Best Bitcoin & XRP Cloud Mining Sites 2025

Explore the top 7 Bitcoin and XRP cloud mining platforms in 2025 with detailed insights, risks and smart strategies for passive crypto income.

Cloud mining has re-emerged as one of the most talked-about trends in the cryptocurrency space in 2025. This renewed interest is driven by a combination of rising Bitcoin prices, heightened mining difficulty, major advancements in renewable-powered mining infrastructure and a wave of platforms that promise to streamline passive crypto earnings. Best Bitcoin & XRP. Instead of spending thousands on ASIC hardware, dealing with heat and noise at home or struggling to navigate technical complexities, users can now rent hash rate from professional mining farms and receive automated payouts. Bitcoin cloud mining, in particular, has gained momentum as more companies adopt transparent pricing models, eco-friendly energy sources and AI-powered optimization. These features aim to maximize profitability in an environment where mining competition grows continuously.

At the same time, XRP holders have also entered the cloud mining conversation, even though XRP itself is not a mineable asset. Since the entire supply of XRP was created at launch, the term “XRP cloud mining” generally refers to services that allow users to fund Bitcoin or multi-coin mining contracts using XRP as the deposit currency or through internal conversions. Some platforms pay profits out in XRP, while others encourage users to swap mined coins back into XRP after each cycle. This creates a hybrid category where Bitcoin cloud mining intersects with XRP-based funding models. The key, however, is what is technically possible and what is simply clever marketing.

This report presents a thorough breakdown of the seven most talked-about Bitcoin and XRP cloud mining platforms in 2025. Each section explains how the platform operates, how it integrates XRP into its system, what advantages it claims to offer and what users should examine carefully before committing funds. This is a practical, research-driven guide designed to help readers make informed decisions.

Bitcoin vs XRP: What Can and Cannot Be Mined

Why Bitcoin Remains the Core of Cloud Mining

Bitcoin operates on the Proof-of-Work (PoW) consensus mechanism. This system requires miners to solve mathematical puzzles, thereby securing the network and validating transactions. Mining Bitcoin on your own requires advanced ASIC hardware and continuous access to low-cost electricity. By contrast, cloud mining allows users to rent this computing power from remote data centers, removing the need for personal equipment. In 2025, leading cloud mining platforms operate vast networks of renewable-powered facilities and use automated algorithms to distribute hashrate toward the most profitable mining pools. These optimizations can significantly enhance earnings, especially for people who do not want to manage hardware themselves. As a result, Bitcoin continues to dominate the cloud mining sector and remains the foundation upon which most mining contracts are built.

Why XRP Cannot Be Mined and How Platforms Use It Anyway

XRP functions differently from Bitcoin because the XRP Ledger does not rely on Proof-of-Work. Its entire supply already exists, and no new XRP can be created through computational mining. Therefore, any platform claiming to “mine XRP” directly is misrepresenting how the underlying blockchain functions. In practice, so-called XRP mining platforms usually allow users to deposit XRP in order to purchase cloud mining contracts for Bitcoin, Ethereum or other PoW assets. They may also provide the option to receive payouts in XRP or convert mined coins back into XRP through internal exchange features. This setup creates an indirect connection between XRP and cloud mining but does not change the fact that XRP itself is not mineable. this technical distinction is essential before selecting any platform that markets itself under the XRP mining category.

How to Evaluate Bitcoin and XRP Cloud Mining Platforms in 2025

Before exploring individual platforms, it is important to acknowledge what makes a cloud mining service trustworthy. Serious companies tend to provide clear information about their mining farms, energy sources, contracts, fees, team members, locations and regulatory presence. The more transparent a platform is, the more likely it is to be reliable. By contrast, questionable platforms usually offer vague explanations, lack identifiable operators, promise guaranteed returns or push unrealistic daily income projections. In cloud mining, transparency is a strong indicator of legitimacy, while secrecy or exaggerated marketing should immediately prompt deeper scrutiny.

Evaluating cloud mining platforms also involves analyzing how XRP is incorporated into their systems. Legitimate companies usually make it clear that XRP is used only as a funding method or payout option and not as a directly mineable asset. They provide precise contract terms, realistic profitability projections and accessible support channels. The goal is to understand how your funds are used, how profits are calculated and how withdrawals work. When reading any cloud mining advertisement or review, clarity is more important than hype.

