Bitcoin Price Today & Fed Caution Near $92K Tension

Bitcoin price today steadies near $92K after sharp losses as Fed caution, rate uncertainty and risk-off sentiment take their toll.

The Bitcoin price today finds itself in a precarious position: near the $91,000–$92,000 range, attempting to stabilise after a rapid descent from its recent peaks. The world’s largest cryptocurrency slid below the key $90,000 level in the prior session, only to retrace slightly and settle above it once more. According to data from investing .com, Bitcoin traded at about $91,882 by 02:11 ET after hitting as low as $88,610 in a 24-hour span.

What makes the current phase especially interesting is how much the Federal Reserve’s tone and policy outlook are influencing the market. The cryptocurrency is no longer isolated from macro-economic currents; in fact, its trajectory has become entwined with rate expectations, inflation data, job market signals and overall risk-appetite in financial markets. This article examines how the Bitcoin price today reflects under-the-hood cryptocurrency dynamics, explores the macro environment pulling at its leash, and outlines the key levels and scenarios traders and investors alike should be aware of.

Where the Bitcoin Price Today Stands and How It Got Here

The recent journey of Bitcoin has been dramatic. A few weeks ago, the Bitcoin price enjoyed a strong rally that took it to fresh highs above $120,000. That run was driven in part by optimism over interest-rate cuts, vast speculative capital and expanding institutional exposure. But since then, Bitcoin has shed approximately 25-30% of its peak value, and the Bitcoin price today near $92K is part of that correction.

What triggered the drop? One major factor is the shift in market expectations around the Fed’s next moves. Minutes from the Fed’s October 28-29 meeting revealed internal divisions on whether to reduce interest rates in December, citing persistent inflation and a lack of clarity in economic data. The market had originally priced a fairly bold easing cycle, but that view has been tempered. Simultaneously, the U.S. labour-market data has been disrupted by a federal government shutdown, delaying key employment numbers and adding an extra layer of uncertainty for large risk assets like Bitcoin.

