Virginia Bill to Regulate Cryptocurrency Kiosks Advances

A new bill to regulate cryptocurrency kiosks in Virginia heads to the governor’s desk, reshaping oversight, consumer protection, and crypto compliance statewide.

Virginia Bill to Regulate Cryptocurrency kiosks in Virginia heading to the governor’s desk represents a pivotal moment in the evolution of digital asset oversight at the state level. As cryptocurrency adoption expands beyond online exchanges into physical locations such as gas stations, malls, and convenience stores, policymakers are under increasing pressure to modernize regulatory frameworks. Cryptocurrency kiosks, often referred to as Bitcoin ATMs, have become a visible on-ramp for everyday users, but they have also raised concerns around consumer protection, fraud prevention, and regulatory compliance.

Virginia’s move to regulate cryptocurrency kiosks signals a broader shift in how state governments are responding to the rapid mainstreaming of crypto technology. Lawmakers are seeking to strike a balance between fostering innovation and safeguarding residents from financial harm. The legislation heading to the governor’s desk aims to introduce clearer rules for kiosk operators while preserving access to digital assets for legitimate users.

This development places Virginia among a growing number of U.S. states acknowledging that crypto kiosks are no longer a niche phenomenon. Instead, they are an integral part of the financial landscape that requires structured oversight. Understanding what this bill entails, why it matters, and how it could impact consumers and businesses alike is essential for anyone following the future of cryptocurrency regulation in the United States.

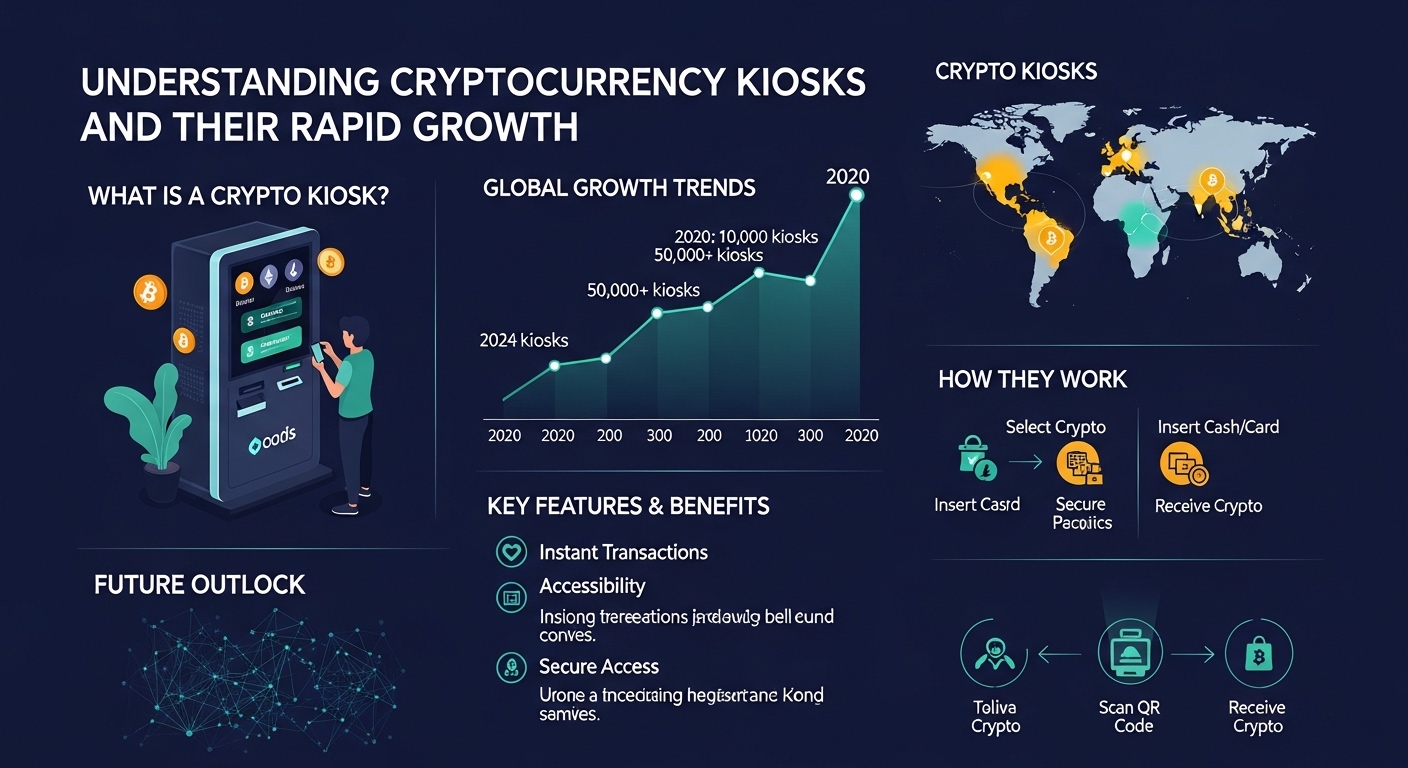

Understanding Cryptocurrency Kiosks and Their Rapid Growth

What Cryptocurrency Kiosks Are and How They Operate

Cryptocurrency kiosks are physical terminals that allow users to buy, and in some cases sell, digital assets using cash or debit cards. Most commonly associated with Bitcoin, these kiosks enable transactions without requiring users to navigate traditional online exchanges. The appeal lies in accessibility, simplicity, and immediacy, especially for individuals who may be unbanked or unfamiliar with complex digital trading platforms.

