Blockchain Adoption Surges Worldwide Despite Crypto Sell-Off

Blockchain adoption is accelerating globally despite crypto market sell-offs, as top CEOs reveal real-world use cases driving long-term growth.

The global crypto market has endured repeated cycles of volatility, sharp corrections, and prolonged sell-offs that have shaken investor confidence. Prices fluctuate, headlines turn bearish, and retail sentiment often swings toward fear. Yet beneath this surface-level turbulence, a powerful and seemingly contradictory trend is unfolding. Blockchain adoption is not slowing down. In fact, it is accelerating across industries, geographies, and use cases, even as speculative crypto assets face downward pressure.

According to insights shared by multiple technology and financial leaders, enterprise interest in blockchain technology has decoupled from short-term crypto price movements. A top CEO recently revealed that while market participants focus on charts and tokens, corporations, governments, and institutions are quietly embedding blockchain into their core infrastructure. This divergence highlights a critical truth Blockchain Adoption Surges Worldwide is no longer driven by hype alone but by tangible value creation.

From supply chain transparency to digital identity, from cross-border payments to data security, blockchain is evolving into a foundational layer of the modern digital economy. This article explores why blockchain adoption explodes everywhere despite crypto sell-offs, what leading CEOs are observing on the ground, and how this shift could redefine the future of finance, governance, and enterprise technology.

The Disconnect Between Crypto Markets and Blockchain Adoption

Why Crypto Sell-Offs Do Not Signal Blockchain Failure

Crypto markets are notoriously emotional and speculative. Prices are influenced by macroeconomic conditions, regulatory announcements, leverage dynamics, and investor psychology. A crypto sell-off often reflects risk-off sentiment rather than a rejection of the underlying technology. Blockchain adoption, by contrast, is increasingly driven by long-term strategic planning rather than short-term trading.

Enterprises adopting blockchain are not speculating on token prices. They are investing in distributed ledger technology to reduce costs, improve efficiency, and enhance trust. This structural demand persists regardless of whether Bitcoin or Ethereum is trending up or down. As a result, blockchain initiatives continue to expand even during extended bear markets.

Long-Term Infrastructure vs Short-Term Speculation

A key reason for this divergence lies in the difference between infrastructure and assets. Blockchain networks function as digital infrastructure, similar to cloud computing or the internet itself. Crypto tokens, while often essential to these ecosystems, represent only one layer of the stack. Blockchain adoption focuses on the infrastructure layer, where value compounds over time through usage, not speculation. This perspective explains why large organizations continue to build on blockchain even when token valuations decline. They are betting on efficiency, transparency, and automation, not on short-term price appreciation.

Top CEO Insights: Blockchain Adoption Is Accelerating

What Industry Leaders Are Seeing Firsthand

Several high-profile executives have publicly acknowledged that blockchain adoption is expanding rapidly across sectors. Arvind Krishna, CEO of IBM, has emphasized that enterprises increasingly view blockchain as a practical tool for solving complex coordination problems. According to Krishna, blockchain’s ability to create shared, immutable records makes it uniquely suited for multi-party business processes.

Similarly, Jamie Dimon has noted that while he remains cautious about speculative crypto trading, his institution continues to invest heavily in blockchain-based payment and settlement systems. This distinction underscores how blockchain adoption can thrive independently of retail crypto enthusiasm.

Enterprise Demand Outpaces Market Sentiment

From banking and logistics to healthcare and energy, CEOs report rising inbound demand for blockchain solutions. Companies are no longer experimenting in isolation. They are moving toward production-scale deployments that integrate blockchain into existing systems. This shift signals maturity. Blockchain adoption is transitioning from proof-of-concept to mission-critical infrastructure.

Enterprise Use Cases Driving Blockchain Adoption

Supply Chain Transparency and Traceability

One of the most compelling drivers of blockchain adoption is supply chain management. Global supply chains involve numerous stakeholders, fragmented data, and limited transparency. Blockchain introduces a shared source of truth that allows all participants to verify transactions and track goods in real time.

By using blockchain, enterprises can reduce fraud, improve traceability, and respond more effectively to disruptions. This value proposition remains strong regardless of crypto market conditions, reinforcing why blockchain adoption continues to expand.

Financial Services and Payments Innovation

Financial institutions are embracing blockchain to streamline payments, settlements, and reconciliation. Traditional cross-border payments can take days and involve multiple intermediaries. Blockchain-based systems enable near-instant settlement with reduced costs and improved transparency.

Banks are increasingly exploring tokenized deposits, on-chain settlement, and blockchain-based messaging systems. These initiatives are driven by operational efficiency rather than speculative gains, highlighting the resilience of blockchain adoption.

