Solo Bitcoin Mining as a Passive Income Strategy

Discover how solo Bitcoin mining works, its risks, rewards, and whether it can truly become your next passive income play in today’s crypto landscape.

Bitcoin has long been associated with financial sovereignty, decentralization, and the promise of generating value outside traditional systems. While most discussions today revolve around buying, holding, or trading Bitcoin, mining remains the fundamental process that secures the network and issues new coins. Within this ecosystem, Solo Bitcoin Mining as a Passive stands out as a concept that captures imagination: the idea that an individual, operating independently, can mine a full block reward and earn significant Bitcoin without sharing it with anyone else.

The appeal is understandable. A single successful block can yield substantial rewards, making solo Bitcoin mining appear like a potential passive income opportunity. However, the reality is far more nuanced. Rising network difficulty, industrial-scale mining farms, and energy costs have transformed mining into a highly competitive arena. Yet, solo mining has not disappeared. Instead, it has evolved, driven by ideological motivations, technological innovation, and a renewed interest in decentralization.

This article explores whether solo Bitcoin mining can realistically be your next passive income play. It explains how it works, the economics behind it, the risks involved, and the scenarios in which it may still make sense. By the end, you will have a clear, balanced understanding of solo mining’s potential and limitations in today’s Bitcoin ecosystem.

Understanding Solo Bitcoin Mining in Simple Terms

What Solo Bitcoin Mining Really Means

Solo Bitcoin mining refers to the process of mining Bitcoin independently, without joining a mining pool. In this setup, the miner connects directly to the Bitcoin network and attempts to solve cryptographic puzzles on their own. When successful, the miner receives the entire block reward, including the newly minted Bitcoin and transaction fees.

