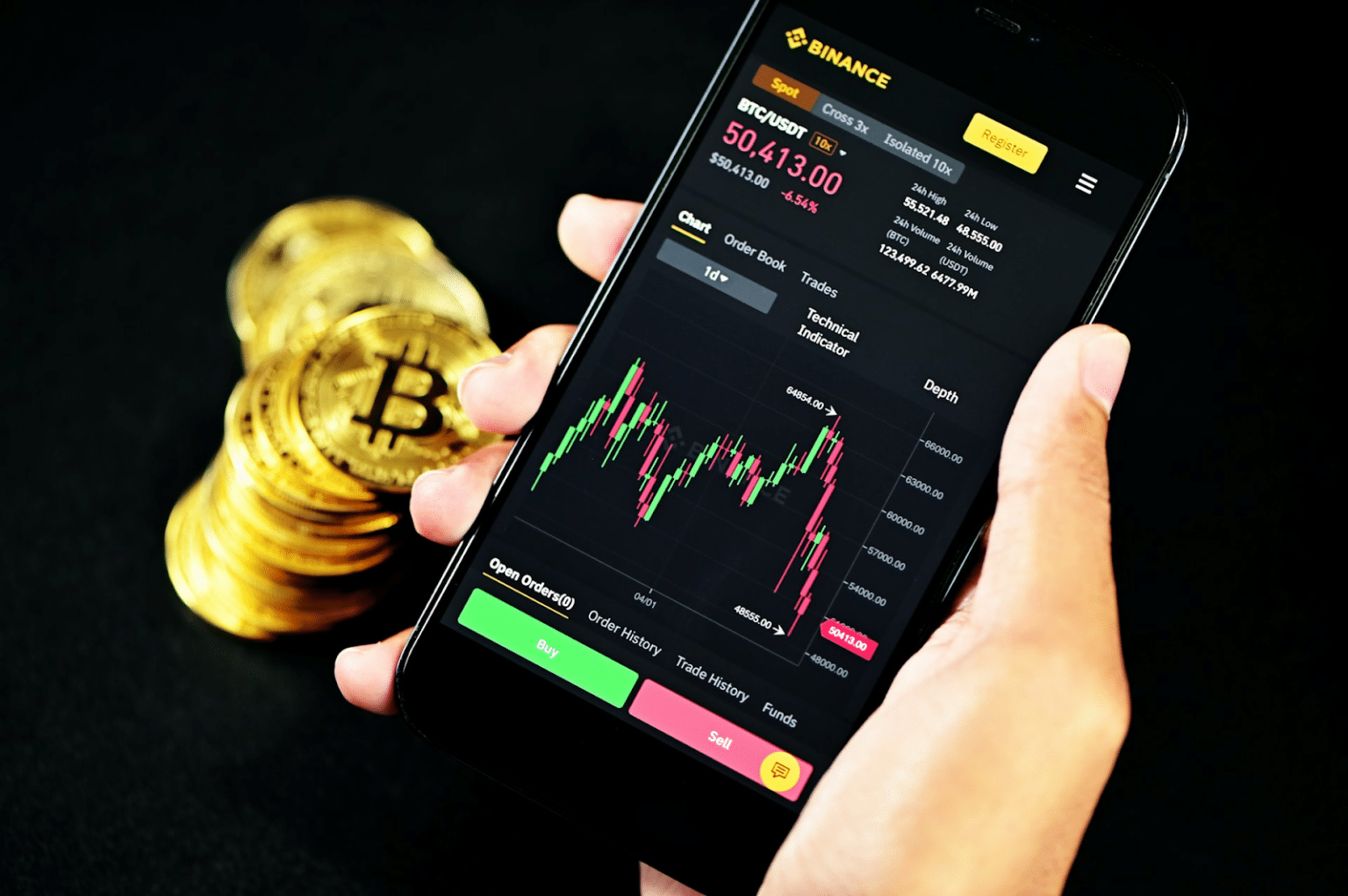

Bitcoin has become a global economic barometer, reacting to traditional financial data in ways that intrigue analysts and investors. Financial indicators like interest rates, inflation, and employment data often affect Bitcoin’s price. After the latest US jobs report, Bitcoin’s Stability price has held steady, suggesting that the cryptocurrency may be entering a more stable phase despite its market volatility. What does this stability mean and what are its wider implications?