Digital Identity and Data Security

As digital interactions grow, so does the need for secure identity verification. Blockchain-based digital identity solutions allow individuals to control their data while enabling organizations to verify credentials efficiently. This approach reduces identity fraud and enhances privacy, making it attractive to governments and enterprises alike.

Blockchain Adoption in the Public Sector

Governments Embrace Distributed Ledger Technology

Governments around the world are exploring blockchain to modernize public services. From land registries to voting systems, blockchain offers transparency and immutability that can reduce corruption and improve trust. These initiatives often proceed independently of crypto market sentiment, driven instead by policy goals and administrative efficiency.

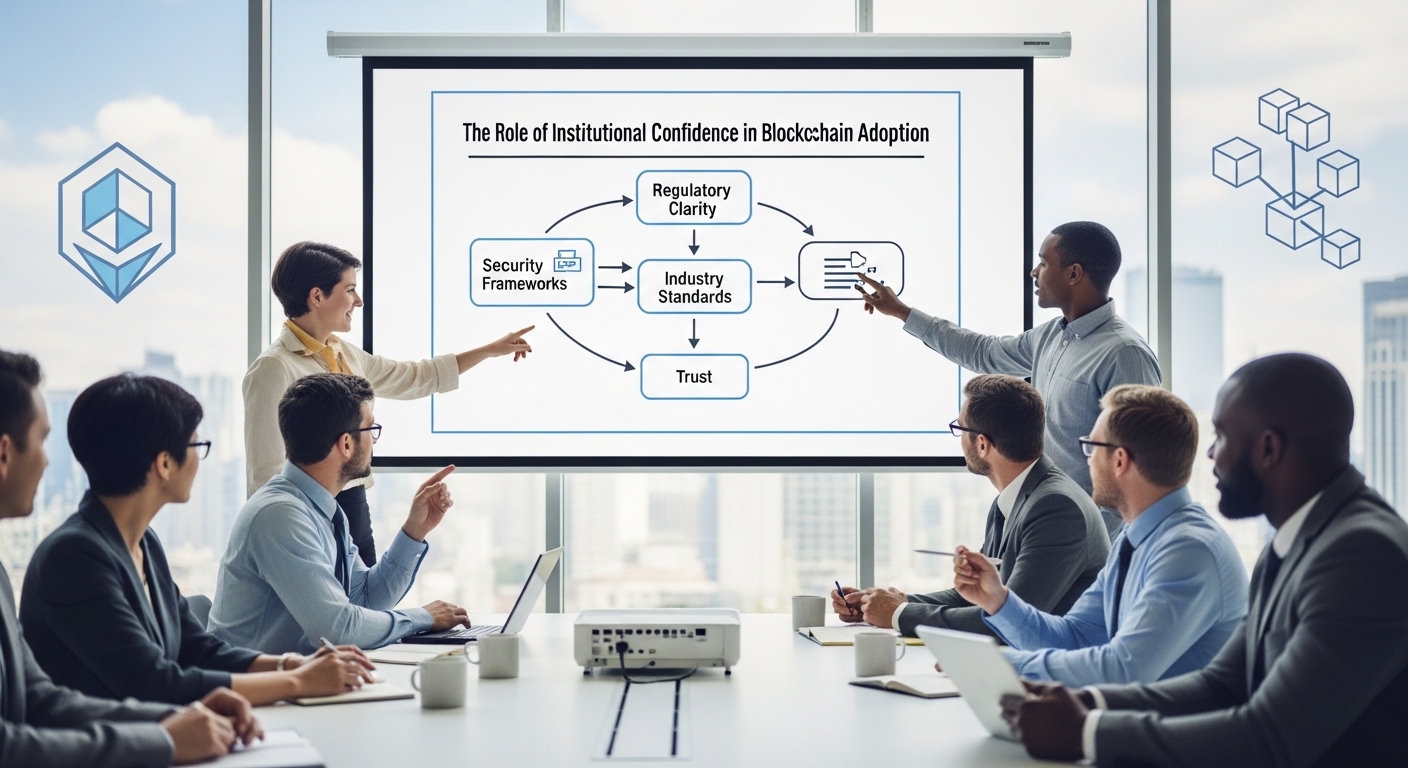

Regulatory Clarity Encourages Institutional Adoption

Clearer regulatory frameworks are also accelerating blockchain adoption. As policymakers distinguish between speculative crypto assets and enterprise blockchain applications, institutions gain confidence to invest. This regulatory differentiation helps explain why adoption continues even during market downturns.

