Bitcoin News BTC Death Cross Warns of $58K Risk

Bitcoin news update BTC prints a fresh death cross as Bitcoin price weakens. Key support sits near $58K—here’s what traders watch next.

Bitcoin news is flashing a familiar warning sign across crypto screens: a fresh Bitcoin News BTC Death Cross is forming on the BTC chart, and traders are openly discussing whether the Bitcoin price could slide toward the psychologically important $58,000 zone. For anyone who follows market cycles, the phrase “death cross” can sound dramatic, but the mechanics are simple: when the short-term trend line (often the 50-day moving average) dips below the long-term trend line (often the 200-day moving average), it signals weakening momentum and rising downside risk.

Still, the Bitcoin price doesn’t move on technicals alone. Liquidity, macro sentiment, derivatives positioning, and institutional flows can either accelerate a breakdown or flip a bearish setup into a false signal. That’s why Bitcoin news around a death cross tends to split the market into two camps. One side sees it as confirmation that the trend is rolling over. The other side points out that death crosses are widely watched, sometimes lagging, and can arrive after much of the damage is already done. Investopedia even notes that historically, a death cross has often been followed by strong short-term returns in many markets, which is a reminder not to treat it as an automatic sell signal.

So why is $58K suddenly back in the conversation? In recent cycle discussions, analysts have framed $58,000 as a critical “line in the sand” support level—an area where the Bitcoin price could either stabilize and rebuild or, if broken cleanly, trigger a deeper reset in sentiment and structure. In practical terms, this means the next phase of price action may be less about headlines and more about whether BTC can defend key support, reclaim trend indicators, and cool off panic without draining demand.In this Bitcoin news deep dive, we’ll break down what a fresh death cross means for the Bitcoin price, why $58K matters, what indicators traders watch next, and how risk management changes when the market turns choppy.

The Fresh Death Cross on the BTC Chart

A death cross typically refers to the 50-day moving average crossing below the 200-day moving average. It’s a trend-following indicator, which means it reacts to what already happened rather than predicting the future with certainty. On a Bitcoin chart, this crossover can appear after weeks of fading momentum, lower highs, and failed rebounds—basically the “slow leak” phase that wears bulls down.

