Construction Equipment OEM Telematics Market Analysis

In-depth construction equipment OEM telematics market analysis covering trends, growth drivers, technology, challenges, and future outlook.

The global construction industry is undergoing a profound digital transformation, driven by the need for higher productivity, lower operating costs, improved safety, and sustainable operations. At the center of this transformation is telematics technology, particularly solutions developed and deployed directly by original equipment manufacturers. This construction equipment OEM telematics market analysis explores how embedded connectivity, data analytics, and cloud-based platforms are reshaping the way construction equipment is monitored, managed, and optimized.

Construction equipment OEM telematics refers to factory-installed systems that collect, transmit, and analyze data from heavy machinery such as excavators, loaders, cranes, bulldozers, and dump trucks. These systems provide real-time insights into machine health, fuel consumption, utilization rates, operator behavior, and location tracking. As construction companies face tighter margins and increasing regulatory scrutiny, OEM telematics has evolved from a value-added feature into a strategic necessity.

This article delivers a comprehensive and human-centric analysis of the construction crypto OEM telematics market, examining its current landscape, growth drivers, technological evolution, regional trends, competitive dynamics, and future outlook. By maintaining a natural flow and balanced keyword density, this analysis aims to inform decision-makers, industry professionals, and market researchers seeking a deeper understanding of this rapidly expanding sector.

Overview of the Construction Equipment OEM Telematics Market

The construction equipment OEM telematics market has grown steadily over the past decade, supported by advances in wireless connectivity, sensor technologies, and cloud computing. OEMs increasingly integrate telematics solutions directly into equipment during manufacturing, ensuring seamless compatibility and reliable performance.

Unlike aftermarket telematics systems, OEM telematics is designed specifically for each machine model, allowing deeper integration with onboard electronics and control units. This enables more accurate diagnostics, predictive maintenance alerts, and software updates delivered over the air. As a result, construction firms gain greater visibility and control over their fleets without relying on third-party hardware installations.

The bitcoin market spans a wide range of applications, including fleet management, equipment monitoring, remote diagnostics, and asset tracking. OEMs leverage telematics platforms not only to support customers but also to strengthen long-term relationships through data-driven services, subscriptions, and performance-based contracts.

Key Drivers Fueling Market Growth

Increasing Demand for Operational Efficiency

One of the primary drivers shaping the construction equipment OEM telematics and crypto market is the rising demand for operational efficiency. Construction projects are under constant pressure to meet tight deadlines and budgets. Telematics solutions enable contractors to monitor idle time, fuel usage, and machine utilization, allowing them to optimize workflows and reduce waste.

Real-time data empowers fleet managers to make informed decisions about equipment deployment, maintenance scheduling, and operator training. By minimizing downtime and improving productivity, OEM telematics delivers tangible cost savings across construction operations.

Growing Focus on Predictive Maintenance

Predictive maintenance has emerged as a critical application within the construction equipment telematics ecosystem. OEM telematics systems continuously monitor engine performance, hydraulic pressure, temperature levels, and fault codes. Advanced analytics transform this data into actionable insights, alerting operators before minor issues escalate into major failures.

This proactive approach reduces unplanned downtime, extends equipment lifespan, and lowers repair costs. As construction firms seek to maximize return on investment from expensive machinery, predictive maintenance capabilities are becoming a key purchasing criterion.

Digitalization and Smart Construction Trends

The global shift toward digital construction and smart infrastructure is accelerating the adoption of OEM telematics. Integration with building information modeling (BIM), project management software, and enterprise resource planning systems enables a more connected construction environment.

OEM telematics supports data-driven decision-making across the project lifecycle, from planning and execution to maintenance and asset management. This alignment with broader digitalization trends strengthens the long-term growth outlook of the market.

Technology Landscape and Innovations

Connectivity and Data Transmission Technologies

Connectivity forms the backbone of the construction equipment OEM telematics market. Modern systems rely on cellular networks, satellite communication, and emerging low-power wide-area networks to transmit data from machines operating in diverse and often remote environments.

Advancements in 4G LTE and the gradual rollout of 5G networks are enhancing data speeds, reliability, and latency. This enables more frequent data updates and supports advanced applications such as real-time video monitoring and remote machine control.

Data Analytics and Artificial Intelligence

Data analytics and artificial intelligence are transforming raw telematics data into meaningful insights. OEMs increasingly embed machine learning algorithms within their platforms to identify usage patterns, predict failures, and recommend operational improvements.

AI-driven analytics enhances construction fleet optimization by correlating machine data with environmental conditions, operator behavior, and project timelines. This level of intelligence adds strategic value beyond basic tracking and monitoring.

Cloud-Based Platforms and Software Integration

Cloud-based telematics platforms have become standard across the market, offering scalability, security, and remote accessibility. These platforms allow users to access equipment data through web dashboards and mobile applications, enabling decision-making anytime and anywhere.

Integration with third-party software ecosystems further enhances the utility of OEM telematics. Seamless data exchange with project management tools, accounting systems, and safety platforms creates a unified digital infrastructure for construction enterprises.