Unlike conventional ATMs connected to banks, cryptocurrency kiosks operate through private companies that facilitate blockchain transactions. This operational difference has historically placed them in a regulatory gray area. As usage has surged, so too have concerns about transparency, transaction fees, identity verification, and misuse for illicit purposes.

Why States Are Paying Closer Attention

The rapid expansion of crypto kiosks across urban and rural areas has caught the attention of regulators nationwide. Reports of scams, particularly targeting elderly and first-time users, have intensified calls for stricter oversight. Many victims are instructed by fraudsters to deposit cash into cryptocurrency kiosks, making recovery of funds nearly impossible once transactions are confirmed on the blockchain.

The bill to regulate cryptocurrency kiosks in Virginia reflects these realities. By addressing how kiosks are licensed, monitored, and disclosed to users, lawmakers aim to reduce abuse while maintaining legitimate access to digital currencies.

How the Bill Advanced Through the Virginia Legislature

Legislative Momentum in the Virginia General Assembly

The bill’s journey through the Virginia General Assembly demonstrates bipartisan recognition of the need for regulatory clarity. Committees reviewed testimony from consumer advocates, law enforcement representatives, and industry stakeholders before moving the proposal forward. The consensus was not about restricting cryptocurrency itself, but about ensuring that physical access points operate responsibly.

Lawmakers emphasized that the absence of clear standards left consumers vulnerable and placed reputable operators at a disadvantage compared to bad actors. The legislation gained traction as it framed regulation as a means of legitimizing the industry rather than stifling innovation.

From Committee Approval to the Governor’s Desk

After clearing both chambers of the legislature, the bill now heads to the desk of Glenn Youngkin. This final step underscores the seriousness with which Virginia is approaching digital asset oversight. While the governor retains the authority to sign, amend, or veto the bill, its passage through the legislature suggests strong institutional support. The advancement of this bill also aligns with Virginia’s broader efforts to modernize its financial regulatory environment while remaining competitive as a technology-friendly state.

Key Provisions of the Cryptocurrency Kiosk Regulation Bill

Licensing and Registration Requirements

One of the most significant aspects of the bill to regulate cryptocurrency kiosks in Virginia is the introduction of formal licensing and registration requirements. Operators would be required to register with the appropriate state regulatory body, providing transparency around ownership, operational practices, and compliance procedures.

This measure aims to eliminate anonymous or fly-by-night operators who exploit regulatory gaps. By requiring registration, the state can maintain a centralized record of kiosk locations and responsible entities, making enforcement and oversight more effective.

Consumer Disclosure and Transparency Measures

Another critical component involves enhanced disclosure obligations. Operators may be required to clearly display transaction fees, exchange rates, and risk warnings directly on the kiosk interface. These disclosures are designed to ensure that users fully understand the financial implications of their transactions before proceeding.

Transparency is a recurring theme throughout the bill. Lawmakers want to reduce instances where users unknowingly pay excessive fees or fall victim to misleading representations. Clear disclosures are viewed as a foundational step in strengthening consumer trust.

Anti-Fraud and Compliance Standards

The legislation also addresses anti-money laundering and fraud prevention measures. Cryptocurrency kiosks could be required to implement identity verification protocols, transaction monitoring, and reporting mechanisms consistent with broader financial regulations.

These provisions align with federal compliance expectations and aim to deter illicit activity without imposing unreasonable burdens on legitimate users. By embedding compliance into kiosk operations, Virginia seeks to harmonize state-level oversight with national standards.

Why Virginia Is Taking Action Now

Rising Consumer Complaints and Scam Reports

Virginia’s decision to advance this bill is closely tied to an increase in consumer complaints related to cryptocurrency kiosks. Law enforcement agencies have reported a surge in fraud cases involving coerced or deceptive kiosk transactions. Victims are often unaware that cryptocurrency transactions are irreversible, making them particularly vulnerable.

The bill to regulate cryptocurrency kiosks in Virginia directly responds to these trends. By implementing safeguards, lawmakers hope to reduce the prevalence of scams while educating users about the risks associated with digital asset transactions.

Aligning With National Regulatory Trends

Across the United States, states are beginning to adopt more proactive stances on crypto regulation. Virginia’s approach mirrors initiatives in other jurisdictions that recognize the need for tailored rules addressing physical crypto access points. Rather than waiting for comprehensive federal legislation, states like Virginia are taking incremental steps to protect residents while contributing to a patchwork of best practices that could eventually inform national policy.