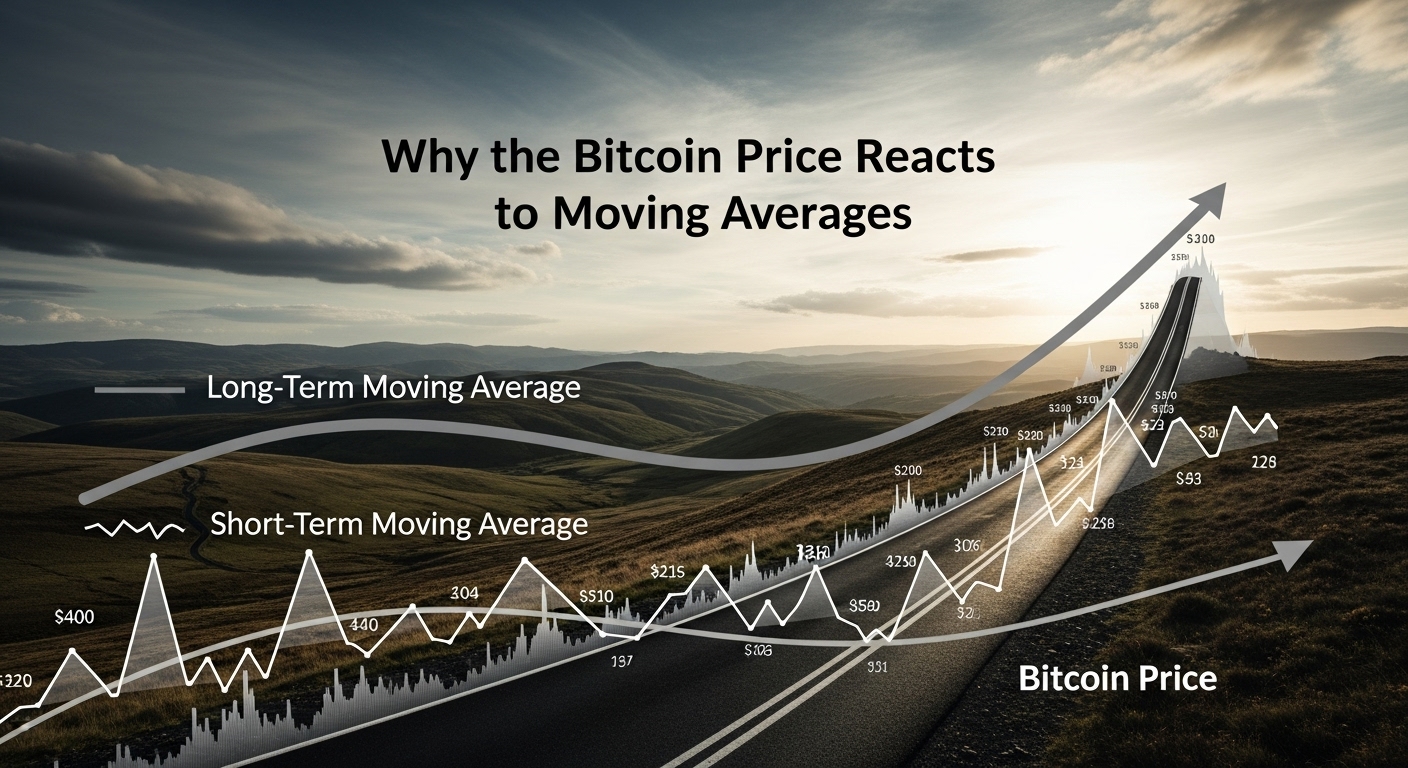

Why the Bitcoin Price Reacts to Moving Averages

The Bitcoin price is highly sensitive to trend perception. Many discretionary traders and systematic strategies use moving averages to classify the market as “risk-on” or “risk-off.” When BTC trades above long-term averages, it’s easier for funds to justify staying exposed. When BTC falls below those averages and a death cross appears, capital often becomes more cautious, and rallies get sold faster.

This is also where Bitcoin news cycles intensify. A death cross becomes a narrative hook, and narratives can move markets—especially in crypto, where sentiment can shift quickly. Even if the indicator is lagging, the social reaction can create real supply pressure, pushing the Bitcoin price into faster pullbacks.

Death Cross vs. Trend Breakdown: Not the Same Thing

A key nuance is that a death cross is not identical to a confirmed macro breakdown. The Bitcoin price could print a death cross and still recover sharply if demand returns. That’s one reason experienced traders treat it as a “risk context” tool rather than a prophecy.In other words, the death cross often signals that the Bitcoin price is entering a higher-volatility environment where downside moves can extend more than traders expect, but it doesn’t guarantee that $58K is inevitable.

Why $58K Is a Major Level in Current Bitcoin News

The $58,000 area has become a widely discussed threshold because it’s seen as a structural support that, if lost, could change the way investors interpret the cycle. Some analysts specifically highlight that slipping below $58,000 risks a more serious “cycle break” scenario for the Bitcoin price.

Support Levels Are Where Psychology Meets Liquidity

Support is not magic. It’s a zone where buyers previously showed up aggressively enough to stop the Bitcoin price from falling further. If BTC returns to that area, two things matter: whether buyers still have conviction and whether sellers still have urgency. If buyers hesitate and sellers press, support can fail quickly.The Bitcoin price also tends to react strongly to round-number levels because they anchor human decision-making. That’s why $60K and $58K can matter even if the “true” support zone is wider on a chart.

How a Drop Toward $58K Could Happen

A move toward $58K usually wouldn’t be a straight line. In many bearish phases, the Bitcoin price chops lower in waves: breakdown, bounce, lower high, breakdown again. Each bounce traps late buyers and exhausts dip-buyers, making the next decline easier.This is where market structure becomes critical. If BTC can’t reclaim key trend levels after the death cross, rallies may become opportunities for sellers to reduce exposure, creating a persistent ceiling over the Bitcoin price.