The 7 Leading Bitcoin and XRP Cloud Mining Platforms in 2025

Topnotch Crypto

Topnotch Crypto is frequently mentioned as one of the leading AI-enhanced cloud mining services in 2025. The platform markets itself as an advanced mining ecosystem powered by renewable energy and algorithmic optimization. It supports Bitcoin and Dogecoin as primary mineable assets while offering a multi-currency system where users can deposit in XRP, Ethereum, USDT, USDC and other major coins. This makes it attractive to XRP holders who want an easy transition into mining without converting through external exchanges.

The service emphasizes automated mining schedules, flexible contract durations and a streamlined registration process. It also highlights smart algorithms that adjust hashrate allocation based on real-time profitability data. Many reviews describe Topnotch Crypto as a hybrid solution that blends traditional cloud mining with AI-driven financial management. Still, as with any platform, users should review contract fees, verify withdrawal reliability and evaluate the realism of projected returns.

FY Energy

FY Energy appears consistently in rankings of Bitcoin and XRP cloud mining platforms. It is known for integrating renewable solar energy into its mining operations, using large monocrystalline solar farms to reduce costs and improve energy efficiency. This environmental focus has helped the platform gain traction among users who prefer sustainable mining models. FY Energy allows deposits in Bitcoin, XRP and several other cryptocurrencies, making it particularly appealing for multi-asset investors.

The platform structures its mining contracts around stable yields, daily distributions and fixed-term agreements. XRP holders typically deposit funds, convert them into mining power and receive Bitcoin payouts, which they can later reconvert into XRP if desired. FY Energy’s reputation is built on security, KYC verification, transparent documentation and clearly defined contract parameters. Despite its popularity, prospective users should thoroughly analyze the returns, understand lock-up periods and remain mindful of the inherent risks of cloud mining.

AIXA Miner

AIXA Miner promotes itself as an AI-optimized cloud mining service operating an extensive network of data centers worldwide. It focuses on mining Bitcoin and Ethereum using intelligent resource allocation to maximize profitability. The platform accepts deposits in various assets, including XRP, which can be used to fund PoW mining contracts without requiring external conversion.

What makes AIXA Miner stand out is its on-platform automation. The system continually analyzes network difficulty, market pricing and mining pool efficiency before distributing computing power accordingly. The company frequently emphasizes its regulatory alignment in the UK and its reliance on renewable energy sources. For XRP supporters who wish to diversify into mining, AIXA Miner provides a fully integrated way to allocate XRP into hashing contracts while maintaining a user-friendly interface.

Even so, the presence of AI does not guarantee returns. Users should independently verify any claims of licensing, examine the terms of service and confirm that the company provides verifiable proof of its mining activities.

Quid Miner

Quid Miner is widely recognized for its mobile-first approach to cloud mining. It offers a platform designed for ease of use, allowing people from more than 180 countries to start mining crypto through a smartphone or web application. Its mining operations rely on AI-based optimization technologies and renewable-powered data centers. The company claims to be regulated in the UK and focuses heavily on security and simplified user onboarding.

In XRP-related discussions, Quid Miner is considered a convenient option for users who wish to deposit XRP and allocate it toward BTC or ETH mining without managing the conversion process manually. The platform provides a series of mining plans with different profitability expectations and timeframes. Users receive daily rewards based on the chosen contract.

Despite the platform’s accessibility and global presence, users should examine the total cost of mining contracts, consider the effect of shifting Bitcoin network difficulty and evaluate whether the projected earnings align with market realities.

RICH Miner

RICH Miner is one of the most aggressively marketed names in the XRP cloud mining niche. The platform claims to generate high daily profits through short-duration mining contracts that can be funded directly with XRP. It often uses ambitious income examples and rapid profit projections to attract attention. This has made it a prominent yet controversial option in the broader cloud mining ecosystem.

The platform describes itself as offering mining services for Bitcoin, Ethereum, Solana and several other assets. It encourages XRP holders to pledge their tokens as collateral for computing power, promising daily rewards and the return of the pledged amount at contract completion. While the idea may seem appealing, the bold profit numbers frequently associated with RICH Miner warrant caution. High advertised returns without detailed operational transparency raise questions that users should examine thoroughly before participating.

