Bitcoin Whales Are Buying Again Amid Market Fear

Bitcoin whales are buying again as retail investors retreat. Discover what whale accumulation signals for the next crypto market move.

The cryptocurrency market has always moved in cycles driven by sentiment, liquidity, and capital concentration. In recent weeks, a familiar pattern has re-emerged: Bitcoin whales are buying again as other investors retreat. While retail traders and smaller holders scale back exposure amid volatility and macroeconomic uncertainty, large holders—commonly referred to as Bitcoin whales—are quietly increasing their positions.

This divergence between institutional-scale investors and retail participants often signals a pivotal moment in the market cycle. Historically, when Bitcoin whales are buying again, it has coincided with accumulation phases that precede strong upward momentum. Conversely, retail retreat frequently reflects fear, uncertainty, and emotional decision-making.

Understanding why whales accumulate during periods of hesitation—and what that means for price action—can provide valuable insight into where Bitcoin may head next. In this article, we explore the mechanics of whale accumulation, the psychology behind retail capitulation, and the broader implications for the crypto market.

The Return of Bitcoin Whale Accumulation

The phrase Bitcoin whales are buying again refers to a measurable increase in holdings among addresses that control significant amounts of BTC—typically 1,000 BTC or more. On-chain analytics platforms monitor wallet movements, exchange inflows and outflows, and supply distribution metrics to detect these accumulation trends.

Recent blockchain data reveals that large wallet cohorts have begun steadily increasing their Bitcoin balances. This accumulation often occurs during price consolidation or moderate pullbacks. When other investors retreat due to short-term uncertainty, whales take advantage of lower prices and improved liquidity conditions.

Why Whales Accumulate During Market Fear

Whales operate with a long-term investment horizon. Unlike retail traders, they are less influenced by daily volatility and short-term news cycles. When Bitcoin whales are buying again as other investors retreat, it often reflects strategic capital deployment rather than reactive behavior.

Accumulation phases typically coincide with: Market corrections following overextended rallies Periods of negative sentiment and media pessimism Declining exchange balances as BTC is moved to cold storage Reduced leverage across derivatives markets By accumulating during fear-driven sell-offs, whales position themselves ahead of potential recovery cycles.

Retail Investors Retreat: Understanding the Psychology

Retail investors tend to react emotionally to price volatility. Sharp corrections, macroeconomic headlines, or regulatory uncertainty can trigger panic selling. When headlines focus on risk, many smaller investors prefer to reduce exposure. The phenomenon where Bitcoin whales are buying again while retail exits highlights the psychological divide between informed capital and reactive capital.

Fear, Uncertainty, and Short-Term Thinking

Retail retreat is often driven by three main factors: Fear of further downside Desire to preserve capital Overexposure during previous bullish phases In contrast, whales assess broader macro trends, adoption metrics, institutional inflows, and long-term supply constraints. When the broader market hesitates, whales often interpret it as discounted opportunity.Historically, markets tend to transfer wealth from emotional participants to patient capital allocators. This dynamic is especially visible in crypto cycles.

On-Chain Data Signals a Shift

On-chain metrics provide objective confirmation that Bitcoin whales are buying again as other investors retreat. Key indicators include supply distribution changes, exchange net flows, and wallet growth in high-value cohorts.

Declining Exchange Reserves

One strong signal of whale accumulation is declining Bitcoin reserves on centralized exchanges. When large investors withdraw BTC into private custody, it reduces immediate sell pressure and reflects long-term holding intent.Exchange outflows often precede supply squeezes. If demand increases while liquid supply decreases, upward price pressure can build.

Rising Large Wallet Balances

Blockchain analytics consistently show growth in wallets holding substantial BTC balances. These movements indicate confidence from high-net-worth participants and institutions.When Bitcoin whales are buying again, it frequently aligns with a bottoming phase in price cycles.

Institutional Influence and Strategic Positioning

The modern crypto market includes hedge funds, asset managers, family offices, and publicly traded companies. Many of these entities qualify as whale-level participants.Institutional involvement changes the dynamics of accumulation. Rather than speculative trading, these entities often allocate Bitcoin as a strategic asset within diversified portfolios.