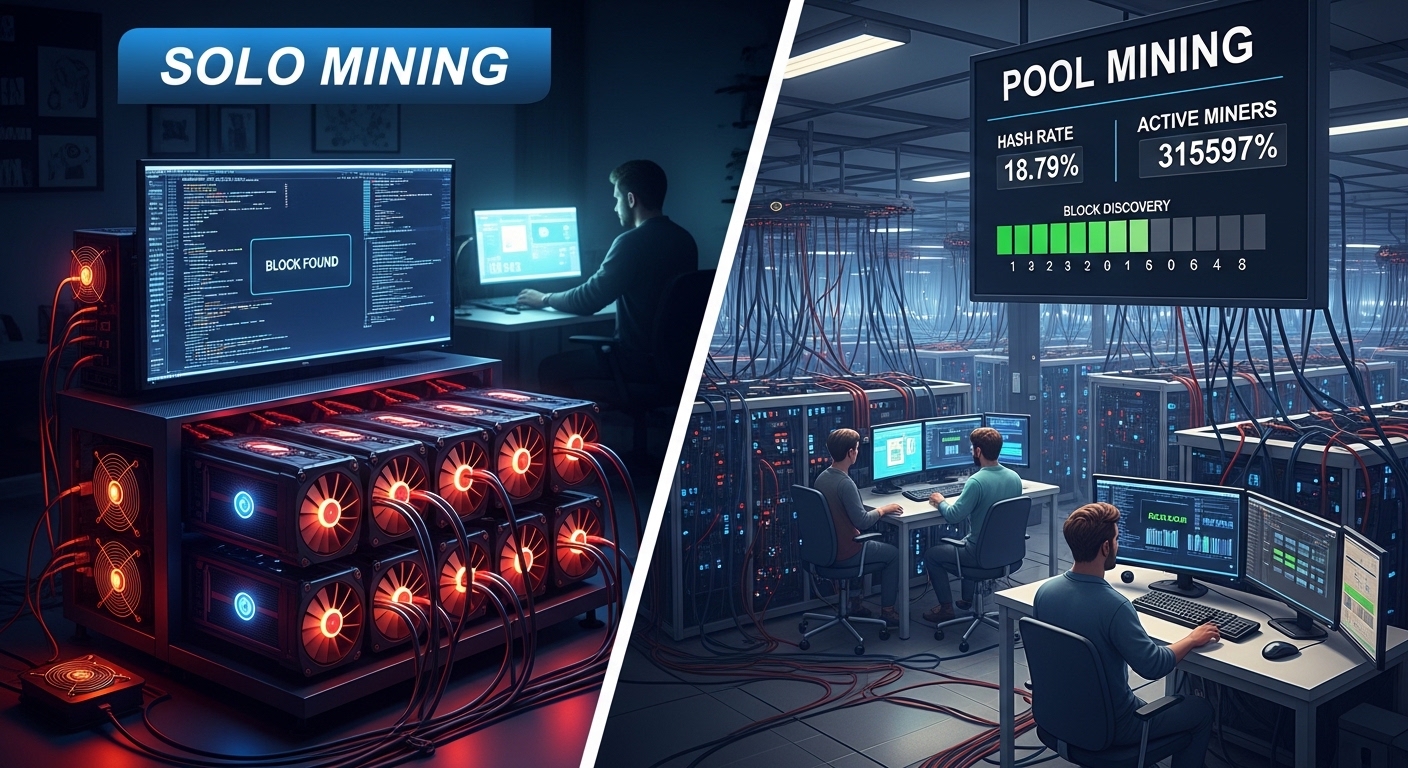

This approach contrasts with pool mining, where multiple miners combine their computational power and share rewards proportionally. Solo mining emphasizes independence and aligns closely with Bitcoin’s original vision of decentralization.

How Solo Mining Differs from Pool Mining

In pool mining, income is relatively predictable because rewards are distributed frequently, albeit in smaller amounts. Solo mining, on the other hand, is characterized by long periods of no reward followed by the possibility of a large payout. This variance is the defining feature of solo Bitcoin mining and a major factor in assessing its viability as a passive income strategy.

The Economics of Solo Bitcoin Mining

Block Rewards and Transaction Fees

The primary incentive in solo Bitcoin mining comes from block rewards. As of now, miners earn a fixed block subsidy along with transaction fees. Over time, the subsidy decreases due to Bitcoin’s halving mechanism, making transaction fees increasingly important.For solo miners, capturing a block means receiving 100% of these rewards. This creates a powerful financial incentive, especially during periods of high network transaction volume when fees spike.

Network Difficulty and Hash Rate Competition

Bitcoin’s mining difficulty adjusts approximately every two weeks to maintain a consistent block time. As more miners join the network and deploy powerful hardware, difficulty rises. This makes it statistically harder for an individual miner to find a block.

Solo Bitcoin mining therefore becomes a probabilistic game. Your chances of success depend on your share of the total network hash rate. For most individuals, this share is extremely small, translating into low odds but not zero probability.

Is Solo Bitcoin Mining Truly Passive Income?

Defining Passive Income in the Context of Mining

Passive income typically implies minimal ongoing effort after an initial setup. Solo Bitcoin mining does require upfront investment in hardware, infrastructure, and configuration. Once operational, however, the system can run continuously with limited human intervention.

That said, mining is not entirely hands-off. Equipment maintenance, software updates, and monitoring energy consumption introduce active elements. Solo Bitcoin mining sits in a gray area between passive and active income.

Income Volatility and Expectation Management

Unlike yield-based investments, solo Bitcoin mining offers no guaranteed returns. Income is highly volatile and unpredictable. This unpredictability challenges the traditional definition of passive income but appeals to those willing to accept long-term uncertainty for the chance of outsized rewards.

Hardware Requirements for Solo Bitcoin Mining

ASIC Miners and Their Role

Modern solo Bitcoin mining relies almost exclusively on ASIC miners, specialized machines designed for SHA-256 hashing. These devices deliver immense computational power but come with significant costs.Choosing the right ASIC is critical. Efficiency, measured in joules per terahash, directly impacts profitability. Older or inefficient machines may consume more electricity than the Bitcoin they generate, even if a block is eventually found.

Infrastructure and Cooling Considerations

Running ASIC miners generates substantial heat and noise. Adequate cooling systems are essential to maintain performance and extend hardware lifespan. Infrastructure costs, including electrical upgrades and ventilation, are often underestimated but play a major role in the overall economics of solo Bitcoin mining.

Energy Costs and Their Impact on Profitability

Electricity Pricing as a Key Variable

Electricity is the largest ongoing expense in Bitcoin mining. Solo miners with access to low-cost or renewable energy sources are at a significant advantage. High electricity costs can quickly erode the potential gains from even a successful block.This reality explains why many solo miners operate in regions with surplus energy or leverage off-grid solutions. Energy efficiency is not optional; it is central to survival in competitive mining.

Sustainability and Environmental Considerations

The environmental impact of Bitcoin mining remains a topic of debate. Solo Bitcoin mining, particularly when powered by renewable energy, can align with sustainability goals. This aspect is increasingly relevant as regulators and investors scrutinize energy-intensive industries.