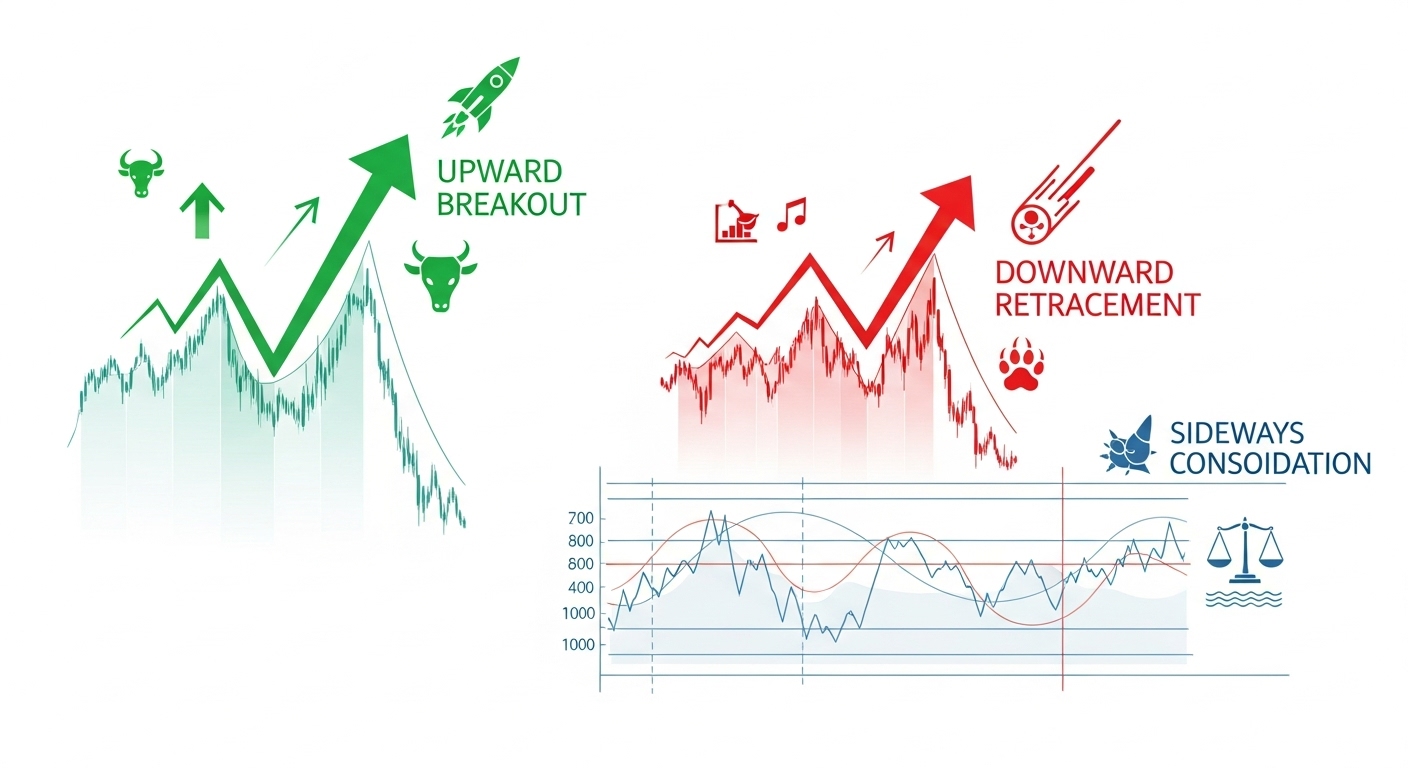

As a result, the Bitcoin price today around $92K reflects a mood shift: buyers are less willing to chase aggressively, sellers are more mindful of risks, and leverage is being trimmed. Given this backdrop, the current range can be seen as a consolidation or a potential precursor to further moves — either up or down.

The Fed’s Role and Why It Really Matters for Bitcoin

The influence of the Federal Reserve (Fed) over the Bitcoin price today cannot be overstated. Though Bitcoin is not a cash-flow generating asset like stocks or bonds, changes in interest rates and monetary policy still ripple through risk-assets broadly, and crypto is no exception.

When the Fed cuts rates, borrowing costs fall, liquidity tends to rise, and investors often pivot toward higher-risk assets including cryptocurrencies. Conversely, when the Fed signals caution—talking of keeping rates elevated, delaying cuts or emphasising inflation risks—market sentiment shifts, risk appetite fades, and assets like Bitcoin often slip. Indeed, after the Fed’s recent statement that a December cut was not a given, markets reacted by scaling back expectations, and Bitcoin’s weakness followed.

Another key mechanism is the relative attractiveness of alternative investments. Higher real yields on bonds make parking money in safe securities more competitive versus speculative assets. The Bitcoin price today being stuck near $92K partly reflects this relative value battle: if investors see better returns in bonds or money-markets—or simply more risk in the economy—they may hold back from pumping additional funds into crypto.

Also worth noting is that institutional capital, such as investments into spot Bitcoin ETFs and futures markets, are influenced by macro policy signals. With the Fed’s tracking uncertain, many professional traders and funds are adopting a wait-and-see stance, which limits upside potential in the near term.

On-Chain and Derivatives Signals Behind the Scenes

Beyond rate policy and macro headlines, the underpinnings of the crypto market help explain why the Bitcoin price today is consolidating near $92K rather than immediately resuming an aggressive rally.

Leverage and liquidation dynamics play a huge part. In the recent sell-off, many highly leveraged traders were caught off guard, triggering cascading liquidations across futures and perpetual contracts. That forced stop-losses, increased volatility and amplified the downswing. As a result, positions have been de-leveraged and risk tolerance appears reduced. On-chain analytics show reduced open interest and more cautious derivatives flows.

Another dimension is the composition of holders. Long-term Bitcoin holders (so-called “HODLers”) are generally sitting tight, whereas short-term speculators are more likely to capitulate in sharp corrections. The fact that exchange reserves remain relatively low suggests fewer coins are queued for immediate sale, which in turn provides some support for the Bitcoin price today. However, accumulation by new buyers appears muted.

Together, these signals imply that while the immediate explosive upside may be delayed, the market is not necessarily primed for a dump either. The current consolidation around $92K could be viewed as the market resetting after a cycle of excess, waiting for the next catalyst.

Broader Macro Backdrop: Risk-Off Mode and Its Impact on Crypto

The environment facing Bitcoin and other digital assets is not just shaped by crypto-specific factors; it is tightly linked with broader themes of global liquidity, equities, yield curves and the U.S. dollar.