Web3, Tokenization, and the Next Phase of Adoption

Beyond Cryptocurrencies: Real-World Asset Tokenization

Tokenization of real-world assets represents a major growth frontier for blockchain adoption. By representing assets such as bonds, real estate, and commodities on blockchain networks, institutions can unlock liquidity and streamline settlement. This trend aligns blockchain with traditional finance rather than positioning it as an alternative.

Interoperability and Scalability Improvements

Technological advancements are also fueling adoption. Improvements in scalability, interoperability, and energy efficiency address earlier limitations. As blockchain networks become faster and more cost-effective, enterprises are more willing to integrate them into core operations.

The Role of Institutional Confidence in Blockchain Adoption

Why Institutions Think Long Term

Institutions operate on multi-year horizons. They evaluate technology based on resilience, security, and return on investment. Short-term crypto sell-offs rarely alter these assessments. As long as blockchain continues to deliver operational benefits, blockchain adoption remains a rational strategic choice.

Strategic Alignment With Digital Transformation

Blockchain aligns closely with broader digital transformation initiatives. Automation, data integrity, and decentralized architectures are priorities for organizations seeking to remain competitive. Blockchain complements these goals, reinforcing its role as a long-term enabler rather than a speculative trend.

Media Narratives vs Reality on the Ground

Why Headlines Can Be Misleading

Media coverage often equates crypto price declines with failure of the broader ecosystem. This narrative overlooks the distinction between speculative markets and technological adoption. In reality, many blockchain projects gain momentum during bear markets as teams focus on building rather than marketing.

Quiet Growth During Market Downturns

Historically, some of the most impactful blockchain developments have occurred during periods of low market enthusiasm. This pattern continues today. Blockchain adoption advances quietly, driven by necessity and innovation rather than hype.

The Economic Impact of Expanding Blockchain Adoption

Productivity Gains and Cost Reduction

As blockchain adoption scales, its economic impact becomes more visible. Reduced reconciliation costs, faster settlements, and improved data accuracy translate into tangible productivity gains. These benefits compound over time, reinforcing adoption across industries.

Competitive Advantage for Early Movers

Organizations that adopt blockchain early often gain a competitive edge. They build expertise, shape standards, and integrate blockchain into their workflows ahead of competitors. This dynamic creates a virtuous cycle that accelerates broader blockchain adoption.

Challenges That Still Remain

Integration With Legacy Systems

Despite progress, integrating blockchain with legacy systems remains complex. Enterprises must navigate technical, organizational, and cultural challenges. However, these hurdles are increasingly viewed as manageable rather than prohibitive.

Skills and Talent Shortages

The demand for blockchain expertise continues to outpace supply. Addressing this gap is essential for sustaining adoption. Training programs, partnerships, and open-source collaboration are gradually easing this constraint.

The Future Outlook for Blockchain Adoption

Why Adoption Is Likely to Accelerate Further

Looking ahead, most indicators point toward continued growth in blockchain adoption. As use cases mature and success stories accumulate, skepticism diminishes. Blockchain is increasingly perceived as a general-purpose technology rather than a niche experiment.

A Foundation for the Next Digital Era

Blockchain’s role as a trust layer for the internet positions it as a cornerstone of the next digital era. Whether crypto markets boom or bust, the underlying technology continues to embed itself into economic and social systems worldwide.

Conclusion

The contrast between crypto sell-offs and expanding blockchain adoption reveals a deeper transformation underway. While market volatility captures attention, enterprises and governments are focused on long-term value creation. Insights from top CEOs confirm that blockchain is no longer defined by speculation but by utility.

As blockchain adoption explodes across sectors, it becomes clear that the technology’s trajectory is independent of short-term price movements. The future of blockchain lies not in charts but in infrastructure, not in hype but in execution. For organizations willing to look beyond the noise, blockchain represents one of the most significant technological shifts of our time.

FAQs

Q: Why is blockchain adoption growing despite crypto sell-offs?

Blockchain adoption is driven by real-world utility, efficiency gains, and long-term strategic value, which are largely independent of short-term crypto price movements.

Q: Do enterprises care about crypto prices when adopting blockchain?

Most enterprises focus on operational benefits rather than token prices, making their blockchain initiatives resilient during market downturns.

Q: Which industries are leading blockchain adoption?

Financial services, supply chain management, healthcare, government, and energy are among the sectors showing strong blockchain adoption.

Q: How do CEOs view the future of blockchain technology?

Many top CEOs see blockchain as foundational digital infrastructure with long-term relevance, even if they remain cautious about speculative crypto trading.

Q: Will blockchain adoption continue if crypto markets remain volatile?

Yes, blockchain adoption is likely to continue expanding as it addresses structural inefficiencies and supports digital transformation across industries.

Also More: Bitcoin mining stock surges after $7B Google-backed deal