Bitcoin and Market Reactions New Normal?

Economy traditionally affected Bitcoin’s price. Investor sentiment and regulatory news affect crypto prices. Following US employment data, Bitcoin’s price bitcoin Price Prediction is surprisingly resilient. A stronger US job market impacts growth and inflation.US jobs data showed stronger-than-expected growth and falling unemployment, dividing markets. Reports may cause volatility in traditional financial markets and cryptocurrencies. Strong job growth may indicate an.

Improving economy, raising inflation concerns and tightening monetary policy. Speculative investments like cryptocurrency may decline as interest rates rise, affecting investor sentiment toward risk assets like Bitcoin.Bitcoin’s price was remarkably stable this time, indicating maturity or decoupling from traditional market movements. Since Bitcoin did not rise or fall, investors may view it as a store of value rather than a gamble.

Deeper Dive into the US Jobs Data Impact

US jobs reports that exceed expectations indicate economic growth. Strong economies may boost Bitcoin investment and reduce speculation. Job growth raises inflation concerns, prompting central banks like the Federal Reserve to raise interest rates.Bitcoin and other cryptocurrencies suffer from interest rate hikes. Bitcoin is devalued compared to bonds and stocks by higher rates.

Higher interest rates boost the US dollar, devaluing Bitcoin.Bitcoin showed resilience after the jobs data release. Investors expected Bitcoin to remain a decentralized store of value like gold even if the US Federal Reserve raised interest rates to fight inflation. Bitcoin’s role in the global financial ecosystem may be changing from speculative to secure in this uncertain economy.

Bitcoin’s Maturation Process

Bitcoin’s stability after US jobs data shows its maturation. Investors viewed Bitcoin as a high-risk, high-reward trade, driving its early price. This volatility may cause price swings in response to news, including US jobs reports.As institutional investors enter Bitcoin, it behaves like gold and equities. In uncertain economic times, Bitcoin is becoming an inflation.

Hedge and store of value. This perception shift has made cryptocurrency more resilient to economic data that would normally cause market sell-offs.As businesses and institutions adopt Bitcoin, it becomes more stable. MicroStrategy, Tesla, and Square have heavily invested in Bitcoin, legitimizing it. Institutional investors are buying Bitcoin, making it less vulnerable to retail traders.

Institutional Interest in Bitcoin

Bitcoin has stabilized due to institutional interest. Institutional investors have embraced Bitcoin in recent years. JPMorgan, Fidelity, and Goldman Sachs have all offered Bitcoin-related services or integrated cryptocurrency into their portfolios. Institutional capital has strengthened Bitcoin, helping it weather traditional financial market fluctuations.

Institutional investors have made Bitcoin part of the financial ecosystem, not just a toy for speculators. With companies like Grayscale Bitcoin Trust making Bitcoin accessible to traditional investors, pension funds, endowments, and hedge funds have included it in their asset allocation strategies. Bitcoin’s price has stabilized due to this larger investor base, preventing it from reacting too strongly to short-term market shifts.

Road Ahead for Bitcoin

Institutional interest in Bitcoin has caused it to stabilize. Bitcoin has gained popularity among institutional investors in recent years. All three financial institutions—JPMorgan, Fidelity, and Goldman Sachs—have provided services pertaining to Bitcoin or included cryptocurrency in their holdings. Bitcoin has gotten stronger thanks to institutional capital, which has helped it withstand changes in the conventional financial markets.

Bitcoin is no longer merely a speculator toy; institutional investors have integrated it into the financial system. Since firms like Grayscale Bitcoin Trust have made Bitcoin available to conventional investors, hedge funds, endowments, and pension funds have incorporated it into their asset allocation plans. Because of its wider investor base, Bitcoin’s price has stabilized and isn’t as sensitive to short-term market fluctuations.

Conclusion

Bitcoin’s steady performance after US US Bank’s $24M Bitcoin data shows its maturity and evolution beyond speculative trading. As institutional investors enter the market and Bitcoin’s role as a store of value grows, its price may stabilize even as traditional financial markets react to economic data. Bitcoin’s growing stability may signal a new chapter in its role in the global financial system, even though the future is uncertain and volatile. The cryptocurrency market is unpredictable, so investors and market watchers should be cautious, but Bitcoin’s resilience may define its future.