Bitcoin price forecast 2026: New calls see fresh highs after 2025 slide

Bitcoin price forecast 2026 explores expert predictions, key drivers, risks, and whether BTC can reach fresh all-time highs after the 2025 market slide.

The Bitcoin price forecast 2026 has become one of the most debated topics in the digital asset space as investors look beyond the volatility of recent years. After a turbulent 2025 marked by sharp corrections, regulatory uncertainty, and shifting macroeconomic conditions, the market is once again asking a familiar question: is Bitcoin price preparing for another historic rally, or will it struggle to regain momentum?

Bitcoin has always moved in cycles driven by adoption waves, technological progress, and broader economic forces. The 2025 slide, which followed a period of euphoric highs, tested investor confidence but also reset expectations. Historically, such resets have often laid the foundation for the next growth phase. As 2026 approaches, analysts, institutions, and retail investors are revisiting long-term fundamentals to reassess where BTC could be headed.

This article provides an in-depth, human-written analysis of the Bitcoin price forecast 2026, examining expert predictions, macroeconomic influences, on-chain trends, institutional demand, and potential risks. By connecting these elements, we aim to present a balanced outlook that helps readers understand why many new calls point toward fresh highs after the 2025 downturn, while also acknowledging scenarios that could limit upside.

The 2025 Bitcoin slide

What caused Bitcoin’s correction in 2025

To understand the Bitcoin price forecast 2026, it is essential to revisit what drove the 2025 slide. After reaching elevated levels in prior years, Bitcoin faced a convergence of pressures. Tight monetary policies in major economies reduced global liquidity, making risk assets less attractive. At the same time, regulatory actions in key markets created uncertainty around exchanges, stablecoins, and custodial services.

Another contributing factor was market structure. By 2025, leverage had once again built up across derivatives markets. When prices began to fall, liquidations accelerated the downturn. Long-term holders largely remained intact, but short-term speculative capital exited quickly, amplifying volatility.

Despite these challenges, the correction did not erase Bitcoin’s core value proposition. Instead, it flushed out excess speculation and restored a more sustainable market base, which many analysts now see as constructive for long-term growth.

Why corrections matter in Bitcoin cycles

Bitcoin’s history shows that deep pullbacks are not anomalies but integral parts of its growth trajectory. Every major bull cycle has been followed by a significant correction, often exceeding 50%. These drawdowns typically coincide with periods of skepticism, yet they have consistently preceded new expansion phases.

From a cycle perspective, the 2025 slide resembles previous mid-cycle resets rather than an end-of-life decline. This context is crucial when evaluating the Bitcoin price forecast 2026, as it suggests that the market may be transitioning from consolidation into renewed accumulation.

Macro forces shaping Bitcoin in 2026

Global monetary policy and inflation trends

Macroeconomic conditions will play a defining role in the Bitcoin price forecast 2026. Central bank policies, particularly interest rate decisions by the US Federal Reserve and other major institutions, directly influence liquidity and investor appetite for alternative assets. If inflation remains persistent while rate cuts gradually return, Bitcoin could benefit as a hedge against currency debasement.

Conversely, if inflation cools faster than expected and restrictive policies remain in place, risk assets may face headwinds. However, Bitcoin’s growing recognition as “digital gold” means it no longer trades purely as a speculative asset, which could soften the impact of tighter financial conditions.

Geopolitical uncertainty and capital flows

Geopolitical tensions, trade realignments, and currency instability in emerging markets continue to drive interest in decentralized assets. In regions facing capital controls or high inflation, Bitcoin adoption has steadily increased. By 2026, these dynamics could intensify, supporting long-term demand and reinforcing bullish projections within many Bitcoin price predictions.

Institutional adoption and its impact

How institutions view Bitcoin post-2025

Institutional sentiment shifted noticeably after the 2025 correction. While some speculative funds reduced exposure, long-term institutions such as asset managers, pension funds, and sovereign entities increasingly viewed the dip as an entry opportunity. Bitcoin’s maturing infrastructure, including regulated custody solutions and transparent markets, has made it more accessible to traditional finance. This structural demand forms a critical pillar of the Bitcoin price forecast 2026, as institutional capital tends to be stickier and less reactive to short-term volatility.

ETFs, custody, and regulated access

The continued expansion of Bitcoin-related financial products, including spot ETFs and institutional-grade custody, has lowered barriers to entry. These vehicles allow investors to gain exposure without directly managing private keys, which has historically been a deterrent. As regulated access broadens in 2026, incremental inflows could significantly impact supply-demand dynamics, especially given Bitcoin’s fixed issuance model.

Supply dynamics and the role of scarcity

Bitcoin halving effects moving into 2026

Although the most recent Bitcoin halving occurred prior to 2026, its effects often play out over multiple years. Reduced block rewards limit new supply entering the market, gradually tightening availability. Historically, the strongest price appreciation has occurred 12–24 months after a halving event.

