Abu Dhabi Wealth Funds Bitcoin ETF Holdings Hit $1B

Abu Dhabi wealth funds’ Bitcoin ETF holdings surpassed $1B by end of 2025, signaling a major shift in sovereign crypto investment strategy.

The global financial landscape reached a defining moment at the end of 2025 when Abu Dhabi wealth funds bitcoin ETF holdings topped $1 billion, marking one of the most significant sovereign-level endorsements of regulated digital asset exposure to date. This milestone did not emerge in isolation. It was the culmination of years of policy calibration, market observation, and strategic asset allocation by Abu Dhabi’s sovereign wealth ecosystem, which has long been recognized for its disciplined, forward-looking investment philosophy.

As Bitcoin exchange-traded funds matured into institutionally acceptable vehicles, Abu Dhabi wealth funds moved decisively yet methodically. Their entry validated Bitcoin ETFs as credible instruments within conservative, long-term portfolios traditionally dominated by equities, fixed income, infrastructure, and private markets. The move also reflected broader macroeconomic realities, including inflation hedging, currency diversification, and exposure to digital value networks.

This article explores how Abu Dhabi wealth funds reached more than $1 billion in Bitcoin ETF holdings by the end of 2025, why this development matters for global markets, and what it signals for the future of institutional crypto adoption. By examining regulatory dynamics, portfolio strategy, and market implications, we provide a comprehensive, SEO-optimized analysis designed for investors, analysts, and policymakers alike.

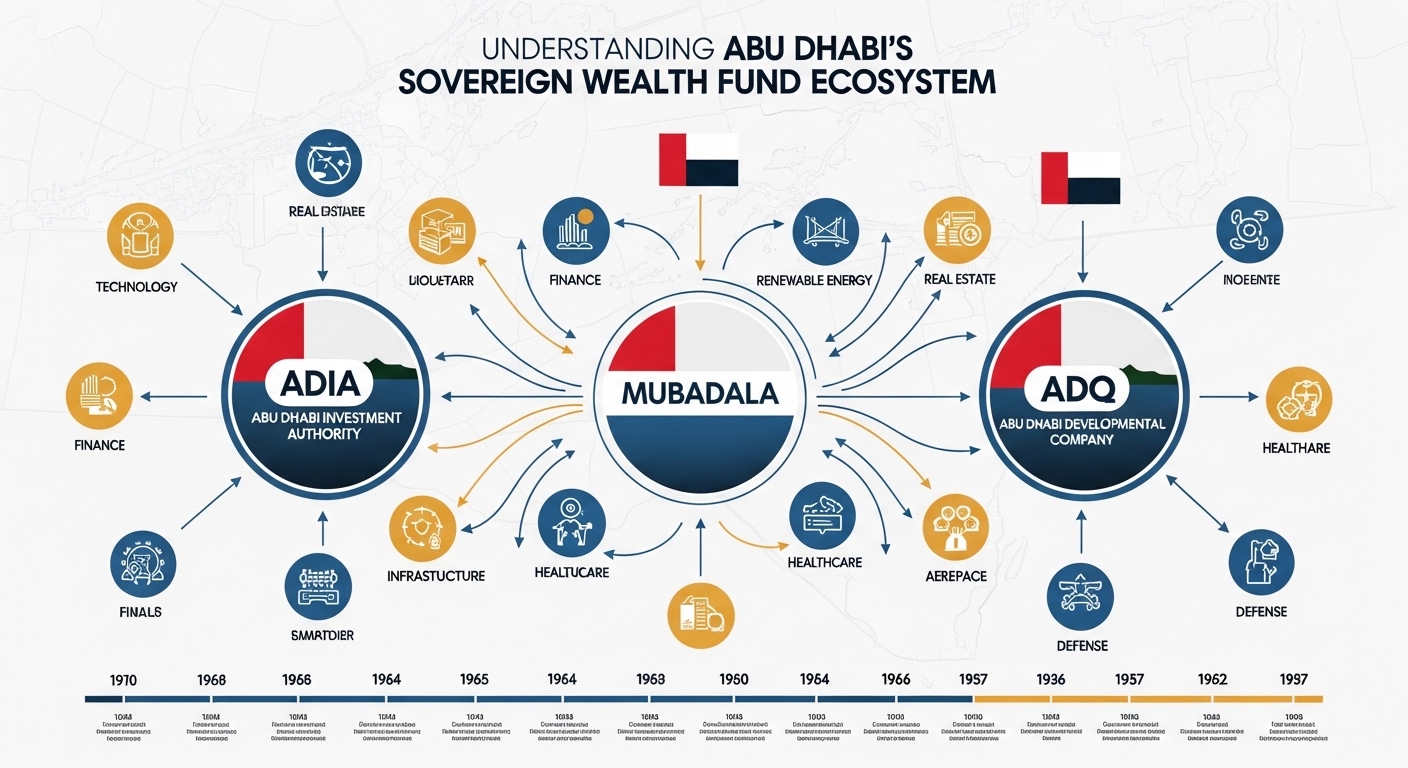

Understanding Abu Dhabi’s Sovereign Wealth Fund Ecosystem

Abu Dhabi oversees one of the world’s most influential sovereign wealth fund networks. Institutions such as the Abu Dhabi Investment Authority and Mubadala Investment Company manage hundreds of billions of dollars across global markets. These entities are known for their conservative risk frameworks, extended investment horizons, and emphasis on capital preservation alongside growth.

