Bitcoin Price Surge powered by technological innovations and institutional involvement potentially reaching $210k by 2025. The price of Bitcoin has long fascinated investors and experts, provoking considerable speculation. The bitcoin market has fluctuated in recent years, but one forecast remains out: Presto Research predicts Bitcoin might reach $210k by 2025. This bold forecast may seem implausible, but the research and analysis behind it explain why Bitcoin’s value may soar. This essay discusses the grounds supporting this estimate and the ramifications for investors, outlining the processes that might push Bitcoin above $210,000 by 2025.

Bitcoin’s Price Trajectory

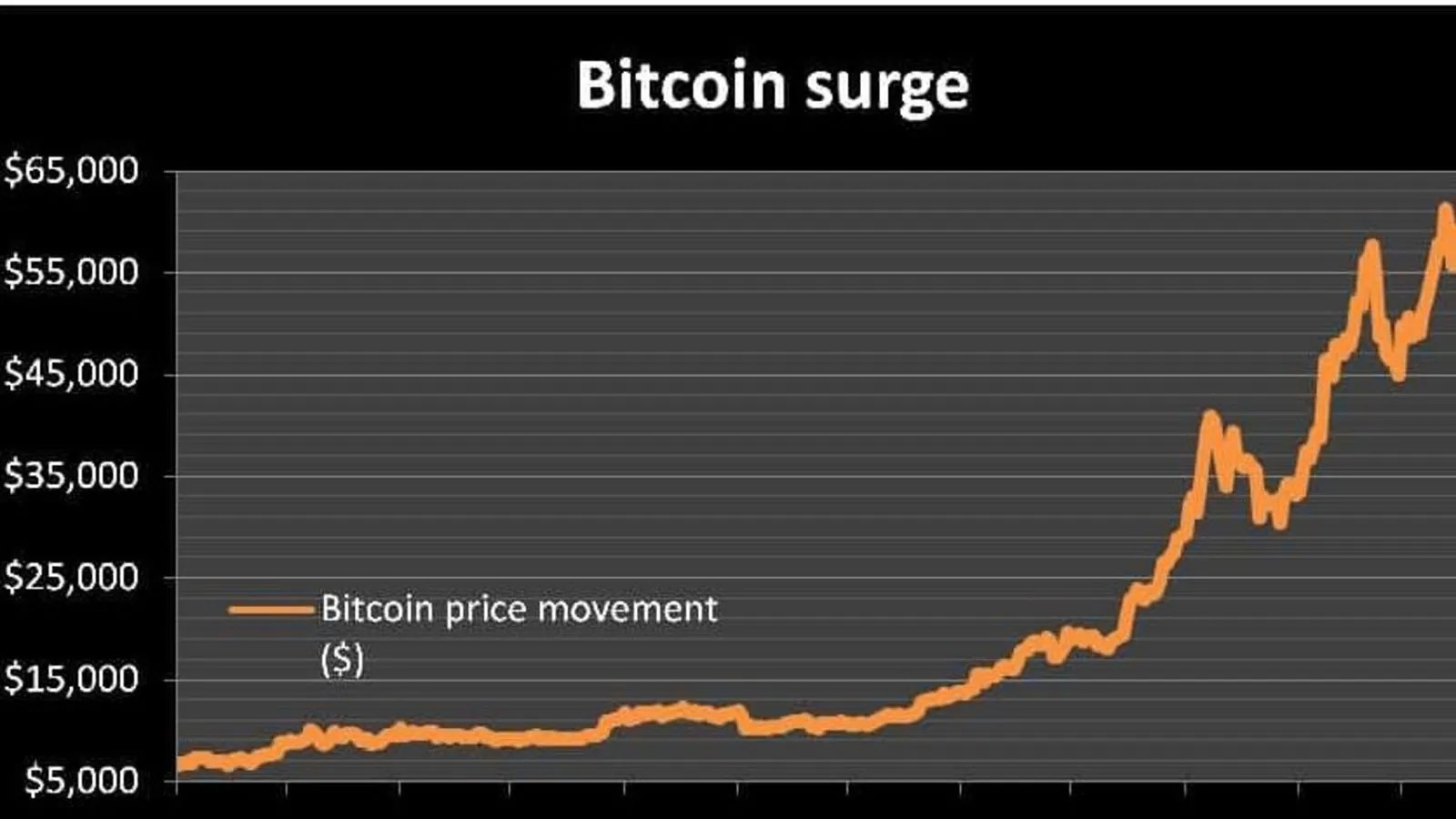

Bitcoin has gone a long way since Satoshi Nakamoto founded it. At a few cents per Bitcoin, it soon attracted a tiny but enthusiastic number of early adopters. Bitcoin rose to new highs, especially throughout market cycles, as its popularity surged. Bitcoin has grown and survived for a decade. Bitcoin’s price swings have been remarkable, from $1k in late 2013 to $60k in 2021. Bitcoin has rebounded from market corrections and reached a new high. These patterns indicate that Bitcoin’s price trajectory is driven by long-term fundamental dynamics that are making it a worldwide asset class.