This delayed impact is central to many bullish Bitcoin price forecasts 2026, as supply constraints intersect with renewed demand.

Long-term holder behavior

On-chain data consistently shows that long-term holders accumulate during downturns. The 2025 slide was no exception, with coins moving into cold storage and remaining inactive. Such behavior reduces liquid supply, making it easier for price to rise once demand returns. This structural scarcity underpins optimistic BTC price predictions and differentiates Bitcoin from inflationary assets.

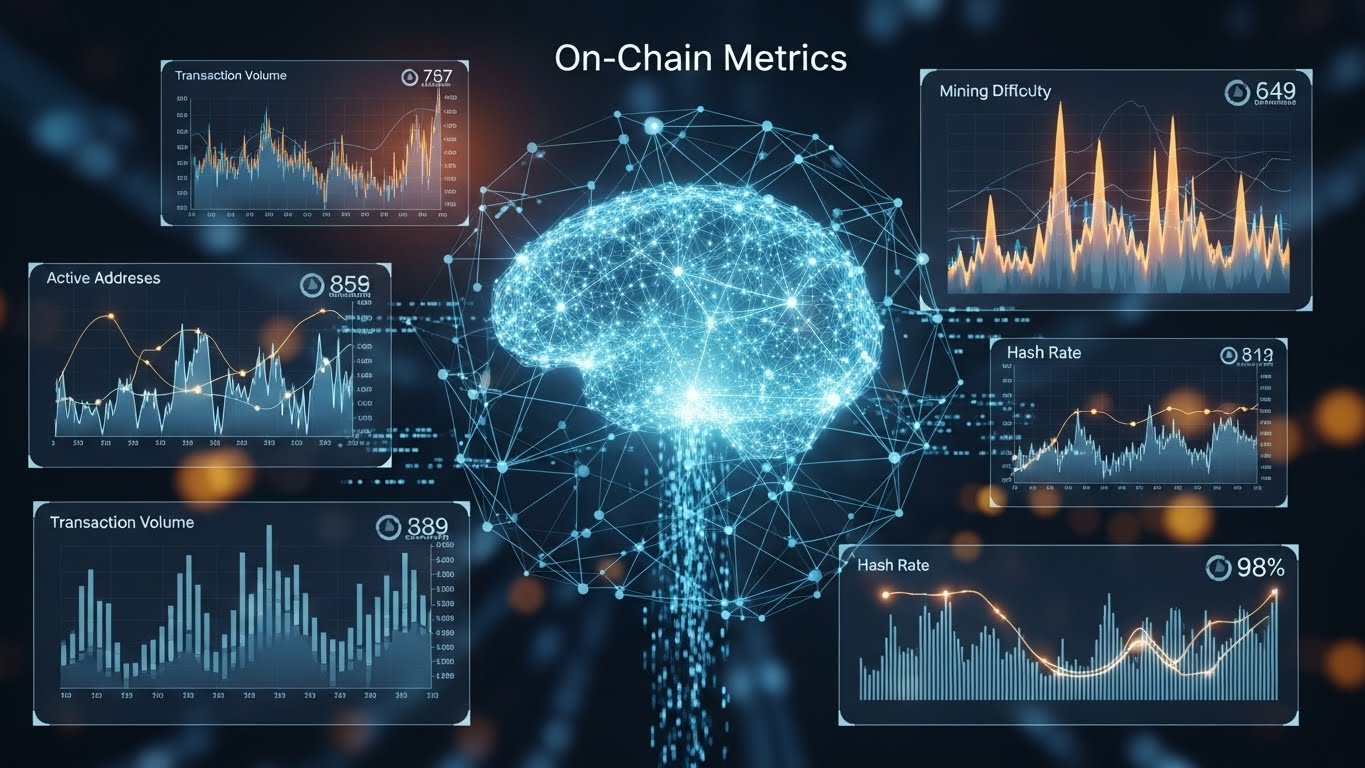

On-chain metrics and network health

Hash rate and network security

Bitcoin’s hash rate, a measure of network security, continued to reach new highs even during the 2025 correction. This indicates strong miner confidence and ongoing investment in infrastructure. A robust network enhances trust, which is critical for long-term valuation models.

For the Bitcoin price forecast 2026, sustained hash rate growth suggests that miners expect higher prices ahead, as mining profitability improves with price appreciation.

Active addresses and transaction trends

User activity, measured through active addresses and transaction volume, provides insight into adoption. While speculative activity cooled in 2025, baseline usage remained resilient. Payments, remittances, and layer-two solutions continued to grow, signaling that Bitcoin’s utility extends beyond price speculation.

Expert opinions and analyst predictions

Bullish forecasts calling for fresh highs

Several prominent analysts believe that Bitcoin could reach new all-time highs by 2026. Price targets vary widely, but common projections range from $120,000 to over $200,000, depending on adoption rates and macro conditions. These forecasts often cite institutional inflows, post-halving supply constraints, and expanding use cases. Such views dominate optimistic Bitcoin price predictions 2026, especially among long-term proponents who see the 2025 slide as a temporary setback.

