In the face of rising market volatility, Toncoin Wallet’s profitability has declined. Learn about the factors contributing to this shift and how to manage your Toncoin investments effectively. Toncoin (TON), the native cryptocurrency of the decentralized blockchain platform TON (The Open Network), has garnered notice for its revolutionary features and strong community support. However, current market conditions have reduced Toncoin (TON) wallet profitability. As market volatility rises, TON wallets and the cryptocurrency market suffer. This article explains market volatility and the fall in Toncoin investors’ profitability. We will also discuss navigating this unpredictable terrain and boosting Toncoin wallet profits.

Why People Like Toncoin

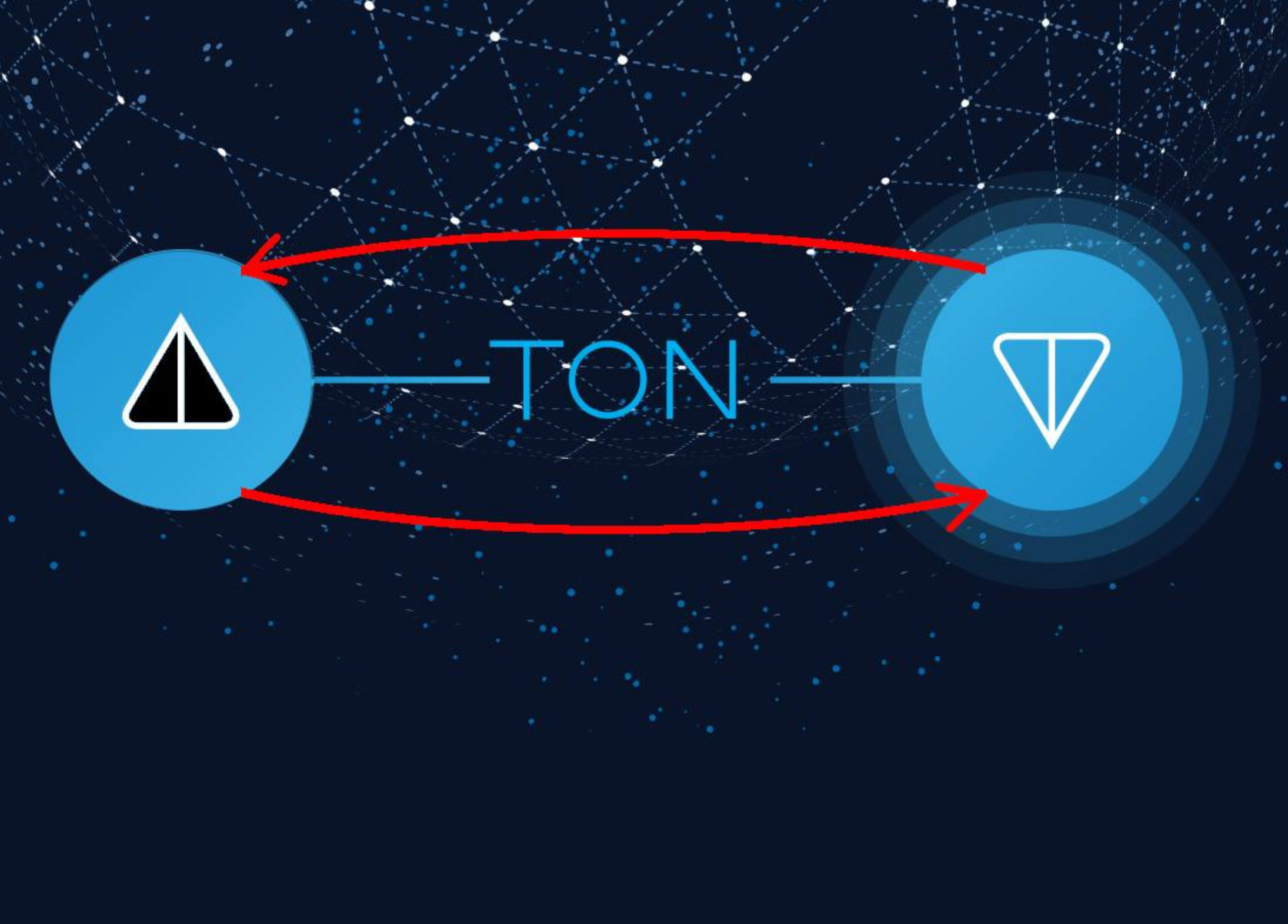

The team behind the well-known messaging software Telegram first created Toncoin (TON), the cryptocurrency that drives the TON blockchain. TON has gained a lot of traction and a burgeoning developer and investor community since it was created to provide a quick and scalable solution for decentralized apps (dApps). As a utility token in the ecosystem, Toncoin (TON) is used for staking, transaction fees, and communication with dApps developed on the network.