Implications for Cryptocurrency Kiosk Operators

Increased Compliance Costs and Operational Changes

For kiosk operators, the bill introduces new compliance obligations that may increase operational costs. Licensing fees, reporting requirements, and enhanced identity verification systems will require investment in infrastructure and personnel.

However, these changes may also benefit reputable operators by leveling the playing field. Companies that already adhere to high compliance standards may find it easier to operate in a regulated environment that weeds out unscrupulous competitors.

Long-Term Industry Legitimization

In the long run, regulation could enhance the legitimacy of cryptocurrency kiosks as a mainstream financial service. Clear rules provide certainty for investors, operators, and consumers alike. The bill to regulate cryptocurrency kiosks in Virginia may ultimately encourage responsible growth rather than hinder adoption. By formalizing expectations, the state signals that crypto kiosks are here to stay, provided they operate within defined legal boundaries.

What This Means for Virginia Consumers

Enhanced Protection and Awareness

For consumers, the most immediate impact is improved protection. Clear disclosures, standardized practices, and accountability mechanisms reduce the likelihood of unpleasant surprises during transactions. Users will be better informed about fees, risks, and recourse options. The bill also promotes awareness by framing cryptocurrency kiosks as financial tools that require caution and understanding, rather than as anonymous machines free from oversight.

Continued Access to Digital Assets

Importantly, the legislation does not ban or severely restrict cryptocurrency kiosks. Instead, it seeks to ensure safe access. Virginia residents will still be able to use kiosks to engage with digital assets, but within a framework designed to minimize harm. This balanced approach reflects an understanding that outright prohibition could drive activity underground, whereas regulation can channel usage into safer, more transparent pathways.

The Broader Impact on U.S. Crypto Regulation

A Model for Other States

Virginia’s bill could serve as a model for other states grappling with similar challenges. By focusing on kiosk-specific risks and solutions, the legislation provides a blueprint for targeted regulation that addresses real-world issues without overreach. As more states consider how to regulate physical crypto infrastructure, Virginia’s experience may inform legislative debates nationwide.

Bridging the Gap Between Innovation and Oversight

The bill to regulate cryptocurrency kiosks in Virginia illustrates a broader philosophical shift in crypto policy. Rather than viewing regulation and innovation as opposing forces, lawmakers are increasingly treating them as complementary. Thoughtful oversight can create conditions for sustainable growth by fostering trust and stability. This perspective may prove crucial as digital assets continue to integrate into everyday financial life.

The Governor’s Decision and What Comes Next

Potential Outcomes at the Governor’s Desk

With the bill now on the governor’s desk, several outcomes are possible. If signed into law, regulatory agencies will move to implement rules, timelines, and enforcement mechanisms. If amendments are requested, the legislature may revisit specific provisions to address concerns. Given the bill’s legislative support, a signature would mark a decisive step forward in Virginia’s approach to crypto oversight.

Implementation and Enforcement Challenges

Assuming enactment, effective implementation will be key. Regulators will need to coordinate with kiosk operators, law enforcement, and consumer protection agencies to ensure smooth adoption. Public education will also play a role in maximizing the bill’s intended benefits. The success of the bill will ultimately depend on how well these measures translate from statute to practice.

Conclusion

The bill to regulate cryptocurrency kiosks in Virginia heading to the governor’s desk represents a measured and pragmatic response to the realities of digital asset adoption. By introducing licensing, transparency, and compliance standards, Virginia is addressing legitimate concerns without undermining innovation. The legislation underscores a growing recognition that cryptocurrency infrastructure, particularly physical access points, must operate within clear and enforceable rules.

For consumers, the bill promises enhanced protection and awareness. For operators, it offers a pathway to legitimacy and long-term sustainability. And for policymakers nationwide, it provides a case study in balancing technological progress with public interest. As the governor considers the bill, Virginia stands at the forefront of state-level crypto regulation, shaping how digital finance evolves in the years ahead.

FAQs

Q: What are cryptocurrency kiosks?

Cryptocurrency kiosks are physical machines that allow users to buy or sell digital assets like Bitcoin using cash or cards without relying on online exchanges.

Q: Why is Virginia regulating cryptocurrency kiosks now?

Virginia is responding to increased consumer complaints, fraud reports, and the rapid growth of crypto kiosks, aiming to protect residents while maintaining access to digital assets.

Q: Does the bill ban cryptocurrency kiosks in Virginia?

No, the bill does not ban kiosks. It establishes licensing, disclosure, and compliance requirements to ensure safer operation.

Q: How will the bill affect kiosk operators?

Operators may face higher compliance costs and regulatory obligations, but the rules could also enhance industry credibility and consumer trust.

Q: When will the new regulations take effect?

If signed by the governor, the bill will move into an implementation phase, with timelines and enforcement details set by state regulators.

Also More: Cryptocurrency Kidnapping in France Triggers Major Arrests