Conservative and bearish scenarios

Not all analysts agree on an aggressive upside. Some caution that regulatory clampdowns, technological competition, or prolonged economic stagnation could limit Bitcoin’s growth. In these scenarios, BTC may trade sideways or experience modest appreciation rather than explosive gains. A balanced Bitcoin price forecast 2026 must account for these possibilities, emphasizing risk management alongside optimism.

Regulatory environment and compliance

Evolving global regulations

Regulation remains one of the most influential variables for Bitcoin’s future. By 2026, clearer frameworks in major economies could reduce uncertainty and encourage broader participation. Transparent rules around taxation, custody, and exchanges would likely be bullish in the long run.

However, restrictive policies or fragmented regulations across jurisdictions could hinder growth, particularly for retail investors.

How regulation could support long-term growth

Paradoxically, regulation may ultimately strengthen Bitcoin’s position. Compliance-friendly infrastructure attracts institutional capital and integrates BTC into the global financial system. This legitimacy factor is increasingly reflected in long-term Bitcoin price forecasts.

Technological developments and innovation

Layer-two solutions and scalability

Technological progress continues to enhance Bitcoin’s functionality. Layer-two networks improve transaction speed and reduce fees, making BTC more practical for everyday use. These innovations expand Bitcoin’s role beyond a store of value. As usability improves, demand could rise, positively influencing the Bitcoin price forecast 2026.

Interoperability and ecosystem growth

Bitcoin’s integration with broader blockchain ecosystems allows it to participate indirectly in decentralized finance and cross-chain applications. While Bitcoin remains conservative by design, these developments increase its relevance in a rapidly evolving digital economy.

Market sentiment and psychology

Fear, greed, and long-term confidence

Investor psychology plays a significant role in Bitcoin’s price movements. The 2025 slide pushed sentiment into fear territory, but such periods have historically preceded strong recoveries. As confidence rebuilds, capital often flows back quickly. Monitoring sentiment indicators provides valuable context for understanding how the Bitcoin price forecast 2026 may unfold.

Media narratives and public perception

Media coverage influences adoption by shaping public perception. Balanced narratives focusing on Bitcoin’s resilience and long-term value could attract new participants, while sensationalism may fuel volatility. By 2026, more mature coverage may contribute to market stability.

Risks that could derail the bullish outlook

Technological and security risks

Although Bitcoin’s protocol is highly secure, no system is entirely risk-free. Potential vulnerabilities, though unlikely, could impact confidence. Additionally, competition from other digital assets may divert attention and capital.

Macroeconomic shocks

Unexpected global events, such as financial crises or severe recessions, could disrupt all asset classes, including Bitcoin. While BTC has shown resilience, extreme scenarios must be considered in any responsible Bitcoin price forecast 2026.

Long-term investment perspective

Why many see 2026 as a pivotal year

For long-term investors, 2026 represents a convergence point where post-halving effects, institutional adoption, and technological maturity intersect. This combination fuels expectations of renewed growth and supports narratives calling for fresh highs.

Balancing optimism with caution

While the outlook is promising, prudent investors recognize that Bitcoin remains volatile. Diversification, risk management, and a long-term mindset are essential when engaging with BTC, regardless of bullish forecasts.

Conclusion

The Bitcoin price forecast 2026 reflects a market at a crossroads, emerging from the shadows of a 2025 correction with renewed confidence and stronger fundamentals. New calls for fresh highs are grounded in tangible factors such as institutional adoption, supply scarcity, network resilience, and technological progress. At the same time, risks ranging from regulation to macroeconomic uncertainty remind us that Bitcoin’s journey is rarely linear.

Ultimately, 2026 could mark another defining chapter in Bitcoin’s evolution. Whether BTC reaches new all-time highs or follows a more measured path, its role as a decentralized, scarce digital asset appears more entrenched than ever. For investors and observers alike, understanding the forces shaping this outlook is key to navigating the opportunities and challenges ahead.

FAQs

Q: What is the most realistic Bitcoin price forecast 2026?

Most analysts suggest a wide range, with conservative estimates near six figures and bullish scenarios extending well beyond, depending on adoption and macro conditions.

Q: Why do many experts expect fresh highs after the 2025 slide?

The correction reset market excesses while fundamentals such as institutional demand, limited supply, and network growth remained strong.

Q: How does regulation affect Bitcoin price predictions for 2026?

Clear and supportive regulation could boost confidence and attract capital, while restrictive policies may slow growth.

Q: Is Bitcoin still a high-risk investment in 2026?

Yes, despite maturation, Bitcoin remains volatile. Long-term potential exists, but risks should not be ignored.

Q: Should long-term investors consider Bitcoin beyond 2026?

Many view Bitcoin as a multi-decade asset. While forecasts focus on 2026, its broader value proposition extends well into the future.