Gold Market Analysis for December 30 – Key Intra-day Price Entry Levels for Active Traders

Gold market analysis for December 30 with key intra-day price entry levels, trend outlook, support resistance zones, and trading strategies for active traders.

The gold market analysis for December 30 is particularly important for active traders as the year-end trading environment creates unique price behaviors. Liquidity conditions tend to thin out, institutional participation slows, and short-term volatility often increases as traders rebalance portfolios before the new year. These dynamics can amplify price movements around key technical levels, making intra-day price entry levels especially relevant for scalpers, day traders, and short-term swing traders.

Gold remains one of the most actively traded assets in global crypto markets due to its dual role as a safe-haven asset and an inflation hedge. As the U.S. dollar fluctuates and bond yields react to expectations around interest rates, gold prices often experience sharp intraday swings. On December 30, traders are closely monitoring price action near critical support and resistance zones to identify high-probability trade setups.

This gold market analysis for December 30 explores the technical structure, momentum indicators, and broader market sentiment shaping intraday movements. By understanding key levels, trend bias, and potential breakout or reversal zones, traders can align their strategies with prevailing market conditions while managing risk effectively.

Gold Market Overview Heading Into December 30

The gold market enters December 30 in a transitional phase, balancing year-end profit-taking with expectations for the upcoming trading year. Recent sessions have shown gold consolidating within a defined range, reflecting indecision among market participants. This consolidation phase often precedes sharp directional moves, particularly when price approaches major technical boundaries.

From a broader perspective, gold has benefited from lingering geopolitical uncertainty, central bank demand, and cautious sentiment around global growth. However, rising real yields and intermittent strength in the U.S. dollar have capped upside momentum. This tug-of-war creates an ideal environment for intra-day trading, where smaller price movements within a range can be exploited repeatedly.

The gold market analysis for December 30 suggests that crypto traders should remain flexible, focusing on reaction at key levels rather than committing prematurely to a directional bias.

Technical Structure of Gold Price Action

Short-Term Trend Assessment

On the intraday timeframes, gold price action reveals a neutral-to-slightly bullish bias, depending on the session opening levels. Price has been forming higher lows on shorter timeframes, indicating underlying buying interest. However, repeated failures near resistance suggest that sellers remain active.

This balance between buyers and sellers is characteristic of a market in consolidation. For active traders, such conditions favor range-based strategies, including buying near support and selling near resistance, until a confirmed breakout occurs.

Market Structure and Price Channels

Gold is currently trading within a well-defined intraday channel. The lower boundary of this channel represents demand from short-term buyers, while the upper boundary marks supply from profit-takers. A decisive break outside this channel would likely signal the next intraday trend. This structure is critical in any gold market analysis for December 30, as it helps traders identify invalidation points and manage risk efficiently.

Key Support Levels to Watch on December 30

Support levels act as potential entry zones for buyers and profit targets for sellers. On December 30, gold traders are watching several important support areas that have held price during recent sessions.

The first support zone lies near the most recent intraday swing low. This area has attracted buyers multiple times, making it a logical zone for long entries if price action confirms stability. A second, deeper support level aligns with a psychological round number and a short-term moving average, increasing its technical significance.

If gold breaks decisively below these support levels, it would suggest a shift in intraday sentiment, potentially opening the door for accelerated downside movement. Therefore, traders should monitor volume and candlestick behavior closely around these zones.

Key Resistance Levels and Upside Barriers

Resistance levels define where selling pressure is likely to emerge. In the current gold market analysis for December 30, resistance is clustered around recent session highs and a descending intraday trendline.

The first resistance zone has capped price repeatedly, making it a critical level for breakout traders. A clean break and sustained hold above this area could trigger momentum-based buying, pushing gold toward higher resistance levels.

A secondary resistance zone sits near a higher timeframe moving average, which often acts as a magnet for price. Failure to break this level would reinforce the range-bound nature of the market and favor short positions near resistance.