Bitcoin Price Forecast

Presto Research, a reputable cryptocurrency consultancy, predicts Bitcoin will reach $210k by 2025. Though ambitious, this projection is based on increased acceptance, institutional engagement, and Bitcoin’s finite supply. Presto Research predicts a Bitcoin price increase when institutional investors enter the market.

In recent years, huge firms and investment funds have added Bitcoin to their portfolios, marking a change in how traditional financial institutions see digital assets. As institutional adoption continues, demand will climb, raising Bitcoin’s price. Presto Research stresses Bitcoin’s scarcity. Bitcoin is deflationary since it has a 21 million-coin supply. Scarcity and rising demand might boost Bitcoin’s price in the future years.

Bitcoin’s Rise to $210k

Institutional cryptocurrency use is driving Bitcoin’s expected surge to $210k. Bitcoin has gained popularity among financial institutions and enterprises in recent years. Tesla, MicroStrategy, and Square have openly incorporated Bitcoin into their balance sheets, proving digital assets are no longer niche investments. More institutional investors have entered the market due to Bitcoin exchange-traded funds (ETFs). In the future years, hedge funds, family offices, and pension funds may boost their Bitcoin exposure due to greater access to traditional investing instruments. Bitcoin may reach $210,000 by 2025 when institutional money enters the market.

Also Read: Bitcoin Reaches $103k and Eyes a New Record 16 Dec 2024

Bitcoin as Digital Gold

Bitcoin is becoming “digital gold.” Bitcoin is positioned as a contemporary substitute to gold, which has been a store of value and inflation hedge. Many investors are using Bitcoin to protect their investments amid global economic turmoil and rising inflation. Bitcoin’s store of value narrative has grown, especially during economic uncertainty. Central banks’ money printing has raised worries about purchasing power loss. With a limited quantity of 21 million coins, Bitcoin’s deflationary characteristic appeals to wealth protectors. Bitcoin’s price might reach $210k by 2025 as its perceived safety grows.

Bitcoin’s Growth Potential

Continuous technical development boosts Bitcoin’s long-term growth potential. The Bitcoin network has undergone several modifications since its introduction to increase scalability, security, and user experience. The Lightning Network, a second-layer Bitcoin solution, might boost transaction speed and lower costs. These improvements may make Bitcoin more usable as a means of trade and store of wealth. Coin acceptance may rise as it becomes more user-friendly and accessible, raising its price.

Bitcoin vs Centralized Currencies

Bitcoin prices also depend on global economic conditions. Many investors use Bitcoin to hedge against traditional financial markets during economic downturns. Bitcoin’s fixed quantity and decentralization appeal to stability seekers as fiat currencies depreciate. Bitcoin’s decentralization and borderlessness make it an enticing option for central bank digital currencies (CBDCs) and stronger regulations as governments across the world explore. Bitcoin’s worldwide asset status may increase if it can be utilized as a store of value independent of central banks.

Halving and Price Surge

Another important aspect of Bitcoin’s price trend is its halving occurrences, which occur every four years. Miners earn half the payout for confirming Bitcoin transactions during these events. This decrease in Bitcoin creation decreases the supply, producing a supply-demand mismatch that has traditionally raised prices. As the number of new coins decreases, the next halving event in 2024 might boost Bitcoin’s price. Bitcoin’s price has regularly risen after halving occurrences, contributing to the $210,000 projection by 2025.

Also Read: Bitcoin 30K Support Zone Key to Future Price Movements

Conclusion

Presto Research predicts Bitcoin will reach $210k by 2025 based on market patterns and dynamics. Institutional acceptance, Bitcoin’s reputation as digital gold, technological developments, and halving occurrences all contribute to its long-term growth potential. Although cryptocurrency is unpredictable, these indicators imply that Bitcoin may undergo a large price spike in the future years. Bitcoin’s place in the global financial system is changing as it becomes a popular asset. In 2025, cryptocurrency investors will wait for factors that might boost Bitcoin’s price to $210k, as forecasted by Presto Research. Though its future is unknown, Bitcoin is here to stay and will continue its journey.