Long-Term Thesis Remains Intact

Despite short-term volatility, the fundamental investment case for Bitcoin remains grounded in: Limited supply capped at 21 million Growing global adoption Increasing regulatory clarity Integration with traditional financial productsWhen Bitcoin whales are buying again as other investors retreat, it signals that large capital allocators remain confident in Bitcoin’s long-term value proposition.

Market Cycles and Historical Precedents

Bitcoin’s history reveals recurring patterns of distribution and accumulation. After strong bull markets, periods of consolidation or correction typically follow. During these phases, retail interest declines, but whales quietly build positions.

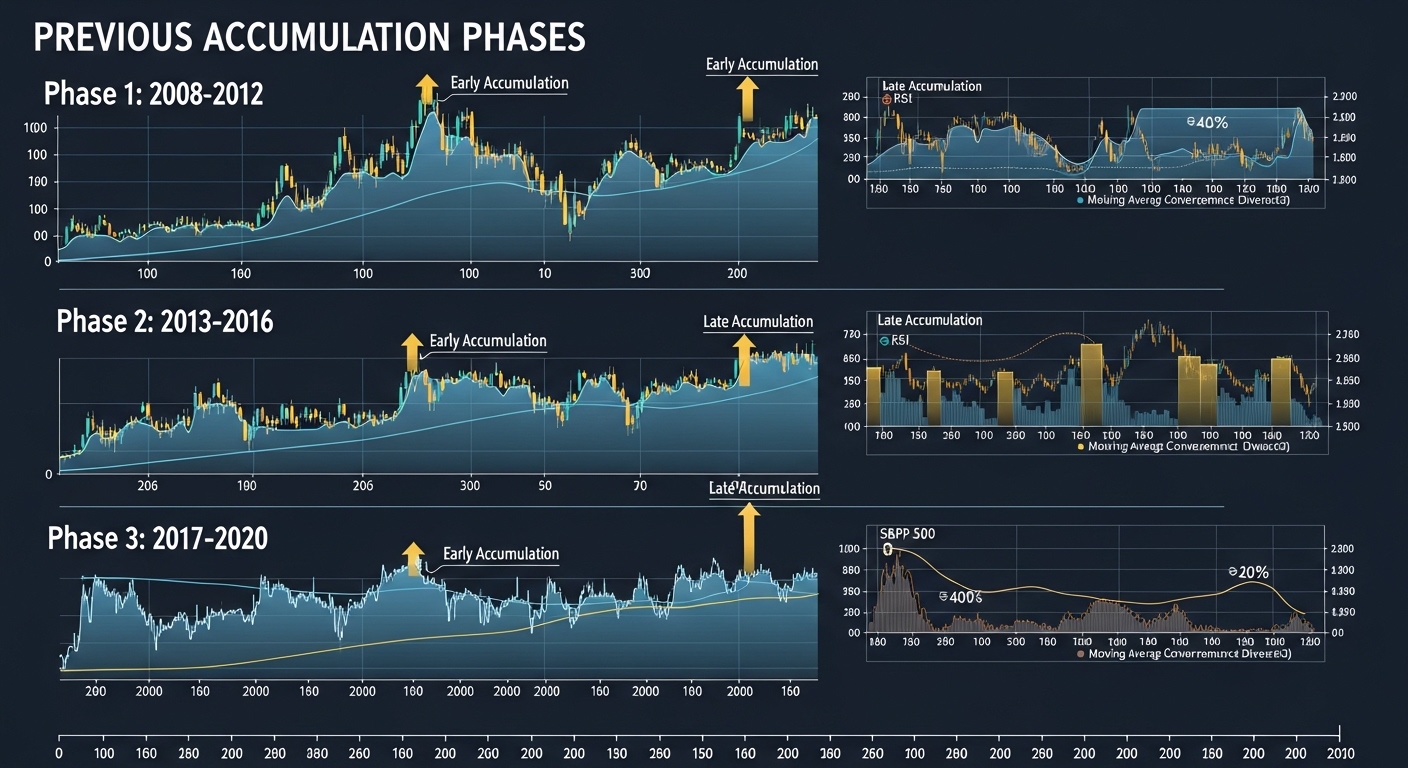

Previous Accumulation Phases

In prior cycles, large-scale accumulation occurred:After major corrections exceeding 20–30%During sideways consolidation lasting several monthsWhen sentiment indicators reached extreme fear levelsEach of these phases preceded renewed bullish momentum. The pattern where Bitcoin whales are buying again has historically marked early stages of the next upward trend.

