: price tells you whether the level is holding.

To keep this actionable, the next sections describe three entry styles that work with intraday gold: pullback entries, breakout entries, and reversal entries. Each style uses support and resistance but applies a different trigger so you don’t overtrade.

Pullback entries for active traders on January 23

Pullback entries are often the most consistent approach when gold is trending. A pullback trade assumes the trend is intact and you’re simply waiting for a better price. In this Gold market analysis, the pullback method focuses on a reclaimed level: gold breaks a prior swing, holds above it, then revisits it. That retest becomes your intra-day price entry level if buyers defend it.

Bullish pullback entry logic

If gold pushes upward and closes decisively above a prior intraday high, that high often becomes new support. Active traders can wait for price to return to that zone and then look for bullish confirmation—such as a strong rejection candle, a quick reclaim after a dip, or an increase in buying momentum. The stop is typically placed beyond the zone where the trade thesis is invalidated. The target is commonly the next liquidity pool: a prior high, a round number, or the upper edge of the day’s projected range.

This approach keeps your Gold market analysis grounded. You’re not buying randomly; you’re buying where the market has already revealed demand. The key is patience. Pullbacks that never arrive are not missed opportunities; they’re a sign of a powerful trend where chasing can be dangerous.

Bearish pullback entry logic

The bearish version flips the script. If gold breaks down below a prior swing low and then rallies back into that level, the retest can become a high-quality short entry. Many active traders lose money by shorting weakness far from structure, only to watch price snap back. A pullback entry avoids that trap because you sell into a rally at a known decision zone.

In a strong downtrend, the best pullback shorts often occur when a prior support becomes resistance and price stalls beneath it. If momentum reappears to the downside, the move can extend quickly as stops trigger and liquidity opens. This is a classic Gold market analysis pattern: break, retest, continuation.

Breakout entries and how to avoid false moves

Breakout trading in gold can be profitable, but it’s also where many traders get chopped. Gold loves to run stops above obvious highs and then reverse. A strong Gold market analysis treats breakouts as a process, not a single candle. You want evidence of acceptance, not just a spike.

The “break and hold” rule for cleaner breakouts

A cleaner breakout often includes two parts: a decisive push beyond a key level, followed by a hold above it. That hold can be a brief consolidation or a retest. For active traders, the intra-day price entry level is frequently the breakout level itself—once it proves it can act as support. If price breaks above resistance and then repeatedly closes above it, you have a higher-probability long than if price simply wicks above and collapses.This is especially important in January 23 conditions where liquidity can be deep and stop-runs can be sharp. The “break and hold” mindset makes your Gold market analysis more selective and reduces impulsive entries.

Using volatility cues to filter breakouts

Volatility is your friend when you’re on the right side and your enemy when you’re late. A breakout that occurs with expanding volatility and strong follow-through has a higher chance of continuation. A breakout that occurs on thin momentum or immediately prints long wicks is more likely to fail. Active traders can watch how quickly gold returns to the breakout level: fast failure is a warning. Stable acceptance is a green flag.In this Gold market analysis, volatility isn’t just a statistic; it’s a behavior signal. If the market can’t hold a breakout level, it’s telling you the breakout didn’t attract real participation.

Reversal entries at support and resistance

Reversals are appealing because they offer excellent reward-to-risk, but they require stricter confirmation. Gold can “look” like it’s reversing many times before it actually does. This part of the Gold market analysis is about trading reversals only at meaningful extremes.