Anyone considering RICH Miner should approach it carefully, perform small test withdrawals and analyze all contract conditions to avoid risks commonly seen in high-yield mining platforms.

PFM Crypto

PFM Crypto presents itself as a multi-asset cloud mining platform that integrates XRP fully into its deposit and payout system. While the platform mines Proof-of-Work cryptocurrencies like Bitcoin and Ethereum, users can fund their contracts directly using XRP. PFM Crypto promotes the idea of principal return at contract maturity, daily mining earnings and an AI engine that reallocates hash rate based on real-time market profitability.

Its marketing positions it as a forward-thinking mining solution designed for investors seeking stable and predictable returns. For XRP users, the appeal lies in not needing to convert assets externally, reducing friction and potential transaction fees. The platform also emphasizes diversification, suggesting that its algorithmic model distributes power across multiple mineable coins to manage volatility.

However, the promise of principal protection should always be treated carefully. Cloud mining remains a high-risk sector, and users should confirm how PFM Crypto manages this guarantee, what reserves it maintains and what happens during extreme market downturns.

Mine Dart

MineDart is known for its straightforward, fast-paced cloud mining model centered primarily on Bitcoin. Although not specifically built for XRP users, many XRP investors choose MineDart by converting their tokens into Bitcoin or stablecoins before funding mining contracts. The platform highlights AI-driven optimization tools, simple contract offerings and quick onboarding supported by an intuitive interface.

MineDart aims to provide mining results quickly through short-term contracts and automated earnings distribution. Its reputation is built on speed and ease rather than deep ecosystem integration. For users who prefer a platform focused solely on Bitcoin without complex multi-asset systems, MineDart can be a suitable choice. But, as always, potential users should research the company’s transparency, examine its mining infrastructure and verify that returns are based on realistic assumptions rather than inflated projections.