Risk Factors Unique to Solo Bitcoin Mining

Statistical Variance and Long Wait Times

The biggest risk in solo Bitcoin mining is variance. A miner could operate for years without finding a block, despite consistent expenses. This risk profile requires patience, financial resilience, and a long-term perspective.Understanding probability is essential. Solo mining is less about monthly income and more about cumulative odds over time.

Hardware Obsolescence and Market Cycles

Mining hardware depreciates rapidly. Newer, more efficient models regularly enter the market, reducing the competitiveness of older machines. Additionally, Bitcoin price cycles influence profitability, making timing an important consideration.

Why Some Miners Still Choose to Go Solo

Decentralization and Ideological Motivation

For many, solo Bitcoin mining is not purely about profit. It represents participation in Bitcoin’s decentralized ethos. Running a solo miner strengthens the network by reducing reliance on large pools and centralized entities.This ideological motivation cannot be quantified financially but remains a powerful driver for a subset of the community.

Sovereignty and Control Over Rewards

Solo miners retain full control over their operations and rewards. There is no pool operator, no payout threshold, and no third-party risk. This autonomy aligns with the broader philosophy of self-custody and financial independence.

Technological Developments Supporting Solo Mining

Lightweight Mining Software and Nodes

Advancements in mining software have lowered the technical barrier to entry. Running a full Bitcoin node alongside mining software enhances privacy and network contribution. These tools make solo Bitcoin mining more accessible than in the past.

The Role of Lottery-Style Mining Services

Some modern services facilitate solo mining by simplifying setup while preserving the solo reward structure. These solutions appeal to hobbyists and small-scale miners seeking exposure without full-scale infrastructure investment.

Comparing Solo Mining to Other Bitcoin Income Strategies

Solo Mining Versus Pool Mining

Pool mining offers stability but sacrifices independence and upside. Solo Bitcoin mining offers the opposite: high variance and full rewards. The choice depends on risk tolerance and financial goals.

Mining Versus Holding Bitcoin

Many argue that simply buying and holding Bitcoin may offer better risk-adjusted returns. However, mining introduces an operational dimension and the possibility of earning Bitcoin at cost rather than market price.

Regulatory and Legal Considerations

Jurisdictional Differences

Regulations around Bitcoin mining vary widely. Some regions encourage mining through favorable policies, while others impose restrictions or bans. Solo miners must understand local laws, energy regulations, and tax obligations.

Taxation of Mining Rewards

Mining rewards are typically considered taxable income. Proper accounting and compliance are essential to avoid legal complications. This factor further influences the net profitability of solo Bitcoin mining.

Long-Term Outlook for Solo Bitcoin Mining

The Impact of Future Halvings

Bitcoin halvings reduce block subsidies, increasing reliance on transaction fees. This shift may alter the economics of solo mining, potentially favoring miners who can operate efficiently over long periods.

Network Evolution and Decentralization Trends

As Bitcoin matures, decentralization remains a core objective. Solo Bitcoin mining contributes to this goal, ensuring that mining power is not overly concentrated.

Conclusion

Solo Bitcoin mining is neither a guaranteed income stream nor an obsolete practice. It occupies a unique position in the Bitcoin ecosystem, blending financial opportunity with ideological commitment. For those with access to efficient hardware, low-cost energy, and a long-term mindset, it can serve as a speculative form of passive income with asymmetric upside.

However, it is not suitable for everyone. The risks, capital requirements, and uncertainty demand careful consideration. Solo Bitcoin mining should be approached as a strategic experiment rather than a dependable paycheck. When understood and executed thoughtfully, it can still play a meaningful role in both personal portfolios and the broader decentralization of Bitcoin.

FAQs

Q: What is the main advantage of solo Bitcoin mining?

The primary advantage is receiving the full block reward without sharing it with a pool, along with complete operational independence.

Q: How long does it usually take to mine a block solo?

There is no fixed timeline. It could take days, years, or never, depending on your hash rate and network difficulty.

Q: Is solo Bitcoin mining profitable in 2026?

Profitability depends on hardware efficiency, electricity costs, and Bitcoin’s market price. For most individuals, it is high-risk but potentially rewarding.

Q: Can beginners start with solo Bitcoin mining?

Beginners can start, but it requires technical understanding, upfront investment, and realistic expectations about returns.

Q: Does solo Bitcoin mining help decentralize the network?

Yes, solo miners contribute to decentralization by reducing reliance on large mining pools and centralized infrastructure.

Also More: New Bitcoin Mining Fleet Mining Reshapes the Future of Miners, Sign Up and Get $100