Historically, Abu Dhabi wealth funds focused on traditional asset classes, prioritizing diversification across geographies and sectors. However, as digital assets gained legitimacy and regulatory clarity improved, these funds began exploring indirect exposure routes. Bitcoin ETFs offered a solution that aligned with governance requirements while enabling participation in the crypto economy.

The decision to allocate capital into Bitcoin ETFs was not speculative enthusiasm. Instead, it was rooted in rigorous due diligence, stress testing, and alignment with long-term macro trends. This institutional discipline explains why the $1 billion threshold is seen as a structural shift rather than a short-term tactical bet.

The Rise of Bitcoin ETFs as an Institutional Gateway

The approval and global expansion of Bitcoin ETFs fundamentally reshaped access to the cryptocurrency market. For sovereign investors, direct custody of Bitcoin raised operational, regulatory, and reputational considerations. Spot Bitcoin ETFs, by contrast, offered regulated exposure with transparent pricing, audited custody, and familiar settlement mechanisms.

By 2025, Bitcoin ETFs had evolved into highly liquid instruments attracting pension funds, insurance companies, and endowments. Abu Dhabi wealth funds recognized that these vehicles reduced barriers to entry while preserving compliance with internal mandates. As a result, institutional Bitcoin adoption accelerated, and sovereign participation became increasingly visible in regulatory filings and market data.

The ability to integrate Bitcoin ETFs within multi-asset portfolios also allowed Abu Dhabi funds to manage volatility more effectively. Exposure levels could be adjusted dynamically without the operational complexity associated with holding the underlying asset.

Why Abu Dhabi Wealth Funds Chose Bitcoin ETFs Over Direct Bitcoin

The preference for ETFs over direct Bitcoin ownership reflects a broader institutional trend. Abu Dhabi wealth funds operate under stringent governance structures that prioritize transparency, risk mitigation, and regulatory alignment. Bitcoin ETFs meet these criteria in ways that self-custodied or exchange-held Bitcoin often cannot.

Another critical factor was counterparty risk management. ETFs backed by reputable custodians and overseen by global regulators provided assurance against operational failures. Additionally, ETFs simplified accounting, reporting, and auditing processes, which are essential for sovereign investors accountable to state authorities.

From a strategic perspective, Bitcoin ETFs also enabled Abu Dhabi wealth funds to gain exposure without signaling aggressive speculation. This subtlety mattered in maintaining confidence among domestic stakeholders and international partners.

Bitcoin ETFs and Portfolio Diversification Strategy

Diversification remains the cornerstone of sovereign wealth fund management. By the end of 2025, Abu Dhabi wealth funds bitcoin ETF holdings topped $1 billion largely because Bitcoin demonstrated low long-term correlation with traditional assets such as equities and bonds.

In periods of monetary tightening and geopolitical uncertainty, Bitcoin’s decentralized nature offered portfolio resilience. While short-term volatility persisted, long-term performance metrics justified modest allocations. Bitcoin ETFs allowed Abu Dhabi wealth funds to calibrate exposure precisely, ensuring that crypto investments complemented rather than disrupted portfolio stability.

This approach aligned with modern portfolio theory, where alternative assets play a critical role in enhancing risk-adjusted returns. Bitcoin ETFs emerged as a new category within this framework, bridging the gap between traditional finance and digital innovation.

Regulatory Clarity and Abu Dhabi’s Crypto-Friendly Framework

Abu Dhabi’s regulatory environment played a pivotal role in enabling sovereign investment into Bitcoin ETFs. The emirate has positioned itself as a global financial hub by fostering clear, innovation-friendly regulations while maintaining robust oversight.

The establishment of dedicated digital asset frameworks reassured sovereign investors that crypto-related investments could coexist with international compliance standards. This clarity reduced uncertainty and allowed Abu Dhabi wealth funds to proceed confidently with ETF allocations.

Moreover, regulatory alignment with major financial jurisdictions ensured that Bitcoin ETFs met global best practices. This compatibility strengthened the case for large-scale institutional participation and reinforced Abu Dhabi’s reputation as a forward-thinking financial center.