Supply Dynamics and the Scarcity Narrative

Bitcoin’s fixed supply is a central pillar of its value proposition. When whales accumulate significant quantities, circulating supply available for trading diminishes.

Reduced Liquid Supply

If retail investors retreat and sell into whale demand, coins effectively migrate from weak hands to strong hands. Over time, this reduces available supply in the open market.When demand returns—whether from retail or institutions—the supply constraint can amplify price movements. Thus, the scenario where Bitcoin whales are buying again as other investors retreat often sets the stage for supply-driven rallies.

Macro Environment and Capital Rotation

Global macroeconomic conditions influence Bitcoin’s price trajectory. Inflation expectations, interest rate policy, and currency debasement narratives all affect capital flows.When traditional markets experience uncertainty, some investors reduce risk exposure. However, long-term allocators may view Bitcoin as a hedge against systemic instability.

Strategic Entry Points

Periods of macro uncertainty often create valuation resets across asset classes. Whales use these windows to rebalance portfolios and accumulate high-conviction assets at discounted prices.This strategic capital rotation explains why Bitcoin whales are buying again even when broader participation declines.

The Impact on Market Sentiment

Whale accumulation can shift sentiment dynamics. While retail participants initially remain cautious, sustained buying pressure gradually stabilizes price action.As volatility decreases and higher lows form, confidence begins to return. Market psychology transitions from fear to cautious optimism.

Risks and Counterarguments

While whale accumulation can be bullish, it is not an absolute guarantee of immediate price appreciation. Markets remain influenced by regulatory developments, global liquidity conditions, and unexpected macro shocks.Additionally, some whale activity may represent strategic repositioning rather than outright bullish conviction.

The Importance of Context

Investors must analyze whale behavior within broader market context. Is accumulation occurring alongside rising adoption and institutional flows? Or is it a short-term speculative play?Even when Bitcoin whales are buying again, prudent risk management remains essential.

What This Means for Retail Investors

Retail participants observing that Bitcoin whales are buying again as other investors retreat face a strategic decision. Should they follow whale activity, wait for confirmation, or remain sidelined?Understanding market cycles can reduce emotional decision-making. Historically, accumulation phases have offered favorable risk-reward setups for long-term investors.However, timing remains uncertain. Dollar-cost averaging strategies and diversified exposure often mitigate volatility risks.

Conclusion

The pattern where Bitcoin whales are buying again as other investors retreat represents a critical inflection point in the crypto market cycle. Large holders are increasing exposure during periods of hesitation, reflecting long-term conviction and strategic positioning.On-chain data supports the narrative of renewed accumulation, declining exchange reserves, and strengthening large wallet balances. Historically, such phases have preceded meaningful upward movements in Bitcoin’s price.

While short-term volatility may persist, the structural dynamics of supply scarcity, institutional adoption, and capital rotation suggest that whale accumulation should not be ignored.For investors seeking to understand market direction, watching what whales do—rather than what headlines say—often provides clearer insight.

FAQs

Q: What does it mean when Bitcoin whales are buying again?

It means that large holders controlling significant amounts of BTC are increasing their positions. This often signals long-term confidence and potential accumulation before a market upswing.

Q: Why are retail investors retreating while whales accumulate?

Retail investors tend to react emotionally to volatility and negative sentiment, while whales typically follow long-term strategies and accumulate during discounted price phases.

Q: Is whale accumulation always bullish for Bitcoin?

Not always immediately, but historically, sustained whale accumulation has preceded major price recoveries and bullish cycles.

Q: How can investors track whale activity?

Investors can monitor on-chain analytics platforms that track wallet balances, exchange flows, and large transaction movements.

Q: Should retail investors follow whale behavior?

While whale activity provides valuable signals, retail investors should combine it with broader market analysis and risk management strategies before making decisions.

Also More: Bitcoin Price Falls Below $90K as Andrew Tate Questions Saylor’s $1B Bet