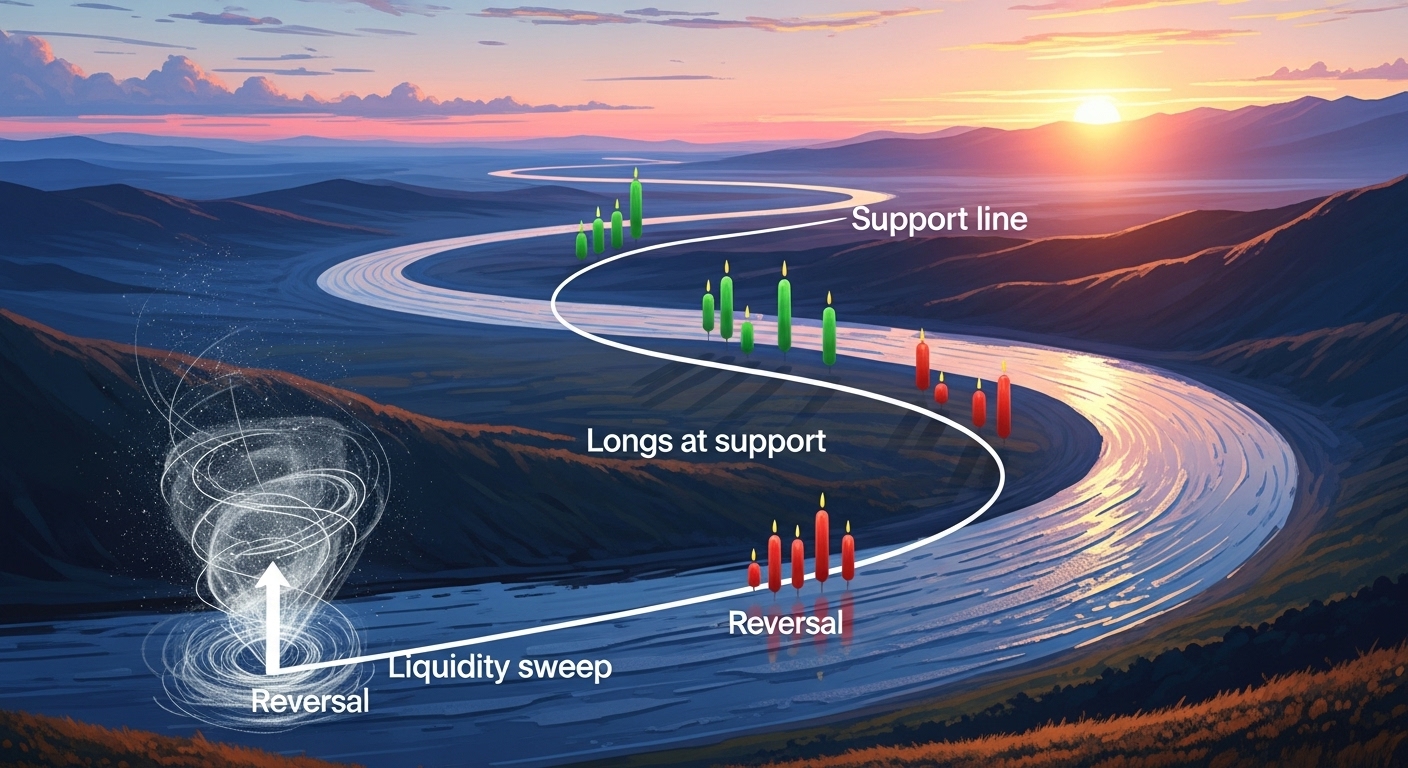

Reversal longs at support with a liquidity sweep

A common reversal pattern in gold is the liquidity sweep: price briefly breaks below a prior low, triggers stops, then quickly reclaims the level. That reclaim is the clue. If the market immediately returns above the broken support and holds, it often signals trapped sellers and a potential push higher. For active traders, the reclaim zone becomes the intra-day price entry level, with risk defined beneath the sweep low.

This strategy can work well on January 23 because intraday liquidity is often dense around obvious lows. The important part is speed and follow-through. A slow reclaim can still fail. A sharp reclaim with rising momentum is more meaningful.

Reversal shorts at resistance with rejection

The bearish reversal pattern mirrors the bullish one. Gold spikes above a prior high, fails to hold, and drops back beneath the level. That failure often signals a stop-run rather than true strength. The intraday entry is typically on the retest from below after the failure, with a stop beyond the rejection high.

Reversal trades can be some of the best trades of the day, but only if your Gold market analysis respects context. If the broader intraday trend is strongly bullish, repeatedly shorting every wick can be costly. Reversals work best when the market is extended, momentum is fading, and the rejection is clear.