In recent weeks, equities—especially riskier growth and tech stocks—have shown signs of correction amid concerns about earnings, valuation and economic growth. When risk assets are hit, Bitcoin often follows, given that many market participants treat it as a high-beta asset rather than a safe haven. The Bitcoin price today near $92K is influenced by this synchronisation of risk-sentiment across asset classes.

At the same time, a strong U.S. dollar or rising real yields tend to siphon liquidity away from speculative assets, making them relatively less attractive. Because Bitcoin has matured into a more mainstream asset, albeit still volatile, these macro-factors are now material. If global liquidity tightens, or the Fed’s communications remain hawkish, the Bitcoin price today will reflect that caution.

Finally, delayed or weak economic data adds to the uncertainty. With key jobs or inflation numbers postponed, markets don’t have full transparency, which in turn increases risk premia, elevates the implied volatility structure in crypto, and keeps buyers at bay. So in a sense the Bitcoin price today is reacting not just to what is known, but to what might be unknown.

Key Price Levels and Scenarios for Bitcoin’s Next Move

With the Bitcoin price today sitting near $92K, it’s useful to frame what could come next. Rather than bullet lists, let’s walk through potential support and resistance zones, and the scenarios that emerge accordingly.

The first important zone is where Bitcoin just was: near the $88,000–$90,000 band. Several analysts view that as a critical support zone. If the price decisively breaks below this area, it could signal a deeper retracement, potentially toward lower pivot levels around $75,000 or beyond. On the flip side, the current band around $91,000–$92,500 serves as a battleground region—market participants are watching whether buyers can hold this range, or whether sellers regain control.

Upwards, the next meaningful resistance lies in the $96,000 to $100,000 region. This area functioned as support during the recent uptrend, and if Bitcoin were to reclaim and convincingly break through this zone, it could reignite interest and momentum, signaling a potential return toward previous highs. Whether that happens hinges on a macro catalyst: a dovish pivot from the Fed, strong inflows into crypto, or a reduction in economic uncertainty.

In terms of scenarios, one possibility is that Bitcoin enters a period of consolidation around the current levels—say, fluctuating between $88K and $100K—for an extended time. During this range-bound phase, volatility might narrow and the market might digest the recent move. A second scenario is a breakdown, triggered by renewed hawkish signals from the Fed or a large macro shock; that would likely lead the Bitcoin price today to test lower support zones and could shake out weaker holders. The third scenario is a relief rally: if the Fed signals a clear path to easing or if liquidity surges, Bitcoin could bounce off $90K and head toward $100K-plus again. Each of these outcomes is plausible—what matters is the interplay of macro, crypto-specific flows and market psychology.

What This Means for Investors and Traders (With a Word of Caution)

For anyone tracking the Bitcoin price today, the message is one of caution coupled with opportunity. The market is clearly in a phase of recalibration rather than runaway advances. The role of macro-policy—especially the Fed’s messaging—has moved to the centre stage. That means staying attuned to economic data, central bank commentary, and liquidity flows is as important as watching crypto-specific metrics.

Investors with longer time-horizons may regard current levels near $92K as a potential accumulation zone, particularly if institutional adoption continues and on-chain metrics remain supportive. At the same time, the risk of further downside remains real, especially if macro risks intensify. For traders, volatility remains the friend—but also the foe. Sharp moves can present opportunity, but they also demand tighter risk management and awareness that leverage can be punished.

It is worthwhile to remember that past performance is not indicative of future outcomes, and the Bitcoin price today is subject to unpredictable swings. Crypto markets remain nascent compared to major asset classes, and external shocks can produce outsized effects. This is not financial advice; each reader must undertake their own due diligence, weigh their risk tolerance, and possibly consult a professional before making significant allocations.

See More: Best Crypto to Buy Now 7 November – XRP, Solana, Dogecoin

Final thoughts

In sum, the Bitcoin price today near $92K reflects a market caught between its bullish potential and a wave of macro and internal caution. The recent losses have trimmed speculative excess, but policy uncertainty and risk-off sentiment remain headwinds.

Whether Bitcoin embarks on its next leg up or enters a deeper correction will depend largely on how the Fed, liquidity flows and investor sentiment converge. For now, the story is of consolidation with tension—a quiet before the next move.