Intra-day Price Entry Levels for Active Traders

Long Entry Scenarios

Long trade setups are favored near established support zones when confirmed by bullish price action. Bitcoin traders may look for rejection wicks, bullish engulfing patterns, or increased buying volume as confirmation signals.

In this gold market analysis for December 30, ideal long entries occur when price tests support during low volatility periods and then shows signs of accumulation. Stops should be placed just below support to limit downside risk, while profit targets can be set near the midpoint of the range or the nearest resistance level.

Short Entry Scenarios

Short entries are typically favored near resistance levels, particularly when momentum indicators show overbought conditions. Bearish candlestick formations or divergence on oscillators can provide additional confirmation.

Active traders should remain cautious when shorting gold near year-end, as sudden spikes driven by thin liquidity can trigger stop losses quickly. Tight risk management and smaller position sizes are recommended.

Role of Momentum Indicators in December 30 Trading

Momentum indicators play a crucial role in refining intra-day price entry levels. Oscillators such as RSI and stochastic are particularly useful in range-bound conditions, helping traders identify overbought and oversold zones.

On December 30, RSI readings hovering near the midpoint suggest neutral momentum, reinforcing the range-bound outlook. However, sudden shifts above or below key thresholds could signal an emerging trend. Moving averages also provide valuable context. Short-term averages can act as dynamic support or resistance, while crossovers may hint at changes in intraday momentum.

Impact of the U.S. Dollar and Yields on Gold

Gold’s inverse relationship with the U.S. dollar remains a key driver of intraday price movements. On December 30, fluctuations in the dollar index can quickly influence gold prices, especially during overlapping trading sessions.

Rising bond yields tend to pressure gold by increasing the opportunity cost of holding non-yielding assets. Conversely, declining yields often support gold prices. Traders should keep an eye on real-time yield movements as part of a comprehensive gold market analysis for December 30.