Despite its strong use case, toncoin (TON) has seen volatility similar to that of the larger cryptocurrency market. Numerous reasons, such as market sentiment, legislative changes, and technology breakthroughs, can be blamed for the volatility of digital assets, including Toncoin. Although many people have made money using TON wallets, overall profitability has decreased due to growing market volatility.

Rising Market Volatility

In recent months, investors have worried about rising market volatility in traditional and digital marketplaces. A rise in asset price volatility frequently indicates market uncertainty or risk. Understanding the causes of increased market volatility might help investors weather the storm. Global economic instability drives volatility. Market players become more cautious due to inflation, interest rate fluctuations, and geopolitical concerns, causing price fluctuations. Cryptocurrencies and equities may fall when central banks hike interest rates to fight inflation.

Another cause of bitcoin market volatility is regulatory uncertainty. As governments worldwide tighten digital asset rules, market reactions are typically strong due to legal uncertainty. Investor sentiment matters, too. Fear, uncertainty, and doubt (FUD) might increase panic selling and price volatility under uncertainty. Speculative trading and herd behavior increase market volatility. Rising volatility can challenge investors, but well-prepared investors can capitalize. Investors can reduce volatility risks by remaining educated and diversifying and hedging.

Toncoin wallets and volatility

Toncoin (TON), the native cryptocurrency of The Open Network (TON) blockchain, is popular for its scalability, speed, and decentralized environment. Like all cryptocurrencies, Toncoin wallet profitability has recently suffered due to market volatility. In the bitcoin market, volatility is fast price changes. Toncoin investors’ holdings might fluctuate rapidly. Toncoin’s price fluctuates according to global economic conditions, market sentiment, and regulatory developments. TON token wallets are especially vulnerable during turbulent periods.

When Toncoin prices fall, wallet assets lose value, affecting portfolios. Investments may benefit from expansion price increases. Price adjustments reduce profitability. Thus, this is transitory. Price volatility affects popular passive income source toncoin staking incentives. Toncoin’s value volatility may lower staking rewards and investment profitability. Toncoin wallet investors must diversify, hold, and follow market movements to benefit from market upheaval. Understanding volatility helps investors optimize returns and reduce risk in an uncertain market.

Profitability in volatile markets

Profitability in turbulent markets confronts investors with both problems and possibilities. Asset prices fluctuate, notably in cryptocurrency, stocks, and commodities. Some investors avoid tumultuous markets, but others benefit from price changes. Volatile markets are plagued by uncertainty caused by abrupt asset price movements. If investors fail to pace the market, their portfolios may change substantially in short intervals, incurring losses. Unpredictability makes it tougher to retain earnings; emotional reactions like panic selling or excessive purchasing can worsen the issue.

Skilled investors profit from price volatility. One strategy is buying the dip—purchasing assets when their values fall to rebound. Short-term traders profit from price changes spanning days or weeks in volatile markets. Diversifying assets across asset classes or businesses minimizes risk and enhances profitability. Options let investors hedge significant losses. Profitability in volatile markets requires balance, market understanding, and emotional control. Prepared investors can weather the storm and profit.

Conclusion

Toncoin Wallet profitability is falling as market volatility rises. This article discusses the decrease and how to optimize your Toncoin holdings. Market volatility has harmed Toncoin (TON) wallet profitability in recent months. Price volatility due to economic instability, legal constraints, and speculative trading makes it harder for investors to make money. Diversification, long-term holding, and staying current can help investors survive market turbulence. Toncoin (TON) and the cryptocurrency sector are growing; therefore, investors must adapt. Preparation and market knowledge can help investors overcome volatility.