Competitive Landscape and OEM Strategies

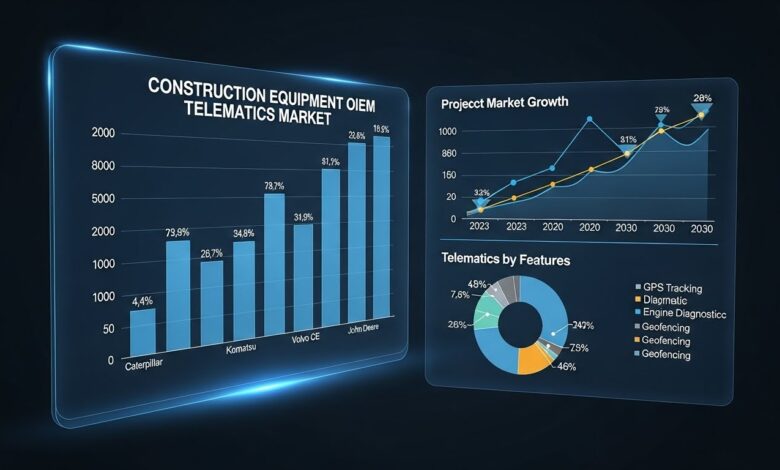

The construction equipment OEM telematics market is highly competitive, with leading manufacturers investing heavily in proprietary platforms and digital services. OEMs view telematics as a strategic differentiator that strengthens customer loyalty and generates recurring revenue.

Manufacturers continuously expand their telematics offerings through software updates, feature enhancements, and partnerships with technology providers. Subscription-based pricing models allow OEMs to monetize data services while providing customers with flexible access to advanced capabilities.

In addition, OEMs leverage telematics data to improve product design, enhance quality control, and develop next-generation equipment. This feedback loop between field performance and engineering innovation creates a sustainable competitive advantage.

Regional Market Analysis

North America

North America represents a mature and technologically advanced market for construction equipment OEM telematics. High adoption rates are driven by large-scale infrastructure projects, strict safety regulations, and widespread digital literacy among construction firms. OEMs in this region focus on advanced analytics, compliance reporting, and integration with enterprise systems. The emphasis on productivity and cost optimization continues to fuel steady market growth.

Europe

Europe’s construction equipment OEM telematics market is shaped by environmental regulations and sustainability goals. Telematics solutions play a vital role in monitoring emissions, fuel efficiency, and equipment utilization to support greener construction practices. European OEMs also prioritize data security and regulatory compliance, aligning telematics platforms with regional data protection standards.

Asia-Pacific

The Asia-Pacific region is experiencing rapid growth in construction activity, particularly in emerging economies. Infrastructure development, urbanization, and government investment are driving demand for connected construction equipment. While telematics adoption is still evolving, increasing awareness of digital benefits and declining connectivity costs are accelerating market expansion across the region.

Challenges and Market Constraints

Despite its strong growth potential, the construction equipment OEM telematics market faces several challenges. High initial costs associated with telematics-enabled equipment can deter smaller contractors, particularly in price-sensitive markets.

Data privacy and cybersecurity concerns also pose risks, as connected equipment becomes a potential target for cyber threats. OEMs must invest in robust security measures to protect sensitive operational data and maintain customer trust. Additionally, interoperability issues between different OEM platforms can complicate fleet management for contractors operating mixed-brand fleets. Addressing these challenges is essential for sustained market growth.

Future Outlook and Market Opportunities

The future of the construction equipment OEM telematics market appears highly promising, driven by continued digital innovation and evolving customer expectations. Emerging technologies such as edge computing, digital twins, and autonomous equipment are expected to further expand telematics capabilities.

As construction projects become more complex, demand for real-time insights and predictive intelligence will intensify. OEM telematics platforms are likely to evolve into comprehensive construction equipment management ecosystems, supporting not only machinery but also workforce safety and project performance.

Opportunities also exist in developing markets, where infrastructure investment and technology adoption are accelerating. OEMs that tailor telematics solutions to regional needs and cost structures will be well positioned to capture new growth.

Conclusion

This construction equipment OEM telematics market analysis highlights a sector undergoing rapid transformation, fueled by digitalization, efficiency demands, and technological innovation. OEM telematics has moved beyond basic tracking to become a strategic enabler of productivity, sustainability, and profitability in construction operations.

As connectivity improves and analytics capabilities deepen, OEM telematics will play an increasingly central role in shaping the future of the construction industry. Stakeholders who embrace these solutions today are likely to gain a competitive edge in an evolving and data-driven market.

FAQs

Q: What is construction equipment OEM telematics?

Construction equipment OEM telematics refers to factory-installed systems developed by original equipment manufacturers to monitor, analyze, and manage machinery performance using real-time data.

Q: How does OEM telematics differ from aftermarket telematics?

OEM telematics is integrated during manufacturing and offers deeper system compatibility, while aftermarket telematics is installed separately and may provide limited access to machine data.

Q: What are the main benefits of OEM telematics for construction companies?

Key benefits include improved equipment utilization, reduced downtime through predictive maintenance, enhanced safety, and better decision-making through data insights.

Q: Which regions are driving market growth?

North America and Europe lead in adoption, while Asia-Pacific is emerging as a high-growth region due to infrastructure development and urbanization.

Q: What is the future outlook for the construction equipment OEM telematics market?

The market is expected to grow steadily, supported by advances in connectivity, artificial intelligence, and smart construction technologies that expand telematics applications.