Global Market Impact of Abu Dhabi’s $1 Billion Bitcoin ETF Holdings

When Abu Dhabi wealth funds bitcoin ETF holdings topped $1 billion at end of 2025, global markets took notice. Sovereign wealth funds are often viewed as “smart money” due to their analytical rigor and long-term perspective. Their participation sent a powerful signal to other institutional investors considering crypto exposure.

The move contributed to increased liquidity and reduced volatility within Bitcoin ETF markets. As sovereign capital entered the space, price discovery improved, and market depth expanded. This dynamic further legitimized Bitcoin ETFs as institutional-grade products.

Additionally, Abu Dhabi’s investment encouraged other sovereign and public-sector investors to explore similar strategies. The ripple effect extended beyond the Middle East, influencing asset allocators across Europe and Asia.

Relationship Between Abu Dhabi Wealth Funds and Major ETF Issuers

Abu Dhabi wealth funds primarily accessed Bitcoin exposure through leading ETF issuers such as BlackRock and Fidelity Investments. These firms offered products with deep liquidity, transparent structures, and strong custodial arrangements.

The collaboration between sovereign investors and global asset managers underscored the institutionalization of Bitcoin. It also highlighted the convergence of traditional finance and digital assets, with ETFs serving as the connective tissue. For Abu Dhabi wealth funds, partnering with established issuers reduced reputational risk while ensuring access to best-in-class investment infrastructure.

Macroeconomic Drivers Behind the Allocation Decision

Several macroeconomic factors influenced Abu Dhabi wealth funds’ decision to expand Bitcoin ETF holdings. Persistent inflation concerns, currency debasement risks, and shifting global trade dynamics all contributed to the search for alternative stores of value.

Bitcoin’s fixed supply and decentralized governance resonated with long-term capital allocators seeking hedges against systemic risks. While not a replacement for gold or sovereign bonds, Bitcoin ETFs offered complementary exposure within diversified portfolios. By the end of 2025, these macro drivers converged, making the $1 billion milestone a logical outcome rather than an anomaly.

Risk Management and Volatility Considerations

Despite their confidence, Abu Dhabi wealth funds approached Bitcoin ETFs with caution. Volatility management remained central to allocation decisions. Position sizing, rebalancing strategies, and scenario analysis were employed to ensure that crypto exposure did not compromise overall portfolio objectives.

Bitcoin ETFs facilitated this disciplined approach by offering liquidity and transparency. In contrast to direct holdings, ETFs allowed rapid adjustments in response to market conditions, aligning with sovereign risk frameworks. This emphasis on governance and control explains why the investment was widely praised as prudent rather than speculative.

Long-Term Implications for Institutional Crypto Adoption

The fact that Abu Dhabi wealth funds bitcoin ETF holdings topped $1 billion at end of 2025 carries profound implications for the future of digital finance. Sovereign participation accelerates normalization, paving the way for broader institutional adoption.

As more public-sector investors follow Abu Dhabi’s lead, Bitcoin ETFs may become standard components of diversified portfolios. This trend could drive further innovation in crypto-linked financial products, including multi-asset digital ETFs and tokenized securities. For the crypto industry, sovereign investment represents a transition from experimental adoption to structural integration within global finance.

Conclusion

The milestone achieved by Abu Dhabi wealth funds at the end of 2025 reflects a strategic, measured embrace of digital assets through regulated channels. By surpassing $1 billion in Bitcoin ETF holdings, these institutions validated Bitcoin’s role within institutional portfolios while reinforcing Abu Dhabi’s position as a financial innovator.

This development is not merely symbolic. It signals a long-term shift in how sovereign investors perceive value, diversification, and technological change. As markets evolve, Abu Dhabi’s example will likely influence asset allocation strategies worldwide, cementing Bitcoin ETFs as a legitimate pillar of modern finance.

FAQs

Q: Why did Abu Dhabi wealth funds invest in Bitcoin ETFs instead of direct Bitcoin?

Bitcoin ETFs offer regulated, transparent exposure that aligns with sovereign governance standards, reducing operational and custodial risks.

Q: How significant is the $1 billion milestone for global markets?

It represents strong institutional validation, encouraging other sovereign and institutional investors to consider Bitcoin ETF exposure.

Q: Do Bitcoin ETFs fit within conservative investment strategies?

Yes, when used in modest allocations, Bitcoin ETFs can enhance diversification without undermining portfolio stability.

Q: Will Abu Dhabi wealth funds increase their Bitcoin ETF holdings further?

Future allocations will depend on market conditions, regulatory developments, and long-term performance assessments.

Q: What does this mean for the future of crypto regulation?

Sovereign participation through ETFs supports clearer, more robust regulatory frameworks, fostering sustainable crypto market growth.

Also More: Trump-Backed American Bitcoin Expands Holdings to 4,004 BTC Worth $415M