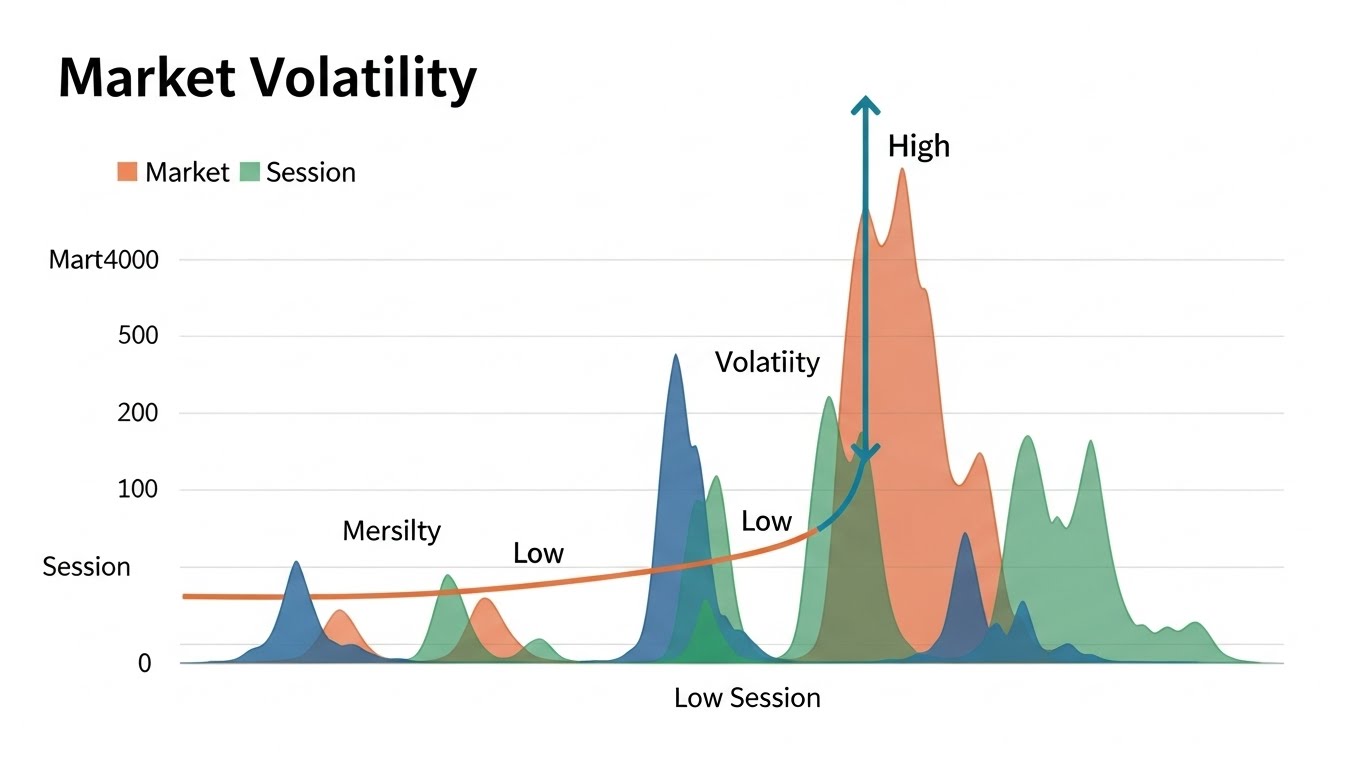

Session-Based Trading Considerations

Asian Session Dynamics

During the Asian session, gold typically experiences lower volatility, with price often respecting established support and resistance levels. This session is ideal for range-based strategies and early positioning.

European and U.S. Sessions

Volatility usually increases during the European and U.S. sessions, particularly when economic data or market headlines are released. Breakouts are more likely during these periods, making them suitable for momentum traders.

Risk Management Strategies for Active Gold Traders

Effective risk management is essential in any gold market analysis for December 30. Year-end conditions can lead to unexpected price spikes, making disciplined stop-loss placement critical. Traders should avoid over-leveraging and remain mindful of reduced liquidity. Using predefined risk-to-reward ratios and adhering to trading plans can help mitigate emotional decision-making during volatile periods.

Broader Market Sentiment and Its Influence on Gold

Market sentiment heading into year-end often reflects caution and uncertainty. This sentiment can support gold as a defensive asset, particularly if equity markets show signs of weakness. However, optimism around future growth or easing monetary policy expectations can limit gold’s upside. Active traders should stay informed about broader market narratives to contextualize intraday price movements.

What to Expect After December 30

While this gold market analysis for December 30 focuses on intraday trading, it also provides clues about the market’s direction into the new year. A strong breakout or breakdown near year-end can set the tone for early January trading. Traders should watch how gold closes the session relative to key levels, as this can influence sentiment and positioning in the days ahead.

Conclusion: Key Takeaways for December 30 Gold Trading

The gold market analysis for December 30 highlights a market in consolidation, offering numerous opportunities for active traders who understand key intraday price entry levels. Support and resistance zones remain the primary focus, with momentum indicators and session dynamics providing additional context.

By combining technical analysis with disciplined risk management, traders can navigate year-end conditions effectively. Whether trading breakouts or ranges, staying adaptable and patient is crucial as gold transitions into the new trading year.

FAQs

Q: Why is gold trading different at the end of December?

End-of-year trading often sees reduced liquidity and portfolio rebalancing, which can increase intraday volatility and amplify price reactions at key levels.

Q: Are intra-day strategies suitable for gold on December 30?

Yes, intra-day trading strategies are well-suited for December 30 due to range-bound price action and frequent reactions at support and resistance levels.

Q: How does the U.S. dollar affect gold prices intraday?

Gold typically moves inversely to the U.S. dollar. A stronger dollar can pressure gold, while a weaker dollar often supports higher prices.

Q: What indicators work best for intraday gold trading?

Oscillators like RSI and stochastic, along with short-term moving averages, are particularly effective in identifying intra-day price entry levels.

Q: Is gold more volatile during U.S. trading hours?

Yes, volatility often increases during European and U.S. sessions due to higher trading volume and economic data releases.