How to combine indicators with price levels without overcomplicating

Many traders overload charts. A better Gold market analysis uses indicators to confirm what price is already saying. Two tools are usually enough: a trend reference and a momentum gauge.A short-term moving average can help define whether pullbacks are being bought or sold. If gold is above the trend reference and pullbacks hold, bullish setups have better odds.

If gold is below and rallies fail, shorts tend to work better. A momentum gauge, such as RSI or a simple rate-of-change view, can help you spot divergences at key levels. A divergence doesn’t guarantee reversal, but it can warn you when chasing is risky.The point is not to trade the indicator; it’s to trade the level with confirmation. That keeps your Gold market analysis clean, repeatable, and adaptable.

Session timing: when intraday gold levels matter most on January 23

Gold can move at any time, but the best reactions to key levels often happen when liquidity is highest. In general, the early European window can set the tone, and the U.S. open can accelerate the dominant move or flip it. Active traders should watch how gold behaves around the first major swings of the day. Those swings often become the day’s most important support and resistance references.

If gold respects a level repeatedly during high volume windows, that level becomes more meaningful. If it only reacts during thin hours and then ignores it later, the level may be weaker than it looked. This timing awareness makes your Gold market analysis more realistic because it accounts for participation, not just geometry.

Risk management for active traders using intraday entry levels

Even the best Gold market analysis fails without risk control. Intraday gold can be unforgiving because volatility expands quickly. That means your stop placement must be logical, not emotional. A stop belongs beyond the point where the idea is invalidated, not at an arbitrary distance.

Position size should match volatility. If gold is moving fast, smaller size with wider stops may be safer than larger size with tight stops that get clipped. Likewise, profit-taking should respect structure. If your target sits just before a major resistance zone, taking partial profits ahead of that zone can reduce regret and protect your account during reversals.Strong risk management is what turns intra-day price entry levels from interesting ideas into consistent trading behavior.

Common mistakes traders make in gold intraday analysis

A reliable Gold market analysis is as much about what you avoid as what you do.One common mistake is chasing price in the middle of the range. Another is entering before confirmation at a level, then blaming the level when the real issue was impatience.

A third mistake is ignoring the day type: applying breakout logic on a range day or mean reversion logic on a trend day. Finally, many traders misread volatility and place stops where gold naturally hunts liquidity.If you want to improve quickly, focus less on finding more indicators and more on executing fewer, higher-quality trades at better-defined intra-day price entry levels.

Conclusion

This Gold market analysis for January 23 focuses on what active traders need most: a clear way to identify key intra-day price entry levels and execute with structure. The core idea is simple: treat major support and resistance zones as decision points, then use confirmation to choose pullback, breakout, or reversal entries depending on the day type. Combine level-based trading with basic momentum and volatility awareness, and support it all with disciplined risk management. If you do that, you’ll trade gold with more patience, fewer impulsive entries, and a much clearer plan—exactly what intraday markets reward.

FAQs

Q: What is the best way to use a Gold market analysis for intraday trading?

The best approach is to map key intraday zones first, then wait for price to confirm direction at those zones. A good Gold market analysis is less about prediction and more about preparation and disciplined execution.

Q: Which intra-day price entry levels matter most for active traders?

The most influential intra-day price entry levels often include prior day highs/lows, early-session swing highs/lows, and clearly defended pivot zones that repeatedly attract buying or selling.

Q: How do I know if January 23 will be a trend day or a range day?

You won’t know in advance with certainty, but you can infer it early. Trend days show directional follow-through and defended pullbacks; range days show repeated failures at extremes and choppy mid-range trading.

Q: Are breakout trades reliable in gold?

They can be, but gold frequently produces false breakouts. The most reliable breakout approach is to wait for a break and then a hold (acceptance), rather than entering on the first spike beyond a level.

Q: What’s the biggest risk management tip for intraday gold traders?

Match your risk to volatility and place stops beyond invalidation, not at random distances. Strong risk management is what makes any Gold market analysis actually usable over time.

Also More:Gold Market Analysis for December 30 – Key Intra-day Price Entry Levels for Active Traders