What Traders Watch Next: Signals That Matter After a Death Cross

Bitcoin news headlines often focus on the death cross itself, but traders tend to watch what happens after the crossover—because that’s where the real information is.

Volume and Volatility: Confirmation or Fake-Out

A death cross paired with rising sell volume is more concerning than a quiet crossover. If the Bitcoin price breaks key support with strong volume and expanding volatility, it signals urgency and forced selling. If the market drifts lower on weak volume, it may be more of a grind than a crash—still bearish, but different in character.

Momentum Indicators and Bullish Divergences

Even in bearish Bitcoin news periods, the Bitcoin price can form bullish divergence setups where momentum stops weakening even as price makes lower lows. Some market commentary has pointed to oversold conditions and divergence signals alongside otherwise bearish trend data, suggesting the potential for sharp relief rallies even within a weak structure.The practical takeaway is that the Bitcoin price can rally hard in a downtrend, and those rallies can be misleading if traders mistake them for full trend reversals.

The Role of Macro Conditions in Bitcoin Price Risk

A death cross often arrives when macro uncertainty is already elevated. Crypto is not isolated; it’s heavily influenced by global liquidity, interest rate expectations, and risk appetite.

Risk Assets Move Together More Than People Admit

When markets are tense, BTC can trade like a high-beta risk asset. That means the Bitcoin price may correlate with broader investor behavior—especially if leverage is high and liquidity is thin. In these environments, even “good” Bitcoin news can fail to lift price, because the market is de-risking across the board.

Why “Lagging Indicators” Still Matter in Crypto

Some traders dismiss moving averages because they lag. But in crypto, a lagging indicator can still be useful because it shapes positioning. If a large share of the market interprets the death cross as bearish, they may hedge, reduce spot exposure, or short rallies—actions that can weigh on the Bitcoin price even if the signal arrived late.

Institutional Flows and ETF Sentiment: A Hidden Driver

One of the biggest shifts in modern Bitcoin news is how much institutional positioning can influence the Bitcoin price narrative. Discussions around spot Bitcoin ETF flows, large fund behavior, and risk management have become part of day-to-day analysis.

Why Outflows Can Amplify Bearish Technicals

When technical structure weakens, institutional investors may become more sensitive to drawdowns. Reports have highlighted periods where Bitcoin ETF withdrawals and shifting sentiment coincided with broader weakness after bearish technical signals, reinforcing downside pressure.This doesn’t mean ETFs “control” the Bitcoin price, but it does mean that demand sources matter more than ever. If marginal demand fades while supply rises, BTC can slide faster than many expect.

Institutional Demand Can Also Create Surprise Reversals

The flip side is that institutions can re-enter quickly when the Bitcoin price looks discounted relative to their models. In that scenario, a death cross becomes a contrarian signal—especially if positioning is already heavily bearish and a small spark triggers short covering.

On-Chain and Exchange Dynamics: Supply Pressure vs. Accumulation

On-chain behavior can either support or contradict what the Bitcoin chart suggests. When BTC moves onto exchanges, traders often interpret it as potential sell supply. Some market commentary has pointed to exchange inflows and shifting supply signals during death cross discussions, adding to bearish concerns.

What Exchange Inflows Can Signal for the Bitcoin Price

If more coins move to exchanges during a fragile trend, the market can interpret it as preparation to sell, which pressures the Bitcoin price. This matters most when liquidity is thin, because a relatively small increase in sell orders can push price through support zones faster.

Long-Term Holders and “Quiet Accumulation”

A more constructive scenario is when long-term holders continue accumulating while short-term traders panic. That can set up a base even if Bitcoin news remains gloomy. Over time, supply gets absorbed, volatility cools, and the Bitcoin price can rebuild.

Scenarios for the Bitcoin Price: From $58K Risk to Recovery Paths

The best way to think about the current setup is not as a single prediction, but as scenarios with clear invalidation points.