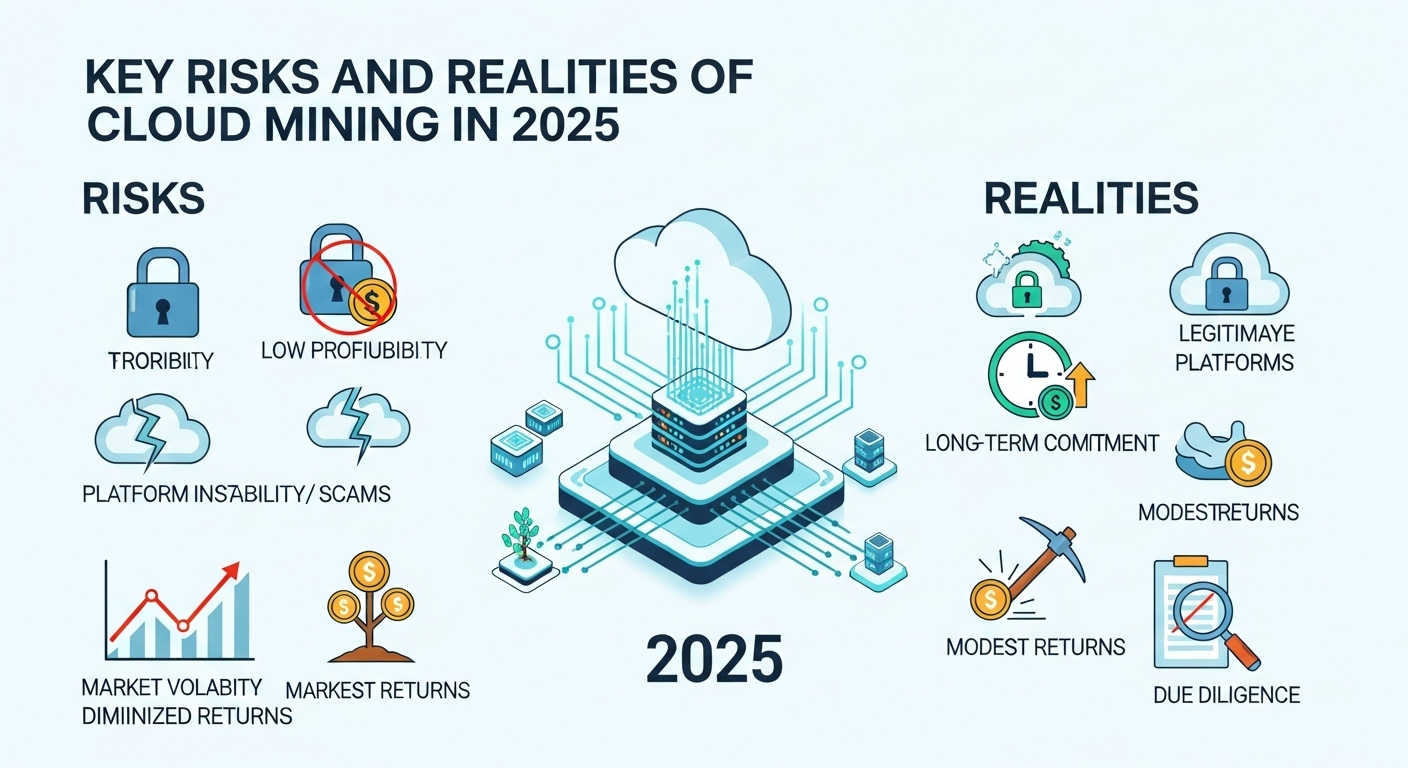

Key Risks and Realities of Cloud Mining in 2025

Cloud mining in 2025 offers opportunities but also carries significant risks. One of the most common issues is the appearance of platforms advertising guaranteed daily income, unrealistic profit margins or claims of mining cryptocurrencies that cannot be mined, such as XRP. Any platform that insists it can generate new XRP through computational mining is not operating within the technical confines of blockchain reality.

Another major concern is the promise of exceptionally high daily returns, sometimes hundreds or even thousands of dollars per day from relatively small deposits. Sustainable mining does not generate such outcomes consistently. Bitcoin mining difficulty increases over time, energy expenses fluctuate and cryptocurrency markets remain highly volatile. These factors make guaranteed or overly stable returns virtually impossible.

Users should also be aware of counterparty risk. When you pay for cloud mining contracts, you are trusting the platform to operate faithfully, manage funds responsibly and distribute profits honestly. If the company collapses, is hacked or operates as a Ponzi scheme, there may be no way to recover your capital. This makes proper due diligence essential. Transparent platforms provide detailed documentation, verifiable company identities, operational histories and accessible customer support. Vague or inaccessible platforms often signal hidden dangers.

Smarter Alternatives for XRP Investors Seeking Passive Income

Many XRP holders enter cloud mining because they want to earn passive income without selling their digital assets outright. While some cloud mining platforms support XRP deposits, there are alternative ways to generate returns that are often clearer and easier to audit. These may include lending XRP on centralized platforms, staking synthetic or wrapped XRP in DeFi environments or using algorithmic trading tools designed for XRP pairs. Each alternative carries risks of its own, but they operate on mechanisms that are generally more transparent than certain cloud mining schemes.

In some cases, diversification between cloud mining and other passive income methods may be the most prudent strategy. A balanced approach helps reduce exposure to any single point of failure.

See More: Best Crypto to Buy Now 7 November – XRP, Solana, Dogecoin

Conclusion

The cloud mining landscape in 2025 is filled with both opportunity and risk. Platforms such as Topnotch Crypto, FY Energy, AIXA Miner, Quid Miner, RICH Miner, PFMCrypto and MineDart are frequently discussed in reviews and rankings, each offering different strengths and targeting different user groups. Some emphasize green energy, others highlight AI-driven mining optimization, and still others focus on short-term high-yield contracts.

Yet the underlying truth remains: XRP itself cannot be mined, and any meaningful engagement with cloud mining revolves primarily around Bitcoin or other Proof-of-Work cryptocurrencies. XRP holders may fund mining contracts or receive payouts in XRP, but they are not mining XRP directly. this distinction allows users to navigate the market with clarity rather than falling for misleading marketing.

In the end, cloud mining should be approached as a speculative tool rather than a guaranteed income solution. With realistic expectations, careful research and diversified strategies, users can participate in the cloud mining sector while managing risks effectively. The key is to rely on informed judgment rather than hype, ensuring that every decision supports long-term financial stability rather than short-term excitement.