Controlled Decline Toward $58K and a Base

In a controlled decline, the Bitcoin price bleeds lower with periodic sharp bounces. Sentiment turns sour, but forced liquidations remain limited. BTC eventually reaches the $58K region, attracts value buyers, and forms a base. In this case, the death cross is a late confirmation of weakness, and the market spends time repairing structure.

Fast Breakdown If Key Levels Snap

If BTC breaks major support levels decisively, the Bitcoin price can slide rapidly as stop-losses trigger and leveraged positions unwind. Some technical outlooks have suggested that losing certain key levels could open the door to much deeper moves, reinforcing why support zones matter in 2026 trading narratives.

Scenario 3: Bear Trap and Sharp Reversal

A bear trap happens when the Bitcoin price dips below a widely watched level, triggers panic selling, and then reverses aggressively as sellers exhaust. In a bear trap, the death cross becomes part of the “shakeout” story. The confirmation would come if BTC reclaims major moving averages and holds them, forcing shorts to cover.

Risk Management in a Death Cross Market

Bitcoin news can be exciting, but volatility punishes emotional decision-making. When the Bitcoin price is near pivotal trend indicators, risk management often matters more than prediction.

Position Sizing Matters More Than Being Right

In choppy conditions, being “right” about direction doesn’t guarantee profit if position sizing is too large. Wide intraday swings can stop traders out before the move plays out. Smaller sizing and wider invalidation logic often help traders avoid getting shaken out.

Time Horizon Changes the Meaning of the Signal

For short-term traders, a death cross can shift the bias toward selling rallies. For long-term investors, it can be a reminder to expect volatility and consider staged entries rather than all-in buys. The Bitcoin price can still trend higher over a multi-year horizon even if it suffers a painful drawdown in the meantime.

Conclusion

The latest Bitcoin news around a fresh death cross is a serious signal, but it’s not a guarantee of collapse. What it really says is that the Bitcoin price is in a higher-risk regime where downside scenarios deserve respect and rallies may be less reliable until structure improves. A move toward $58K is on the table because that level is widely viewed as a crucial support zone, and analysts have explicitly flagged sub-$58,000 risk as a meaningful structural break in some 2026 outlook frameworks.

The next few chapters will likely be written by how BTC behaves around key moving averages, whether buyers defend support with conviction, and how liquidity and institutional flows evolve. If the Bitcoin price reclaims major trend lines, the death cross could fade into history as a lagging scare. If BTC fails to recover and support gives way, the path toward $58K becomes far more plausible.Either way, this is the kind of environment where disciplined planning beats impulse trading—and where understanding the signal matters more than fearing the headline.

FAQs

Q: What is a death cross in Bitcoin news, and why does it matter?

A death cross is a bearish technical signal that typically occurs when the 50-day moving average crosses below the 200-day moving average. It matters because many traders interpret it as trend deterioration, which can influence how they position and how the Bitcoin price reacts during rallies and pullbacks.

Q: Does a death cross guarantee the Bitcoin price will fall to $58K?

No. A death cross is a lagging indicator, not a guaranteed forecast. The Bitcoin price can still rebound if demand returns and BTC reclaims key trend levels. However, $58K is discussed because it’s viewed as a major support threshold in some recent market analysis.

Q: Why is $58K considered an important support level for BTC?

Support levels are zones where buyers previously absorbed selling pressure. The $58,000 area is psychologically important and has been highlighted by analysts as a level that could change cycle structure if broken, making it a focal point in Bitcoin news discussions.

Q: What indicators should I watch after a fresh death cross?

Traders often watch whether the Bitcoin price can reclaim the 200-day moving average, whether sell volume expands on breakdowns, and whether momentum indicators show bullish divergence. Moving-average crossover tracking is also commonly used to contextualize trend shifts.

Q: How should investors think about risk when the Bitcoin price turns bearish?

In bearish conditions, many investors reduce position sizes, avoid chasing bounces, and focus on clear invalidation levels. The best approach depends on time horizon: short-term traders may sell rallies, while long-term investors may use staged entries and expect higher volatility rather than trying to time an exact bottom.

Also More: Bitcoin Trendline Breakdown What Key Indicators Reveal